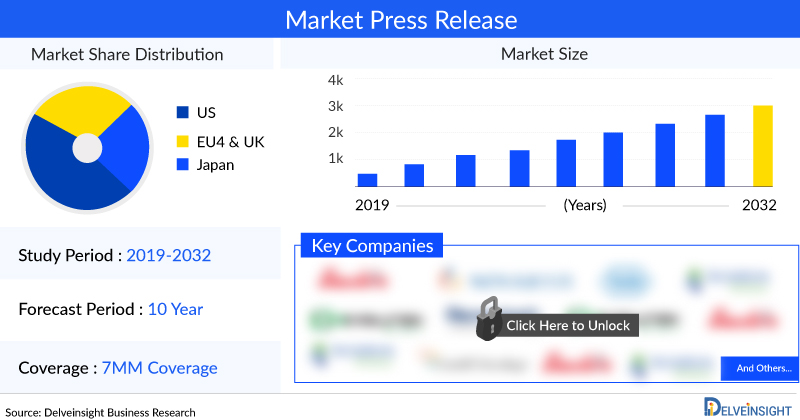

In the Chronic Venous Insufficiency (CVI) market, significant growth is anticipated from 2019 to 2032, as detailed in the latest report, “Chronic Venous Insufficiency Market Insights, Epidemiology and Market Forecast 2032” by DelveInsight. This expected surge is driven by substantial R&D efforts from both academic and industrial sectors. The market is set to expand notably during the forecast period (2023–2032) due to the anticipated launch of numerous new therapies and devices. The market size is projected to grow at a robust CAGR throughout the study period.

The report provides insights into current treatment practices for Chronic Venous Insufficiency, emerging drugs in the pipeline, market shares of various therapies, and forecasts the market trajectory from 2019 to 2032 across the 7MM (the United States, the EU-4—Italy, Spain, France, and Germany—the United Kingdom, and Japan).

Driving Forces Behind the Chronic Venous Insufficiency Market Growth

Several factors are expected to accelerate the growth of the Chronic Venous Insufficiency market during the forecast period (2023–2034). Increased awareness about available treatments, rising disease prevalence, and heightened disease awareness are key drivers. Additionally, the introduction of promising new therapies from the pipeline will further propel market expansion. A deeper understanding of disease pathogenesis will also support the development of innovative therapeutics for Chronic Venous Insufficiency, contributing to the market’s progress.

Discover the Anticipated Evolution and Growth of the Market @ Chronic Venous Insufficiency Therapeutics Market Forecast

Therapeutic Advancements and Emerging Treatments:

-

Chronic Venous Insufficiency Clinical Trial Progression: The market is poised for substantial growth, fueled by the advancement of emerging therapies anticipated to launch between 2023 and 2034. Leading companies such as Verigraft, MediWound, TissueTech, Amniox Medical, and others are actively working on developing innovative treatments for potential market introduction.

-

Chronic Venous Insufficiency Innovative Therapies: Ongoing research and development efforts are paving the way for new therapies aimed at addressing the symptoms and underlying causes of Chronic Venous Insufficiency. Innovations such as P-TEV, EscharEx, TTAX01, and others are advancing the Chronic Venous Insufficiency market.

Chronic Venous Insufficiency Market Dynamics

Chronic venous insufficiency (CVI) is a common but often underestimated cause of leg pain and swelling, frequently associated with varicose veins. It is essential for patients to receive appropriate treatment to prevent potential complications. CVI, a potentially serious condition, requires timely diagnosis, evaluation of risk factors, and a thorough understanding of the disease and prescribed treatments to ensure effective management and adherence to medical advice.

Companies such as Verigraft and MediWound are at the forefront of developing therapies to address CVI, aiming to fill existing market gaps. The Chronic Venous Insufficiency market is expected to experience substantial growth during the forecast period (2023–2034), driven by increased awareness of available treatments, rising disease prevalence, and the promising new therapies emerging from the pipeline. Additionally, a deeper understanding of CVI’s underlying mechanisms will support the development of innovative treatments for this condition.

Chronic Venous Insufficiency Treatment Market

Chronic venous insufficiency (CVI) in the lower limbs is a common yet frequently underrecognized condition. Due to its diverse clinical presentations, a high index of suspicion is necessary when evaluating patients. Understanding the normal venous anatomy and function is essential for accurate diagnosis and effective management of CVI.

While CT or MR scans can be useful for assessing lower extremity arterial disease, duplex ultrasound (DUS) is critical for diagnosing CVI, as it provides essential functional information. Compression stockings are typically the first-line conservative treatment, though adherence to this therapy can be challenging. For patients with significant symptoms, early consideration of venous ablation therapy may offer substantial benefits. In cases where severe symptoms are due to iliac vein compression or stenosis, iliac vein stenting has proven effective in significantly alleviating symptoms.

Leading Chronic Venous Insufficiency Companies and Emerging Drugs: Innovative companies like Verigraft, MediWound, TissueTech, Amniox Medical, and others are actively working on developing new therapies for potential entry into the Chronic Venous Insufficiency market.

Chronic Venous Insufficiency Therapeutic Landscape: Notable therapies for treating Chronic Venous Insufficiency include P-TEV, EscharEx, TTAX01, among others.

