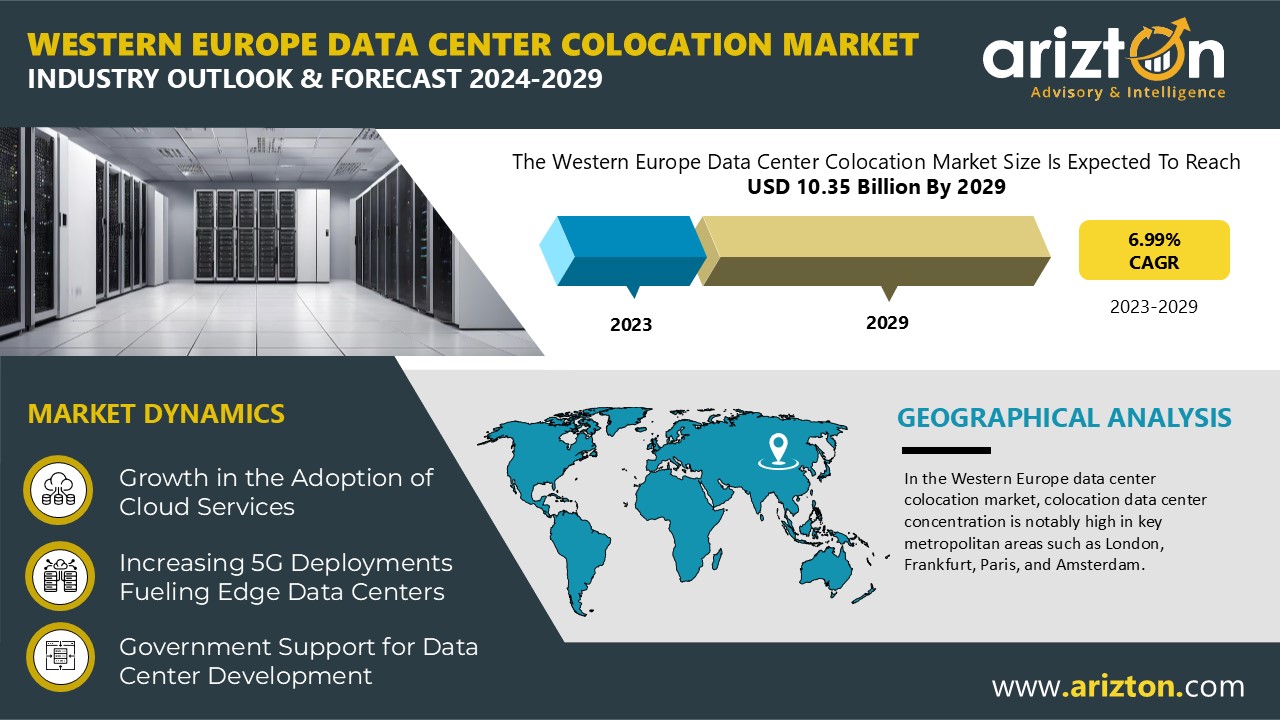

According to Arizton’s latest research report, the Western Europe data center colocation market to grow at a CAGR of 6.99% during the forecast period.

Looking for More Information? Click: https://www.arizton.com/market-reports/western-europe-data-center-colocation-market

Report Scope:

Market Size (2029): $10.35 Billion

Market Size (2023): $6.9 Billion

CAGR (2023-2029): 6.99%

Market Size – Area (2029): 4,684.4 thousand sq. ft

Power Capacity (2029): 1,010 MW

Historic Year: 2020-2022

Base Year: 2023

Forecast Year: 2024-2029

Market Segmentation: Colocation Service, Infrastructure, Electrical Infrastructure, Mechanical Infrastructure, Cooling Systems, Cooling Techniques, General Construction, Tier Standards, and Geography

Geographical Analysis: Western Europe (UK, Germany, France, Netherlands, Ireland, Switzerland, Italy, Spain, Belgium, Portugal, Other Western European Countries)

In the Western European data center colocation market, the adoption of advanced cooling technologies, such as liquid immersion and enhanced air conditioning, is on the rise. A notable example is Nautilus Data Technologies’ EcoCore modular facility in Portugal. Key players like Eaton, Caterpillar, Cummins, Legrand, Aksa Power Generation, ABB, Rolls Royce, and Schneider Electric are instrumental in deploying critical electrical infrastructure to ensure uninterrupted power supply. These companies emphasize advanced UPS systems and maintain robust N+1 redundancy.

