Summary:

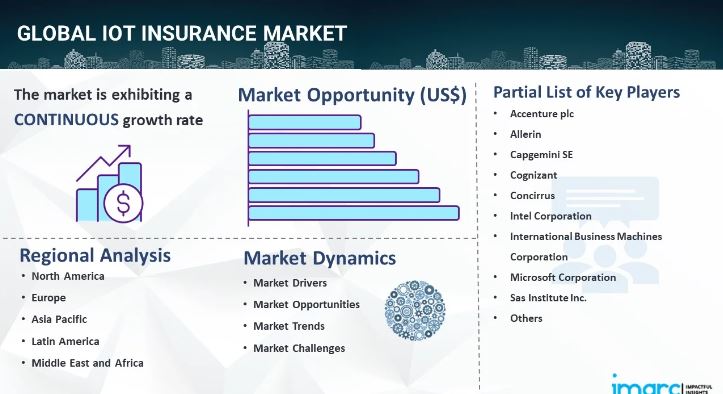

- The global IoT insurance market size reached USD 37.0 Billion in 2023.

- The IoT insurance market is expected to reach USD 430.1 Billion by 2032, exhibiting a growth rate (CAGR) of 30.38% during 2024-2032.

- North America leads the market, accounting for the largest IoT insurance market share.

- Property and casualty insurance accounts for the majority of the market share in the insurance type segment because it leverages IoT technologies to enhance risk assessment, improve loss prevention, and streamline claims processing, thereby increasing efficiency and customer satisfaction.

- Solution holds the largest share in the IoT insurance industry because they enable insurers to collect, analyze, and utilize real-time data from IoT devices.

- Automotive, transportation and logistics remain a dominant segment in the market, because IoT technologies improve fleet management, reduce accidents, and optimize operational efficiency.

- The increasing adoption of telematics in vehicles is driving the growth of the IoT insurance market by enabling usage-based insurance models and real-time risk assessment.

- Growing concerns about data security and privacy are pushing insurers to adopt more robust IoT solutions, enhancing trust and driving market expansion.

Request to Get the Sample Report: https://www.imarcgroup.com/iot-insurance-market/requestsample

Industry Trends and Drivers:

- Technological Advancements in IoT Devices

The rapid evolution of IoT technology is a primary driver in the IoT insurance market. Enhanced connectivity, improved sensor accuracy, and the miniaturization of devices have made IoT solutions more accessible and reliable. These advancements enable insurers to collect real-time data on various risk factors, such as vehicle performance, home security, and health metrics.

The integration of artificial intelligence and machine learning with IoT devices further amplifies data processing capabilities, allowing for more accurate risk assessment and personalized insurance offerings. As IoT technology continues to advance, it fosters innovative insurance products and services that cater to the dynamic needs of consumers and businesses alike.

- Data Analytics and Enhanced Risk Assessment

The ability to harness and analyze vast amounts of data collected from IoT devices is a significant driver in the IoT insurance market. Advanced data analytics enable insurers to gain deeper insights into customer behavior, usage patterns, and potential risk factors. By leveraging predictive analytics, insurers can assess risks more accurately, leading to better pricing strategies and reduced claim incidences.

Enhanced risk assessment not only improves profitability for insurers but also allows for more tailored and personalized insurance products for customers. Additionally, real-time data monitoring helps in proactive risk management, minimizing losses and enhancing customer satisfaction, thereby driving the adoption of IoT-enabled insurance solutions.

- Regulatory Support and Compliance Requirements

Supportive regulatory frameworks play a crucial role in propelling the IoT insurance market growth. Governments and regulatory bodies are increasingly recognizing the benefits of IoT in enhancing risk management and improving insurance services. Clear regulations around data privacy, security standards, and interoperability of IoT devices foster a trustworthy environment for both insurers and consumers.

Compliance requirements also encourage insurers to adopt IoT technologies to meet regulatory standards, such as those related to cybersecurity and data protection. Furthermore, incentives and subsidies for adopting advanced technologies can accelerate the integration of IoT solutions in the insurance sector, thereby driving market growth and innovation.

Buy Report: https://www.imarcgroup.com/checkout?id=4850&method=502

IoT Insurance Market Report Segmentation:

Breakup By Insurance Type:

- Life and Health Insurance

- Property and Casualty Insurance

- Others

Property and casualty insurance dominate the IoT insurance market due to the widespread use of connected devices in property management and the growing need for comprehensive coverage against various risks and damages.

Breakup By Component:

- Solution

- Service

Solution holds the largest share in the IoT insurance market because integrated platforms and advanced analytics enable insurers to effectively utilize IoT data for risk assessment, policy pricing, and streamlined claims processing.

Breakup By Application:

- Automotive, Transportation and Logistics

- Life and Health

- Commercial and Residential Buildings

- Business and Enterprise

- Agriculture

- Others

The automotive, transportation, and logistics sector leads the IoT insurance market as the adoption of IoT devices in vehicles and supply chains enhances risk monitoring, improves operational efficiency, and reduces losses through real-time data insights.

Breakup By Region:

- North America

- Asia-Pacific

- Europe

- Latin America

- Middle East and Africa

North America is the largest market in IoT insurance due to its advanced technological infrastructure, high adoption rates of IoT devices, and the presence of major insurance and technology companies driving innovation and market expansion.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=4850&flag=C

Top IoT Insurance Market Leaders: The IoT insurance market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

Some of the key players in the market are:

- Accenture plc

- Allerin

- Capgemini SE

- Cognizant

- Concirrus

- Intel Corporation

- International Business Machines Corporation

- Microsoft Corporation

- Sas Institute Inc.

- Telit

- Verisk Analytics Inc.

- Wipro Limited

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Browse Related Reports:

Healthcare IoT Security Market Size, Trends, Share & Forecast 2032

Livestock Insurance Market Size, Share, Growth & Forecast Analysis 2032

Marine Insurance Market Size, Share, Industry Trends & Forecast Report

Printed Electronics Market Size, Share, Demand, Key Players & Forecast 2032

Superdisintegrants Market Size, Industry Trends, Share & Growth Report

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Media Contact

Company Name: IMARC Group

Contact Person: Elena Anderson

Email: Send Email

Phone: +1-631-791-1145

Address:134 N 4th St.

City: Brooklyn

State: NY

Country: United States

Website: https://www.imarcgroup.com