Chronic Venous Insufficiency Overview:

Chronic Venous Disease (CVD) is a common condition impacting the venous system, especially the veins in the lower limbs. It covers a range of venous disorders from minor cosmetic issues like spider veins to serious, debilitating conditions such as venous ulcers. Chronic Venous Insufficiency (CVI) represents the advanced stages of CVD, characterized by impaired blood flow in either superficial or deep veins, leading to increased venous pressure, or venous hypertension. This elevated pressure results in various symptoms, including swelling, skin changes, and discomfort in the lower extremities.

Diagnosing CVI involves evaluating clinical symptoms alongside confirmatory diagnostic tests. Venous duplex ultrasound is the primary diagnostic tool, offering a noninvasive way to assess blood flow and venous anatomy. Clinically, CVI presents with symptoms such as dependent pitting edema, leg discomfort, fatigue, and itching. Patients may also experience telangiectasias, reticular veins, varicose veins, pain, cramping, and sensations of itching, prickling, and throbbing. As CVI progresses, individuals might develop varicose veins, persistent tenderness, refractory edema, and skin changes, including dermal atrophy, hyperpigmentation, and ulceration.

Treatment for CVI should be tailored to the disease’s severity and characteristics. Goals include alleviating discomfort and swelling, improving skin condition, reducing venous reflux and varicose veins, and promoting ulcer healing. Management typically involves conservative measures such as leg elevation, resistance exercises, weight management, and compression therapy, either alone or in combination with medications and interventional procedures.

Request for a detailed sample report @ https://www.delveinsight.com/sample-request/chronic-venous-insufficiency-market

Key Facts Chronic Venous Insufficiency Market Report:

-

In 2023, the United States represented the largest market for Chronic Venous Insufficiency in the 7MM, with a market size of approximately USD 1,200 million. Among the EU4 countries and the UK, Germany led with the highest market size, while Italy recorded the smallest.

-

By 2034, Laser Ablation/Radiofrequency Ablation is anticipated to be the top revenue-generating non-pharmacological treatment in the 7MM, followed by surgical interventions.

-

In 2023, the Chronic Venous Insufficiency (CVI) market in the 7MM (United States, EU-4, the United Kingdom, and Japan) was valued at approximately USD 2,000 million. DelveInsight estimates that there were around 470 million prevalent cases of Chronic Venous Disease (CVD) in the 7MM in 2023, with this number expected to increase throughout the study period.

-

In the United States alone, there were 52 million diagnosed prevalent cases of CVD in 2020.

-

Recent developments in the field include the FDA approval of the Duo Venous Stent System on December 26, 2023. Additionally, in August 2023, Medtronic received FDA 510(k) clearance for an updated ClosureFast radiofrequency ablation (RFA) catheter with a lower 6-F profile, now available in the U.S. for treating CVI.

-

On January 11, 2022, Philips completed the acquisition of Vesper Medical Inc., a U.S.-based company specializing in minimally invasive peripheral vascular devices. This acquisition, valued at EUR 227 million, expands Philips’ Image-Guided Therapy segment and enhances its portfolio of diagnostic and therapeutic devices with an advanced venous stent portfolio for treating deep venous disease.

Chronic Venous Insufficiency Epidemiology Segmentation:

-

In 2020, the total number of prevalent Chronic Venous Disease (CVD) cases in the 7MM was approximately 463 million. Within the 7MM, the United States had the highest prevalence of Chronic Venous Insufficiency (CVI), with nearly 6.2 million cases reported.

-

Among the EU4 countries and the UK, Germany recorded the highest number of CVI cases, followed by the UK, while Spain had the lowest prevalence.

-

DelveInsight’s epidemiology model for CVD indicates that, in the United States, Stage C1 had the highest diagnosed prevalence.

The Chronic Venous Insufficiency market report proffers epidemiological analysis for the study period 2020–2034 in the 7MM segmented into:

• Total Prevalence of Chronic Venous Insufficiency

• Prevalent Cases of Chronic Venous Insufficiency by severity

• Gender-specific Prevalence of Chronic Venous Insufficiency

• Type-specific Prevalence of Chronic Venous Insufficiency

• Age-specific Prevalence of Chronic Venous Insufficiency

• Diagnosed Cases of Chronic Venous Insufficiency

DelveInsight’s comprehensive report provides a thorough exploration of the Chronic Venous Insufficiency market, covering key Chronic Venous Insufficiency players, emerging Chronic Venous Insufficiency therapies, treatment dynamics, and market challenges.

For in-depth insights, access the full report @ Chronic Venous Insufficiency Market Outlook 2034

Media Contact

Company Name: DelveInsight Business Research LLP

Contact Person: Kritika Rehani

Email: Send Email

Phone: +14699457679

Address:304 S. Jones Blvd #2432

City: Las Vegas

State: Nevada

Country: United States

Website: https://www.delveinsight.com/

Press Release Distributed by ABNewswire.com

To view the original version on ABNewswire visit: Chronic Venous Insufficiency Market Growth Anticipated by 2034 | Companies includes Verigraft, MediWound, TissueTech, Amniox Medical