For instance, Digital Realty has partnered with Schneider Electric to bolster sustainability at its PAR6 facility in Paris, focusing on low-voltage and medium-voltage electrical gear, switchgear, and three-phase UPS systems. In Western Europe, data centers are prioritizing free cooling methods over liquid-based solutions, taking advantage of the region’s oceanic climate to dissipate waste heat naturally and utilize cooler external air. As of 2023, cooling systems accounted for over 65% of total mechanical infrastructure spending in data centers. The PAR9 facility by Digital Realty in France, for example, utilizes high-density racks with free cooling, while Edged Energy’s Barcelona campus employs waterless cooling technology.

In the FLAPD region, there is significant growth in Tier III and IV-certified colocation data centers, adhering to Uptime Institute standards. These facilities cater to sectors such as BFSI, telecom, education, and government, offering customizable solutions for retail or wholesale colocation, rack configurations, and latency requirements. This reflects a strong commitment to reliability and operational excellence in colocation data center infrastructure.

Innovation in Western Europe Data Center Colocation Market

Nautilus Data Technologies: Launched EcoCore, a modular data center with 2.5MW capacity and advanced cooling technologies at Start Campus, Portugal (March 2024).

Vertiv: Introduced Liebert XDU Coolant Distribution Units for liquid cooling solutions following the acquisition of CoolTera in the UK (March 2024).

Mavin: Built a containerized prefabricated data center at the Global Centre of Rail Excellence in South Wales, operational by 2025 (February 2024).

Eviden: Planned a modular data center in Germany for the Jupiter supercomputer, featuring 50 interchangeable modules (January 2024).

Sonic Edge: Supplied a 100kW immersion modular cooling data center named MegaPod for Castrol’s research site in the UK (January 2024).

The Retail Colocation Market Investment to Reach Over $8 Billion by 2029

Retail colocation services allow enterprises to retain ownership and management of their IT infrastructure while leveraging the resources of a colocation data center. Unlike managed hosting, businesses maintain control over their hardware and software in dedicated racks, enabling greater customization. This model provides access to redundant power, cooling, security, and tailored connectivity options, facilitating scalability to meet evolving needs. Additionally, retail colocation offers proximity to diverse networking ecosystems and interconnection opportunities, promoting seamless connectivity and hybrid IT environments. Enterprises can focus on core competencies while benefiting from the operational efficiencies and robust infrastructure of colocation facilities.

The report includes the investment in the following areas:

Colocation Services

- Retail Colocation

- Wholesale Colocation

Infrastructure

- Electrical Infrastructure

- Mechanical Infrastructure

- General Construction

Electrical Infrastructure

- UPS Systems

- Generators

- Transfer Switches & Switchgear

- PDUs

- Other Electrical Infrastructure

Mechanical Infrastructure

- Cooling Systems

- Racks

- Other Mechanical Infrastructure

Cooling Systems

- CRAC & CRAH Units

- Chiller Units

- Cooling Towers, Condensers & Dry Coolers

- Economizers & Evaporative Coolers

- Other Cooling Units

Cooling Techniques

- Air-based Cooling

- Liquid-based Cooling

General Construction

- Core & Shell Development

- Installation & Commissioning Services

- Engineering & Building Design

- Fire Detection & Suppression

- Physical Security

- DCIM/BMS Solutions

Tier Standards

- Tier I & II

- Tier III

- Tier IV

Geography

Western Europe

- UK

- Germany

- France

- Netherlands

- Ireland

- Switzerland

- Italy

- Spain

- Belgium

- Portugal

- Other Western European Countries

Competitive Landscape

Prominent Colocation Investors

- Aire Networks

- Business Overview

- Service Offerings

- Aixit GmbH

- AQ Compute

- Ark Data Centres

- Aruba

- AtlasEdge

- Blue

- Castle IT

- China Mobile

- CKW

- Cogent Communications

- Colt Data Centre Services (Colt DCS)

