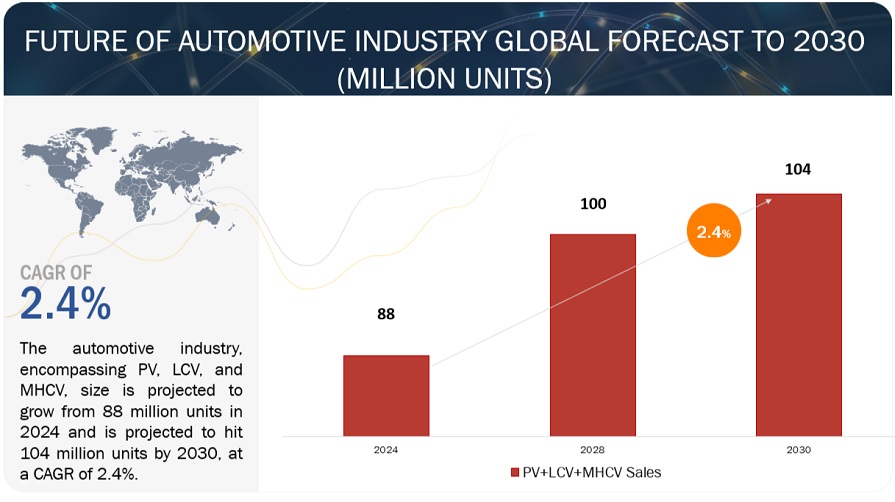

The automotive industry, encompassing PV, LCV, and MHCV, size is projected to grow from 88 million units in 2024 and is projected to hit 104 million units by 2030, at a CAGR of 2.4%.

The growth of the automotive industry is influenced by various factors such as adoption of electric vehicles, development and manufacturing of long-range batteries along with installation of fast and ultra-fast charging points, introduction of autonomous vehicles, deployment of 5G connectivity and trends related to shared mobility.

Countries such as China, Brazil, South Korea and India have increased their investments in the development of automotive industry due to the growing urban population and economy in these countries. Due to such investment demand for automotive market will be more during the forecast period.

Autonomous vehicles are anticipated to witness significant growth

The introduction of autonomous cars with enhanced safety features and higher level of automation is shifting the trends in the automotive market. Numerous OEMs are introducing Level 2 (L2) and Level 3 (L3) autonomous vehicles, including Nissan (Japan), Honda (Japan) , Audi (Germany), BMW (Germany), and Mercedes-Benz (Germany). OEMs such as BMW and Mercedes have received approval for L3 autonomous vehicles in Germany and the US, respectively. BMW has also received approval to test its L3 vehicles in Shanghai, China. We expect L3 vehicle sales to gain pace in 2024 as these OEMs start rolling out their L3 models. In addition to testing the cars on roads several tech giants and OEMs have adopted acquisition strategies to take over smaller companies that operate in the space of developing driverless or autonomous technology. The number of Level 3 (L3) autonomous vehicles is projected to grow at a CAGR of 86.5% between 2023 and 2030. The Level 4 (L4) autonomous vehicle market is expected to experience limited commercial growth, primarily in select markets.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=142125279

Growing adoption of connected vehicles

The total addressable market (TAM) for connected vehicle technologies is forecasted to surge from USD 0.8 billion in 2023 to USD 568 billion by 2035. This growth is driven by enhanced features and services, with potential earnings of USD 1,600 per car annually. Connectivity in vehicles provides better consumer experience, efficient data-driven services and opens innovative business models. Future cars will offer over 300 connected features, signaling the automotive industry’s shift towards more connected, autonomous, shared, and electric vehicles, driving a fundamental transformation in mobility. In 2022, approximately 90% of the connected cars had integration of 4G technology. However, with 5G connectivity the share of connected cars is expected to grow. It is expected that over 20% of the cars on road will be connected to cellular network by the end of 2024. Companies have started exploring the connectivity space to gain first mover advantage in the market. For instance, in December 2023, Magna, a major supplier in the automotive industry joined Telia and Ericsson’s NorthStar Program to innovate and deploy the 5G ADAS system.

“Asia Pacific is expected to be the largest market during the forecast period”

Asia-Pacific region hold the major share in the sales volume of PV and CV combined. The major factor for this is the intensive manufacturing and export of cars in China. The Chinese market is the worlds largest market in terms of vehicle sales as well as production. In 2023, China’s sales volume for passenger vehicles was over 25 million units, with a share of around 50% globally. China is the most dominant nation in automotive industry with respect to supplying raw materials, manufacturing as well as its sales. China has the most powerful supply chain of EV batteries. Over 50% of the EV batteries are manufactured in China. Moreover, around 75% of the components of EV batteries are manufactured in China. These Chinese manufacturers are looking to expand their services and acquire additional market share around the world. The Asia region has seen growth in automobile production in 2022 and 2023. Continuing this trend, the Asia region will dominate the market during the forecast period.

Key Players

The top automobile OEMs in the market are Toyota Motors Corporation (Japan), Tesla (USA), Volkswagen AG (Germany), Ford (USA) , BYD (China), Hyundai Motor Corporation (South Korea) and so on. The other companies that support the automobile industry with technology development are ABB, Siemens, Nvidia, Waymo, Bosch and others. These companies adopted new product launches, acquisitions, partnerships, collaborations, and other key strategies to gain traction in the automotive market.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=142125279

Media Contact

Company Name: MarketsandMarkets™ Research Private Ltd.

Contact Person: Mr. Aashish Mehra

Email: Send Email

Phone: 18886006441

Address:630 Dundee Road Suite 430

City: Northbrook

State: IL 60062

Country: United States

Website: https://www.marketsandmarkets.com/Market-Reports/future-of-automotive-industry-142125279.html

Press Release Distributed by ABNewswire.com

To view the original version on ABNewswire visit: Future Of Automotive Industry Size worth 104 million units by 2030