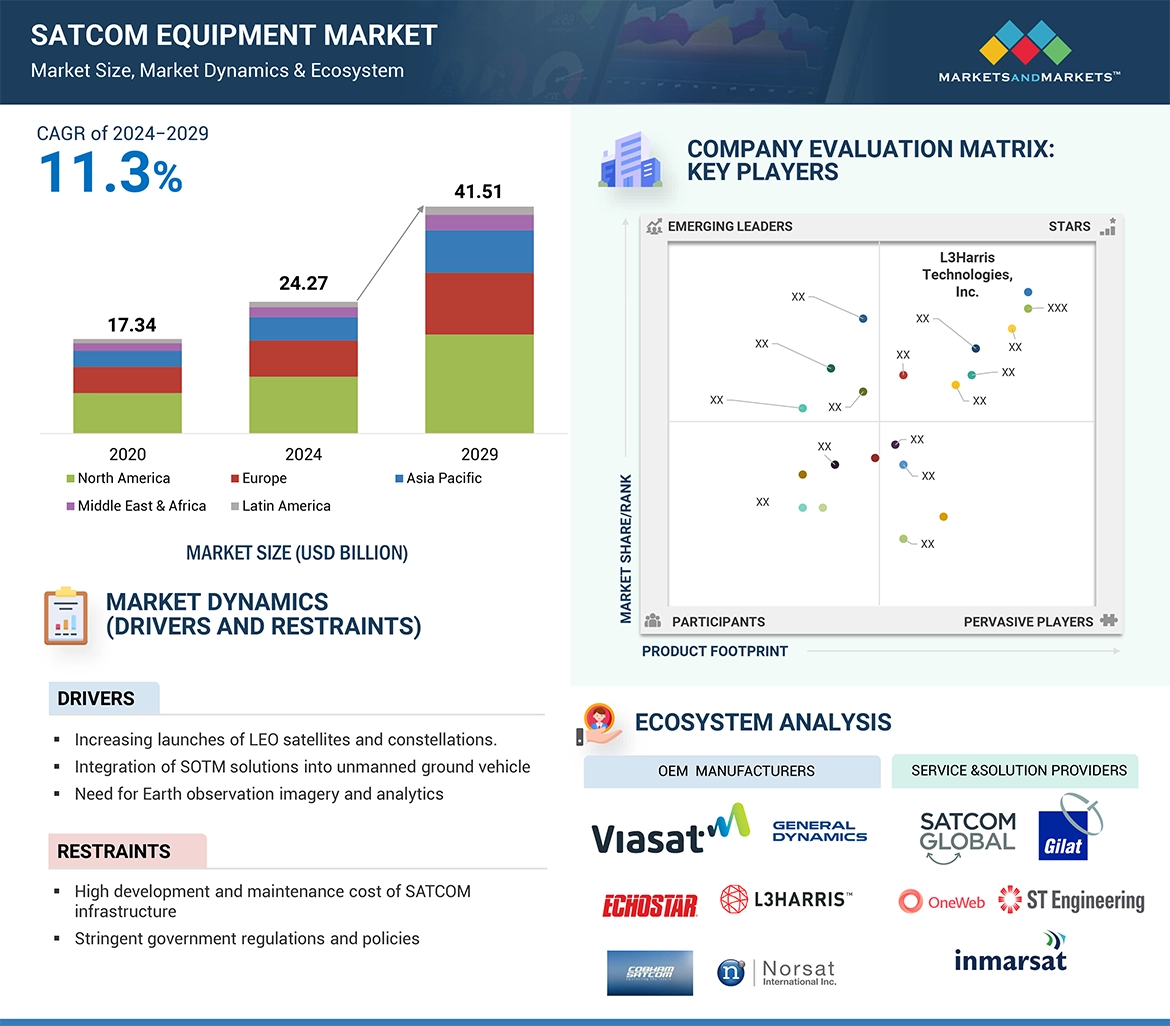

The report “Satellite Communication (SATCOM) Equipment Market by Solution (Product (Antennas, Transceivers, Power Amplifiers, Converters), Service (Engineering)), Platform, Type, Vertical, Frequency, Connectivity, and Region – Global Forecast to 2029″, SATCOM equipment market is valued at USD 24.27 billion in 2024 and is projected to reach USD 41.51 billion by 2029, at a CAGR of 11.3% from 2024 to 2029.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=159285646

Browse 320 market data Tables and 78 Figures spread through 349 Pages and in-depth TOC on “Satellite Communication (SATCOM) Equipment Market – Global Forecast to 2029”

View detailed Table of Content here – https://www.marketsandmarkets.com/Market-Reports/satellite-communication-satcom-equipment-market-159285646.html

The SATCOM equipment market is a rapidly evolving sector that has become integral to global communications, thanks to the use of satellite technology to offer reliable, high-capacity connectivity. The range of products and services encompasses antennas, transceivers, modems, power amplifiers, and integrated systems designed for different applications. SATCOM equipment provides military operations with secure communication and the real-time transmission of data, which helps improve situational awareness and operational effectiveness. Key technologies driving this market include phased array antennas, which enable electronically steerable beams for improved signal tracking; software-defined networking (SDN), which enhances flexibility and efficiency in managing communications; and low Earth orbit (LEO) satellite constellations that significantly reduce latency and increase bandwidth availability.

Beyond defense, the market serves many civil and commercial sectors, such as telecommunications, broadcasting, maritime, aviation, and emergency services. With the increasing demand for high-speed internet and reliable communication solutions, the integration of software-defined networks and the emergence of LEO satellite constellations transform the SATCOM landscape. Such technologies are supposed to increase bandwidth, reduce latency, and enhance overall service quality.

