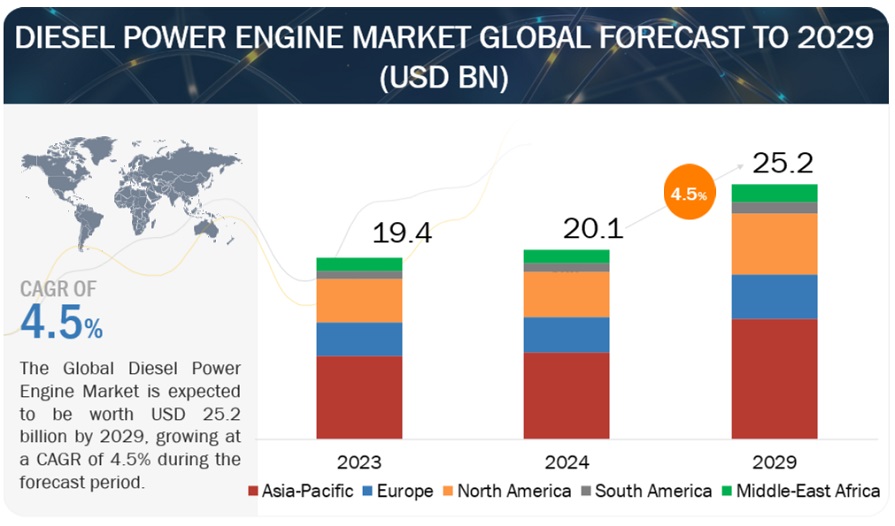

According to a research report “Diesel Power Engine Market by Operation (Standby, Prime, Peak Shaving), Power Rating (Below 0.5 MW, 0.5–1 MW, 1–2 MW, 2–5 MW, and Above 5 MW), End User (Power Utilities, Industrial, Commercial, and Residential), Speed, & Region – Global Forecast to 2029″, the market size for diesel power engine is projected to reach approximately USD 25.2 billion by the year 2029, as compared to the estimated value of USD 20.1 billion in 2024, at a Compound Annual Growth Rate (CAGR) of 4.5% over the forecast period. The global diesel power engine market is driven by a confluence of factors that influence demand and shape its future trajectory. Rapid economic growth in regions like Asia Pacific, Africa, and South America fuels the need for reliable power sources. Diesel engines play a crucial role, particularly in areas with limited grid infrastructure or frequent outages. They provide primary or backup power for businesses, industries, and communities, enabling uninterrupted operations and fostering economic development. As economies expand, industrial activity and urbanization accelerate. These sectors heavily rely on diesel engines for power generation, both for primary use and backup during grid disruptions. Reliable power ensures smooth operation of factories, construction sites, and commercial facilities. Governments worldwide are implementing stricter emission regulations to combat air pollution. This drives advancements in cleaner burning diesel engine technologies.

Manufacturers are developing engines with lower NOx and particulate matter emissions, ensuring compliance with regulations and reducing environmental impact. The market is exploring alternative fuel options like biodiesel or biofuels derived from renewable sources. This allows diesel engines to contribute to a more sustainable energy mix while maintaining their reliability and power output. The integration of renewable energy sources like solar and wind power into the grid is increasing. However, these sources are intermittent. Diesel engines can act as a balancing mechanism, providing backup power during periods of low renewable energy generation and stabilizing grid frequency. Combining diesel engines with renewable energy sources in hybrid power plants offers a promising solution. Renewable energy provides primary power when available, while diesel engines take over during peak demand periods or outages, ensuring a reliable and efficient power supply. These drivers, along with factors like fluctuating fuel prices and advancements in alternative energy technologies, will continue to shape the global diesel power engine market. Manufacturers that prioritize cleaner technologies, efficient engines, and adaptability to changing energy landscapes will be well-positioned to capitalize on future growth opportunities.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=65999135

Commercial segment, by End User, to hold the third-largest market in diesel power engine market.

