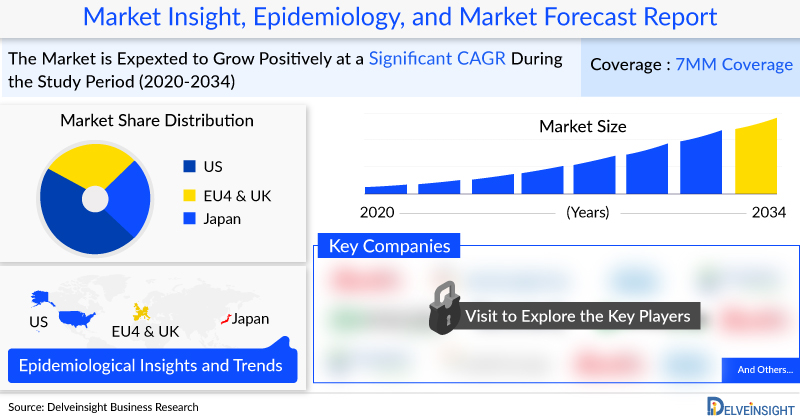

(Albany, USA) DelveInsight’s Acute Pain Market Insights report includes a comprehensive understanding of current treatment practices, acute pain emerging drugs, market share of individual therapies, and current and forecasted market size from 2020 to 2034, segmented into 7MM [the United States, the EU-4 (Italy, Spain, France, and Germany), the United Kingdom, and Japan].

Request for Sample Report @ Acute Pain Market Forecast

Key Takeaways from the Acute Pain Market Report

- The United States accounts for the largest Acute Pain market size, in comparison to EU4 (Germany, Spain, Italy, France), the United Kingdom, and Japan.

- As per DelveInsight analysis, the acute pain market size in the US was approximately USD 3 billion in 2021.

- In 2023, postoperative pain, trauma pain, and acute medical illness accounted for ~40%, ~40%, and ~20% of diagnosed incident cases of acute pain in the United States, respectively.

- Leading acute pain companies such as Hyloris Pharmaceuticals, AFT Pharmaceuticals, Formosa Pharmaceuticals, Concentric Analgesics, Vivozon, Vertex Pharmaceuticals, Taiwan Liposome Company (TLC), Medical Developments International (MVP), Neumentum Pharmaceuticals, Charleston Laboratories, Neurana Pharmaceuticals, AcelRx Pharmaceuticals, Teikoku Pharma, PainReform, Nevakar, Unither Pharmaceuticals, Aptys Pharmaceuticals, Avenue Pharmaceuticals, and others are developing novel acute pain drugs that can be available in the acute pain market in the coming years.

- The promising acute pain therapies in the pipeline include MAXIGESIC IV (paracetamol + ibuprofen), APP13007 (Clobetasol Propionate Ophthalmic Nanosuspension), opiranserin (VVZ-149), vocacapsaicin (CA-008), VX-548, TLC590 (ropivacaine liposomal), PENTHROX (methoxyflurane), NTM-001 (Ketorolac Pre-Mixed Bag), NTM-006, CL-108, CL-H1T, ZALVISO (sufentanil), TPU-006 (dexmedetomidine transdermal system [DMTS]), PRF110, NVK-009 (pregabalin and acetaminophen), and others.

- On January 30, 2024, Vertex Pharmaceuticals announced positive Phase 3 results for VX-548, a novel non-opioid pain signal inhibitor, showing significant improvement in pain compared to placebo. Vertex plans to file a New Drug Application (NDA) for VX-548 by mid-2024.

- On July 30, 2024, Vertex announced FDA acceptance of the NDA for Suzetrigine, another non-opioid pain signal inhibitor, for the treatment of moderate-to-severe acute pain. The FDA granted priority review and assigned a Prescription Drug User Fee Act (PDUFA) target action date of January 30, 2025.

- On November 13, 2024, CalciMedica announced positive data from the Phase 2b CARPO trial of Auxora (CRAC channel inhibitor) in patients with acute pancreatitis, which also showed potential for treating acute pain.

- In February 2024, AFT Pharmaceuticals disclosed the launch of Maxigesic IV, the intravenous variant of its pain relief medication, in the United States through its licensee, Hikma Pharmaceuticals.