Satcom and terrestrial networks can be integrated using NTNs, that is, LEO and MEO satellites for backhaul and connectivity to terrestrial infrastructure, for providing access to remote or underprivileged areas where traditional terrestrial infrastructure cannot be deployed economically. Satellite backhaul can further enhance the resilience and redundancy of terrestrial networks. The option of secondary connectivity becomes available in case of a network outage or disaster, through which satellite links can establish connectivity quickly and efficiently when an outage occurs and maintain the operation of critical communications services.

Based on the platform, the airborne SATCOM segment is estimated to account for the fastest growth of the SATCOM EQUIPMENT market from 2024 to 2029.

Based on platform, the airborne SATCOM segment is likely to continue to lead the SATCOM equipment market during 2024-2029 and is expected to grow due to modernization programs undertaken by various countries, which is likely to raise the demand for the advanced airborne SATCOM in new aircraft. Airborne SATCOM equipment can also be installed in the existing fleet as a part of retrofitting or upgrading activities. For instance, Integrated Broadcast Service (IBS) program, initiated by the U.S. Department of Defense (DoD) aims to enhance the capabilities of existing military platforms by integrating advanced SATCOM systems that provide real-time situational awareness and intelligence dissemination. This upgrade focuses on improving the interoperability of airborne assets, allowing for seamless communication across different branches of the military. The program enhances data sharing from various sensors and platforms, enabling operators to receive timely updates and better coordinate joint operations.

Based on verticals, the commercial segment is estimated to account for the fastest growth of the SATCOM EQUIPMENT market from 2024 to 2029.

Commercial segment is expected to lead the SATCOM equipment market in the forecast period from 2023 to 2028, by verticals. This can be ascribed to the increasing need for smooth mobile broadband coverage in rural and far-off regions, large-scale usage of small satellites for business and data communication, improvement in transportation and logistics networks, and increased demand for broadband connections and VSAT connectivity. In July 2021, the DCC responded affirmatively to the sector regulator’s request, which paved the way for VSAT operators to extend satellite-based cellular backhaul connectivity to telecom companies. This move ensures that remote and distant mobile broadband areas are not interfered with.

Based on connectivity, the LEO orbit segment is estimated to account for the fastest growth of the SATCOM EQUIPMENT market from 2024 to 2029.

The SATCOM equipment market has been segmented based on connectivity into LEO and MEO/GEO orbit. The LEO orbit segment is estimated to grow at a higher CAGR during the forecast period. Emphasis on the development of SATCOM equipment, coupled with the integration of IoT and 5G technology hardware, is fueling the growth of the SATCOM equipment market. Typically, LEO satellites are used for meteorology and communication applications. SpaceX and Iridium are heavily investing in launching thousands of satellites in LEO orbit over the next few years, opening up manifold opportunities for suppliers of numerous components. SpaceX launched 56 Starlink internet satellites and also successfully achieved rocket landing at sea in May 2023. To date, SpaceX has successfully launched more than 4,300 Starlink spacecraft, with most of those in operation. The Starlink constellation, developed by SpaceX, will enable global broadband coverage. While the firm provides greater speeds and latency compared to the more traditional geostationary satellite systems, this launch is part of an increasing Starlink network that intends to provide dependable and high-speed internet access to its users all over the world.

The North American market is projected to contribute the most significant share from 2024 to 2029 in the SATCOM equipment market.

North America is anticipated to dominate the SATCOM equipment market during the period between 2024 and 2029 by region. SATCOM equipment has an inbuilt opportunity in the lucrative market of the US within North America. The US government is also increasingly investing in the field of SATCOM to improve the quality and effectiveness of satellite communication. It offers efficient and reliable connectivity; hence it is supplementary terrestrial networks. In cases of challenging or economically unviable terrestrial coverage, satellite links and terminals offer adequate connectivity. The US, therefore demands advanced satcom solutions as 5G networks integrate with the existing satcom equipment. Also, the growth of this market is driven by advances in technology in satcom equipment. The satcom equipment manufacturers are continuously in innovation and new introduction for latest technologies to improve performance, efficiency, and reliability. The technological development responsible for driving this adoption into satcom equipment in the US includes high-throughput satellite systems, improved designs for antennas, software-defined solutions, and efficient modulation techniques.

Key Market Players

The SATCOM equipment market is dominated by a few globally established players such Echostar Corporation (US), L3Harris Technologies, Inc. (US), Thales (France), RTX (US), General Dynamics Corporation (US), Cobham Satcom (Denmark), Honeywell International Inc. (US), Viasat, Inc. (US), Gilat Satellite Networks (Israel), Aselsan A.S (Turkey), Iridium Communication Inc. (US), Intellian Technologies Inc. ( South Korea), ST Engineering (Singapore), SpaceX (US), Elbit Systems Ltd. (Israel), Campbell Scientific, Inc. (US), ND SatCom GmbH ( Germany), among others.

Media Contact

Company Name: MarketsandMarkets™ Research Private Ltd.

Contact Person: Mr. Rohan Salgarkar

Email: Send Email

Phone: 18886006441

Address:1615 South Congress Ave. Suite 103, Delray Beach, FL 33445

City: Delray Beach

State: Florida

Country: United States

Website: https://www.marketsandmarkets.com/Market-Reports/satellite-communication-satcom-equipment-market-159285646.html