The commercial segment secures the third-largest market share within the diesel power engine market by end user segment, driven by several key factors. Modern businesses rely heavily on electricity for various functions like lighting, communication systems, data processing, and security. Outages can cause significant disruptions and revenue losses. The commercial segment utilizes diesel generators as a reliable backup power source to ensure business continuity during grid disruptions. Hospitals, data centers, airports, and other critical infrastructure require uninterrupted power supply. Commercial-grade diesel generators provide a reliable backup solution for these facilities, protecting essential services from outages. Businesses located in areas with unreliable grid infrastructure or those seeking greater energy independence might invest in microgrids powered by diesel generators. These microgrids provide a reliable and localized power source, offering greater control and potentially lower energy costs. The construction industry relies on temporary power solutions like diesel generators to power equipment and facilities at remote job sites. Similarly, businesses with off-grid operations, like telecom towers or mining sites, utilize diesel engines for primary power generation. Hotels, shopping malls, and other commercial establishments utilize diesel generators to ensure continued operations during power outages. Maintaining comfortable temperatures, lighting, and electronic systems is crucial for customer satisfaction and security. Warehouses and cold storage facilities require consistent temperature control to ensure product quality. Diesel generators provide backup power to maintain refrigeration systems and prevent spoilage during outages. While renewable energy solutions like solar panels are gaining traction, they often require a higher initial investment. For businesses with tight budgets, diesel generators offer a more cost-effective option for backup or temporary power needs. Diesel generators can be deployed quickly and scaled to meet specific power requirements. This flexibility is crucial for businesses requiring temporary power or those with fluctuating power demands.

2-5 MW segment, by Power Rating, to be the third-largest market segment.

The 2-5 MW segment by power rating holds the third-largest market share in the global diesel power engine market due to its ideal capacity to bridge the gap between smaller-scale applications and large-scale industrial needs. This segment is highly valued for its versatility, efficiency, and ability to meet a diverse range of power requirements across various sectors. One of the primary reasons for the prominence of the 2-5 MW power rating segment is its suitability for medium to large-scale power generation applications. These diesel engines are commonly used in industries such as manufacturing, commercial facilities, hospitals, and data centers, where there is a need for reliable and continuous power supply. The 2-5 MW engines provide sufficient power to support critical operations and ensure operational continuity during power outages or in areas with unreliable grid power. Their ability to deliver a stable and robust power output makes them an essential component for prime and standby power generation solutions. In addition to their application in power generation, the 2-5 MW diesel engines are extensively utilized in the oil and gas industry. In this sector, they are often deployed for drilling operations, offshore platforms, and other energy-intensive processes that require dependable power sources. The harsh and remote environments associated with oil and gas exploration and production necessitate power solutions that are both robust and efficient. Diesel engines in the 2-5 MW range are well-suited for these conditions, providing the necessary power while maintaining operational reliability.

The 2-5 MW segment is favored for its balance between cost and performance. These engines offer a cost-effective solution for applications that require more power than smaller engines can provide but do not necessitate the higher capital and operational expenditures associated with larger engines. This cost-effectiveness extends to fuel consumption as well, where engines in this power rating range are designed to optimize fuel efficiency, resulting in lower operating costs over time. This makes them an attractive option for businesses looking to manage their energy expenses without compromising on power availability. The construction and infrastructure sectors also drive the demand for 2-5 MW diesel engines. Construction sites often require mobile and reliable power sources to operate heavy machinery, lighting, and other essential equipment. Diesel generators in this power rating are portable enough to be transported to different sites while powerful enough to meet the high energy demands of large construction projects. Their ability to provide consistent power in off-grid and remote locations makes them indispensable for large-scale construction and infrastructure development. Additionally, advancements in diesel engine technology have bolstered the market position of the 2-5 MW segment. Manufacturers are continually innovating to enhance the performance, emissions control, and efficiency of these engines. Modern engines in this power rating range feature advanced fuel injection systems, improved combustion processes, and sophisticated control mechanisms that reduce emissions and comply with stringent environmental regulations. These technological improvements not only increase the attractiveness of 2-5 MW diesel engines but also ensure their competitiveness in a market that increasingly values sustainability and environmental responsibility.

Make an Inquiry @ https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=65999135

Middle East & Africa to emerge as the third-largest diesel power engine market.