Discover which therapies are expected to grab the major acute pain market share @ Acute Pain Treatment Market

Acute Pain Overview

According to the International Association for the Study of Pain (IASP), acute pain is defined as sudden pain that begins sharp or intense and is a warning sign of disease or a threat to the body. It is usually caused by an injury, surgery, illness, trauma, or painful medical procedure and lasts from a few minutes to less than 6 months. When the underlying cause is treated or healed, acute pain usually goes away. Flu-like symptoms (fever, chills, sore throat, cough), fatigue, numbness, muscle spasms, insomnia, weight loss, anxiety, depression, sharp pain, throbbing, burning, and so on are the most common symptoms associated with acute pain.

Doctors diagnose pain by talking about the patient’s acute pain symptoms, the intensity and location of the pain, and any history of injury, surgery, or illness. Young patients may be asked to rate their pain intensity using a scale such as VAS, VRS, NPRS, and so on. Blood tests, X-rays, CT scans, MRI, ultrasound, and other acute pain diagnostic tests are also available.

Acute Pain Epidemiology Segmentation

DelveInsight estimates that there were approximately 100 million cases of acute pain in the US in 2021.

As per the DelveInsight estimates, in the US, in 2021, diagnosed incident cases of acute pain were approximately 94 million. These cases are expected to grow with a moderate CAGR in the forecast period 2022–2034.

The acute pain market report proffers epidemiological analysis for the study period 2020–2034 in the 7MM segmented into:

- Total Incident Cases

- Total Diagnosed Incident Cases

- Total Type-specific Cases

- Total Severity-specific Cases

- Total Treated Cases

Download the report to understand which factors are driving acute pain epidemiology trends @ Acute Pain Market Dynamics and Trends

Acute Pain Treatment Market

Acute pain treatment is generally tailored to the individual patient’s assessment and needs prior to admission. It is typically started by anesthetists during the perioperative period and completed by the surgical team. It entails, if necessary, prior planning with the acute pain service (APS) and the use of protocols for managing specific types of surgeries and identifying at-risk patients. The APS comprises a multidisciplinary team of medical, nursing, and pharmaceutical experts. The APS is heavily involved in the day-to-day management of acute pain following surgery and provides training for medical nursing staff involved in postoperative pain management. Other appropriate services (e.g., physiotherapists) should be used to facilitate early recovery and mobilization.

The current acute pain treatment pattern consists of various approaches classified as pharmacologic and nonpharmacological therapies. Analgesics, which are further classified as opioids, nonsteroidal anti-inflammatory drugs (NSAIDs), acetaminophen, corticosteroids, anesthetics, and others, are among the pharmacological therapies. Benzodiazepines, muscle relaxants, antidepressants, alpha-2 agonists, gamma-aminobutyric agonists, and cannabinoids are also used to treat acute pain.

Furthermore, acupuncture, psychological approaches (cognitive behavioral therapy, mindfulness-based stress reduction), chiropractic manipulation, physical therapy, transcutaneous electrical stimulation, massage therapy, exercise, and other complementary and alternative medicine therapies (CAM) are also examples of nonpharmacological therapies. All of these involve the concept of multimodal analgesia.

To know more about acute pain treatment guidelines, visit @ https://www.delveinsight.com/sample-request/acute-pain-market

Acute Pain Pipeline Therapies and Key Companies

- MAXIGESIC IV (paracetamol + ibuprofen): Hyloris Pharmaceuticals/AFT Pharmaceuticals

- APP13007 (Clobetasol Propionate Ophthalmic Nanosuspension): Formosa Pharmaceuticals

- VVZ-149 (opiranserin): Vivozon

- CA-008 (vocacapsaicin): Concentric Analgesics

- VX-548: Vertex Pharmaceuticals

- TLC590 (ropivacaine liposomal): Taiwan Liposome Company (TLC)

- PENTHROX (methoxyflurane): Medical Developments International (MVP)

- NTM-001 (Ketorolac Pre-Mixed Bag): Neumentum Pharmaceuticals

- NTM-006: Neumentum

- CL-108: Charleston Laboratories

- CL-H1T: Charleston Laboratories

- ZALVISO (sufentanil): AcelRx Pharmaceuticals

- TPU-006 (Dexmedetomidine Transdermal System (DMTS)): Teikoku Pharma USA

- PRF110: PainReform

- NVK-009 (Pregabalin and Acetaminophen): Nevakar

Acute Pain Market Dynamics

The dynamics of the acute pain market is predicted to change in the future due to the improvement in the rise in the number of healthcare spending across the world and rising cases of acute pain. Moreover, growing research and development is increasing the demand for better acute pain diagnosis and acute pain treatment options.

