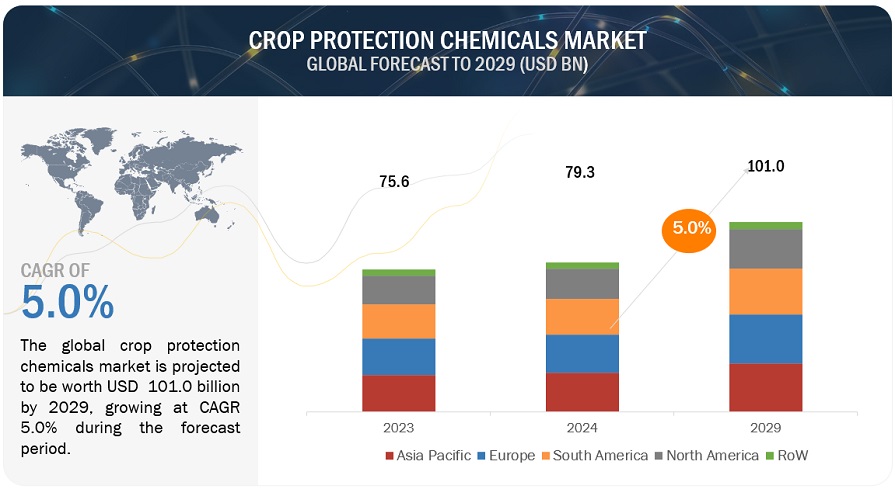

The global crop protection chemicals market is estimated at USD 79.3 billion in 2024 and is projected to reach USD 101.0 billion by 2029, at a CAGR of 5.0% during the forecast period. According to the Centre for Agriculture and Bioscience International (CABI), approximately 40% of global crop yields are lost annually due to pests, pathogens, and weeds, including the destructive Fall armyworm (FAW). This threat, intensified by climate change, poses significant risks to essential crops like maize, wheat, banana, and coffee, impacting household incomes, national economies, and global food security. Such challenges underscore the critical role of effective crop protection solutions in mitigating these risks. The demand for crop protection chemicals is therefore bolstered as farmers seek reliable methods to combat pests and diseases, ensuring stable yields and safeguarding agricultural production. This market growth is driven by the necessity for advanced formulations and technologies that can efficiently manage evolving pest pressures while supporting sustainable agricultural practices. As such, the ongoing need to protect crops from a wide array of threats continues to drive innovation and investment in the crop protection chemicals sector globally.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=380

By origin, the biopesticides segment is expected to grow at the highest CAGR during the forecast period in terms of value.

The overuse of chemical pesticides has led to increased pest resistance, reducing the effectiveness of these products. Biopesticides, with their unique modes of action, provide an alternative that can manage pest resistance issues. They often work in conjunction with chemical pesticides in integrated pest management (IPM) strategies, helping to mitigate resistance and extend the useful life of both biopesticides and chemical pesticides. Consumers are becoming more aware of the environmental and health impacts of chemical pesticides. This awareness is driving demand for organic and sustainably produced food, which in turn increases the demand for biopesticides. Farmers are responding to market demand by adopting biopesticides to meet consumer preferences for organic products. Governments and regulatory bodies are increasingly supporting the use of biopesticides through favorable policies and regulations. For example, the European Union’s strict regulations on chemical pesticides encourage the adoption of biopesticides. Similarly, countries like the United States and India are implementing policies that promote sustainable farming practices and the use of biopesticides.

By crop type, cereals & grains are estimated to grow at the highest CAGR during the forecast period.

Cereals and grains are highly susceptible to a variety of pests and diseases. For instance, wheat rust, rice blast, and corn borers can cause significant yield losses. Effective crop protection chemicals, including fungicides, insecticides, and herbicides, are crucial in mitigating these threats and ensuring healthy crop yields. Many governments are investing in agricultural development to ensure food security. Subsidies and support for farmers to purchase and use crop protection chemicals are driving the growth of this market segment. For example, initiatives in countries like India and China aim to boost cereal and grain production through better pest management practices. Cereals and grains are cultivated on a vast scale globally. Regions like North America, Europe, and Asia-Pacific have extensive areas dedicated to these crops. The large-scale cultivation necessitates substantial use of crop protection chemicals to manage pests and diseases over large areas efficiently. For instance, the United States, one of the largest producers of corn, has seen consistent growth in the use of herbicides and insecticides to manage weeds and pests that threaten corn production. Similarly, in Asia, rice cultivation heavily relies on fungicides and insecticides to combat diseases like rice blast and pests like planthoppers.