- Compass Datacenters

- CyrusOne

- Data Castle

- DATA4

- Datum Datacentres

- Denv-R

- Digital Realty

- Digital Reef

- Echelon Data Centres

- EdgeConneX (EQT Infrastructure)

- Energia Group

- Equinix

- Etix Everywhere

- Euclyde Data Centers

- EuNetworks

- Exa Infrastructure

- Fibra Medios Telecom

- Firstcolo

- Global Switch

- Green

- Green Mountain

- Hivelocity

- Iliad

- Ingenostrum

- Iron Mountain (IO)

- ITENOS

- K2 Data Centres

- Kao Data

- KDDI

- Keppel Data Centres

- KevlinX

- LCL Data Centers

- LDex Group

- Liberty Global

- Maincubes

- Merlin Properties

- myLoc managed IT AG

- Nabiax

- Nautilus Data Technologies

- NDC-GARBE Data Centers Europe

- Nehos

- Nexspace

- NorthC Data Centres

- NTT Global Data Centers

- Orange Business Services

- Panattoni

- Penta Infra

- Portus Data Centers

- Prime Data Centers

- Proximity Data Centres

- Pulsant

- Pure Data Centres

- Redwire Data Centre

- Servecentric

- Serverfarm

- STACK Infrastructure

- Stratus DC Management

- T5 Data Centers

- Telecom Italia Sparkle

- Telehouse

- Titan DC

- Vantage Data Centers

- VIRTUS Data Centres (ST Telemedia Global Data Centres)

- Web World

- Yondr

New Entrants

- CloudHQ

- Business Overview

- Service Offerings

- Form8tion Data Centers (Thor Equities)

- Global Technical Realty

- Goodman

- Mainova WebHouse

- Nation Data Center (NDC)

In a nutshell, the Arizton Advisory & Intelligence market research report provides valuable market insights for industry stakeholders, investors, researchers, consultants, and business strategists aiming to gain a thorough understanding of the Western Europe data center colocation market. Request for Free Sample to get a glance of the report now: https://www.arizton.com/market-reports/western-europe-data-center-colocation-market

What Key Findings Will Our Research Analysis Reveal?

How big is the Western Europe data center colocation market?

What is the growth rate of the Western Europe data center colocation market?

What is the estimated market size in terms of area in the Western Europe data center colocation market by 2029?

What are the key trends in the Western Europe data center colocation market?

How many MW of power capacity is expected to reach the Western Europe data center colocation market by 2029?

Looking for Customization According to Your Business Requirement? https://www.arizton.com/customize-report/4520

Why Arizton?

100% Customer Satisfaction

24×7 availability – we are always there when you need us

200+ Fortune 500 Companies trust Arizton’s report

80% of our reports are exclusive and first in the industry

100% more data and analysis

1500+ reports published till date

Post-Purchase Benefit

- 1hr of free analyst discussion

- 10% off on customization

About Us:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Media Contact

Company Name: Arizton Advisory & Intelligence

Contact Person: Jessica

Email: Send Email

Phone: +1-312-235-2040/+1 302 469 0707

Country: United States

Website: https://www.arizton.com/market-reports/western-europe-data-center-colocation-market

Press Release Distributed by ABNewswire.com

To view the original version on ABNewswire visit: Western Europe Data Center Colocation Market Investment to Reach $10.35 Billion by 2029 – Exclusive Research Report by Arizton Advisory & Intelligence