Furthermore, the acute pain market requires new therapies with superior efficacy comparable to opioids but with fewer side effects and drug dependency. As a result, acute pain drugs with novel mechanisms of action and combinations have recently been investigated to overcome the challenges posed by this entity. In addition, clinicians and patients are becoming more aware of multimodal analgesia. Furthermore, increased public awareness creates a lucrative opportunity for therapeutic innovation to propel this acute pain market.

However, several factors are affecting the growth of the acute pain market. One of the major flaws is a lack of effective diagnosis; pain can be a difficult medical problem to diagnose and treat. A variety of events or circumstances can cause it. Many hospitals do not effectively implement pain assessments.

Moreover, existing trial design guidelines must be improved so that future approaches are primarily focused on specific patient groups rather than specific surgical procedures. Specific side effects may jeopardize the drug’s recommendations.

Furthermore, in some cases, patients try to ignore the pain and avoid taking proper medication, which causes the condition to deteriorate and turn into chronic pain, which is caused by a lack of healing in the damaged tissue; this impedes both the diagnosis and treatment process. Thus, all these factors mentioned above will likely hamper the acute pain market growth.

Discover more about acute pain drugs in development @ FDA-approved drugs for acute pain

Acute Pain Market Report Metrics

- Study Period: 2020–2034

- Coverage: 7MM [the United States, the EU-4 (Italy, Spain, France, and Germany), the United Kingdom, and Japan].

- Key Acute Pain Companies: Hyloris Pharmaceuticals, AFT Pharmaceuticals, Formosa Pharmaceuticals, Concentric Analgesics, Vivozon, Vertex Pharmaceuticals, Taiwan Liposome Company (TLC), Medical Developments International (MVP), Neumentum Pharmaceuticals, Charleston Laboratories, AcelRx Pharmaceuticals, Teikoku Pharma USA, PainReform, Nevakar, and others

- Key Pipeline Acute Pain Therapies: MAXIGESIC IV (paracetamol + ibuprofen), APP13007 (Clobetasol Propionate Ophthalmic Nanosuspension), opiranserin (VVZ-149), vocacapsaicin (CA-008), VX-548, TLC590 (ropivacaine liposomal), PENTHROX (methoxyflurane), NTM-001 (Ketorolac Pre-Mixed Bag), NTM-006, CL-108, CL-H1T, ZALVISO (sufentanil), TPU-006 (Dexmedetomidine Transdermal System (DMTS)), PRF110, NVK-009 (Pregabalin and Acetaminophen), and others.

- Therapeutic Assessment: Acute Pain current marketed and emerging therapies

- Acute Pain Market Dynamics: Acute Pain market drivers and barriers

- Competitive Intelligence Analysis: SWOT analysis, PESTLE analysis, Porter’s five forces, BCG Matrix, Market entry strategies

- Unmet Needs, KOL’s views, Analyst’s views, Acute Pain Market Access and Reimbursement

Table of Contents

1. Acute Pain Market Key Insights

2. Acute Pain Market Report Introduction

3. Acute Pain Market Overview at a Glance

4. Acute Pain Market Executive Summary

5. Disease Background and Overview

6. Acute Pain Treatment and Management

7. Acute Pain Epidemiology and Patient Population

8. Patient Journey

9. Acute Pain Marketed Drugs

10. Acute Pain Emerging Drugs

11. Seven Major Acute Pain Market Analysis

12. Acute Pain Market Outlook

13. Potential of Current and Emerging Therapies

14. KOL Views

15. Acute Pain Market Drivers

16. Acute Pain Market Barriers

17. Unmet Needs

18. SWOT Analysis

19. Appendix

20. DelveInsight Capabilities

21. Disclaimer

22. About DelveInsight

About DelveInsight

DelveInsight is a leading Business Consultant and Market Research firm focused exclusively on life sciences. It supports pharma companies by providing comprehensive end-to-end solutions to improve their performance. Get hassle-free access to all the healthcare and pharma market research reports through our subscription-based platform PharmDelve.

Media Contact

Company Name: DelveInsight Business Research LLP

Contact Person: Ankit Nigam

Email: Send Email

Phone: +14699457679

Address:304 S. Jones Blvd #2432

City: Albany

State: New York

Country: United States

Website: https://www.delveinsight.com/consulting/primary-research-services