By type, the herbicides segment is estimated to dominate the crop protection chemicals market.

Herbicides are crucial for managing weeds, which compete with crops for nutrients, water, and sunlight, significantly impacting crop yields. For example, glyphosate, one of the most widely used herbicides globally, has seen extensive application due to its effectiveness in controlling a broad spectrum of weeds. Glyphosate’s market presence is significant, with sales reaching billions of dollars annually. Its use is particularly prominent in countries like the United States, Brazil, and Argentina, where large-scale, industrial farming is prevalent. Another example is atrazine, commonly used in corn production. Atrazine has been integral in managing weed populations and enhancing crop yields, especially in the United States, which leads global corn production. The effectiveness of atrazine in various climatic conditions and soil types has contributed to its widespread adoption, further solidifying the dominance of herbicides in the market. Furthermore, the development of herbicide-resistant crops, such as Roundup Ready soybeans, has bolstered herbicide usage. These genetically modified crops can withstand applications of specific herbicides, allowing farmers to manage weeds more effectively without harming the crops.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=380

The crop protection chemicals market in the South America region is expected to grow constantly during the forecast period.

South America boasts a vast and diverse agricultural landscape, with countries like Brazil and Argentina being major global producers of key crops such as soybeans, corn, sugarcane, and coffee. The region’s extensive agricultural activities drive substantial demand for crop protection chemicals to ensure high yields and crop quality. The tropical and subtropical climates prevalent in much of South America create favorable conditions for a wide range of pests and diseases. Crops in the region are frequently threatened by insects, fungi, weeds, and pathogens, necessitating the use of effective crop protection chemicals to mitigate losses and maintain productivity. For example, soybean rust and the fall armyworm are significant threats that require robust chemical management. The region’s integration into global agricultural markets through favorable trade policies and agreements enhances its competitiveness and export potential. High crop production for export markets necessitates rigorous pest and disease management to meet international quality standards, further fueling the demand for crop protection chemicals.

Key players in the crop protection chemicals market BASF SE (Germany), Bayer AG (Germany), FMC Corporation (US), Syngenta Group (Switzerland), Corteva (US), UPL (India), Nufarm (Australia), Sumitomo Chemical Co., Ltd (Japan), Albaugh LLC (US), Koppert (Netherlands), Gowan Company (US), American Vanguard Corporation (US), Kumiai Chemical Industry Co., Ltd (Japan), PI Industries (India), and Chr. Hansen A/S (Denmark).

Get 10% Free Customization on this Report: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=380

About MarketsandMarkets™

MarketsandMarketsTM has been recognized as one of America’s best management consulting firms by Forbes, as per their recent report.

MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients.

Earlier this year, we made a formal transformation into one of America’s best management consulting firms as per a survey conducted by Forbes.

The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines – TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing.

Built on the ‘GIVE Growth’ principle, we work with several Forbes Global 2000 B2B companies – helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry.

Media Contact

Company Name: MarketsandMarkets™ Research Private Ltd.

Contact Person: Mr. Rohan Salgarkar

Email: Send Email

Phone: 18886006441

Address:630 Dundee Road Suite 430

City: Northbrook

State: IL 60062

Country: United States

Website: https://www.marketsandmarkets.com/Market-Reports/crop-protection-380.html

Press Release Distributed by ABNewswire.com

To view the original version on ABNewswire visit: Crop Protection Chemicals Industry worth $101.0 billion by 2029 | Key Players are BASF SE, Bayer AG, FMC Corporation, Syngenta Group, Corteva, Nufarm, Koppert, and Chr. Hansen A/S