The Middle East & Africa region holds the fourth-largest market share in the global diesel power engine market due to a combination of factors that drive demand across various sectors, including energy, construction, mining, and manufacturing. Firstly, the Middle East’s robust oil and gas industry is a significant contributor to the demand for diesel power engines. Countries like Saudi Arabia, the UAE, and Kuwait rely heavily on diesel engines to power drilling rigs, pump stations, and other critical infrastructure in remote locations where access to the grid is limited. The need for reliable and continuous power in these operations ensures a steady demand for diesel power engines, particularly in mid-to-large power ratings. In Africa, the widespread lack of reliable grid infrastructure drives the demand for diesel power engines as primary and backup power sources. Many African countries face frequent power outages and have limited access to consistent electricity supply. Diesel generators provide an essential solution for businesses, hospitals, and residential areas to ensure uninterrupted power. This is particularly crucial for sectors like healthcare and telecommunications, where power reliability is paramount. The construction boom in the Middle East, driven by massive infrastructure projects and urban development initiatives, also fuels the demand for diesel power engines. Major cities like Dubai and Riyadh are continuously expanding, requiring substantial power for construction machinery, site lighting, and other temporary power needs. Diesel engines are favored in these scenarios due to their portability, robustness, and ability to deliver high power output in varying environmental conditions.

Mining activities across Africa, particularly in countries such as South Africa, Nigeria, and Ghana, further boost the market for diesel power engines. The mining industry operates in remote areas with little to no access to grid power, making diesel engines indispensable for powering mining equipment, ventilation systems, and processing plants. The reliability and durability of diesel engines make them the preferred choice in the harsh operating conditions typical of mining sites. Moreover, the region’s ongoing industrialization and urbanization trends are key drivers of diesel engine demand. As Middle Eastern and African countries continue to develop their industrial base, the need for reliable power solutions increases. Diesel engines play a critical role in supporting manufacturing operations, logistics, and agricultural activities by providing a dependable source of power, especially in areas where the electrical grid is underdeveloped or unstable. Government initiatives aimed at improving energy access and infrastructure also play a role in sustaining demand for diesel power engines. Many countries in the region are investing in expanding their energy infrastructure, including the deployment of diesel generators as a stopgap solution while longer-term projects like renewable energy installations are developed. Lastly, the adaptability of diesel engines to operate in diverse climatic conditions found across the Middle East and Africa, from the arid deserts of the Middle East to the tropical regions of Sub-Saharan Africa, underscores their utility and widespread adoption. Manufacturers in the region have also been focusing on developing engines that comply with stringent emission standards, enhancing their market appeal by addressing environmental concerns.

Ask Sample Pages @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=65999135

Key Players

Key players in the global diesel power engine market include Caterpillar (US), Cummins Inc. (US), WEICHAI POWER CO.,LTD (China), MAN (Germany), Rolls-Royce plc (UK), MITSUBISHI HEAVY INDUSTRIES, LTD. (Japan), HD HYUNDAI INFRACORE (South Korea), DAIHATSU DIESEL MFG. CO., LTD. (Japan), YANMAR HOLDINGS CO., LTD. (Japan), KUBOTA Corporation (Japan), Kohler Energy (US), AB Volvo Penta (Sweden), DEUTZ AG (Germany), Mahindra&Mahindra Ltd. (India), IHI Power Systems Co.,Ltd (Japan), Guangzhou diesel engine factory Limited (China), and Wabtec Corporation (US).

About MarketsandMarkets™

MarketsandMarkets™ has been recognized as one of America’s best management consulting firms by Forbes, as per their recent report.

MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients.

Earlier this year, we made a formal transformation into one of America’s best management consulting firms as per a survey conducted by Forbes.

The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines – TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing.

Built on the ‘GIVE Growth’ principle, we work with several Forbes Global 2000 B2B companies – helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry.

Contact:

Mr. Rohan Salgarkar

MarketsandMarkets™ INC.

630 Dundee Road

Suite 430

Northbrook, IL 60062

USA: +1-888-600-6441

Email: newsletter@marketsandmarkets.com

Media Contact

Company Name: MarketsandMarkets™ Research Private Ltd.

Contact Person: Mr. Aashish Mehra

Email: Send Email

Phone: 18886006441

Address:630 Dundee Road Suite 430

City: Northbrook

State: IL 60062

Country: United States

Website: https://www.marketsandmarkets.com/Market-Reports/diesel-power-engine-market-65999135.html

Press Release Distributed by ABNewswire.com

To view the original version on ABNewswire visit: Diesel Power Engine Market Size to Grow $25.2 billion by 2029 | Caterpillar, Cummins Inc., WEICHAI POWER CO.,LTD, MAN