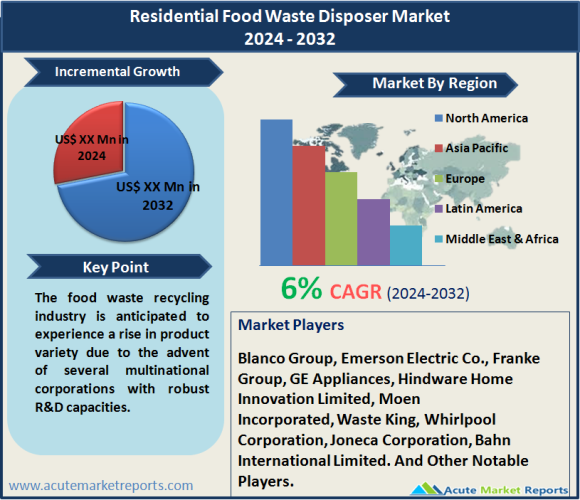

The residential food waste disposer market is anticipated to expand at a compound annual growth rate (CAGR) of 6% during the forecast period of 2024 to 2032. The intricate examination uncovers the importance of technological progress, ecological sustainability, and consumer inclinations in propelling market dynamics. In light of market dynamics, it will be imperative to refine distribution strategies and cater to price sensitivity in order to maintain competitiveness and long-term growth. A global increase in residential food waste has been attributed to a rise in the quantity of residential lodging units. Consequently, there is a growing need for effective technology to manage food waste. Government initiatives pertaining to organic waste disposal and food waste management, alongside environmental awareness concerning the reuse and conservation of organic waste in the agriculture sector, are substantial factors propelling the residential food waste disposal equipment market. Manufacturers and suppliers of food waste disposers are placing increased emphasis on the introduction of technologically sophisticated products as a strategic move to broaden their revenue streams. It is likely that technical complications and the substantial expenses associated with installation and upkeep will hinder the progress of the market. The food waste recycling sector is expected to witness an expansion in product diversity as a result of the entry of numerous multinational corporations with substantial R&D capabilities.

Key Market Drivers

Technological Advancements in Grinding

Progress in grinding technology has evolved as a substantial catalyst for the growth of the residential food waste disposal market. Continuous feed disposers generated the most revenue in 2023 due to the efficiency and smoothness of their milling process. This is supported by the increased adoption of continuous feed disposers, which demonstrates their capacity to manage a continuous flow of food waste and their inherent convenience. The prediction predicts that continuous feed disposers, which feature a technologically sophisticated grinding mechanism, will maintain their market leadership.

Waste Reduction and Environmental Sustainability Initiatives

Waste reduction and environmental sustainability initiatives were instrumental in driving market expansion. As the demand for environmentally responsible solutions increased in 2023, batch feed disposers exhibited the highest CAGR. The waste reduction capabilities of batch feed disposers serve as empirical support for their ability to encourage responsible disposal practices through the provision of controlled batch management and disposal options. As anticipated, batch feed disposers will maintain their preeminent position, which is consistent with the worldwide emphasis on sustainable waste management.

Consumer Demand for Disposers Equipped with Large Grinding Chamber Capacity

The market was propelled by consumer demand for disposers featuring large grinding chamber capacities. In 2023, disposers exceeding 1200ml in capacity generated the most revenue and exhibited the highest CAGR. The assertion is supported by consumer inclinations towards disposers that have the capacity to manage greater volumes of food waste, thereby diminishing the necessity for frequent disposal. The prognosis suggests that disposers featuring larger grinding chamber capacities will maintain their leadership position, in line with the changing preferences of consumers.

Browse for report at : https://www.acutemarketreports.com/report/residential-food-waste-disposer-market

Market Restraint: Sensitivity to Cost and Affordability Matters of concern

Nevertheless, price sensitivity and concerns regarding affordability significantly impeded the expansion of the market. Revenue and CAGR for disposers priced above $200 were both challenged in 2023. Consumer reluctance to invest in disposers with greater prices, particularly in price-sensitive markets, provides the evidence. The importance of market participants addressing pricing strategies in order to increase market penetration is emphasised in the forecast.

Market Segmentation by Product

Continuous feed disposers generated the most revenue in the type segment in 2023, whereas batch feed disposers demonstrated the highest CAGR. This is supported by the evidence of the increased utilisation of continuous feed disposers, which is a result of their enhanced operational efficacy. In contrast, the explosive CAGR of bulk feed disposers reflected their popularity among environmentally conscious consumers. The projection indicates that both categories will experience consistent growth, with batch feed disposers maintaining a higher CAGR and continuous feed disposers maintaining their revenue leadership.

Market by Grinding Stage

Single Stage, Multi Stage: Revenue-wise, single-stage disposers dominated the analysis of grinding stages, demonstrating their effectiveness in grinding food refuse. On the contrary, multi-stage disposers achieved the most substantial CAGR in 2023, owing to their sophisticated pulverising functionalities and capacity to manage a wide variety of food waste. The prognosis emphasises the continued dominance of multi-stage disposers in the waste disposal industry, attributing this to their capacity to meet the changing demands of consumers and the disposal of waste.

Market by Grinding Chamber Capacity

Disposers surpassing 1200ml in grinding chamber capacity dominated in terms of revenue and CAGR during 2023. The rationale for this is supported by the growing need for food waste disposers that can accommodate greater volumes of waste, thereby decreasing the frequency of disposal. The projection suggests that disposers featuring larger grinding chamber capacities will maintain their leadership position, which reflects the preference of consumers for improved functionality.

Market by Power

With regard to power categories, disposers exceeding 1 HP dominated in terms of revenue and CAGR in 2023. This is supported by the evidence of the increased use of high-powered disposers, which is a result of their capacity to grind tough food refuse efficiently. The projections indicate that disposers with higher power ratings will maintain their market dominance, which is consistent with consumer inclinations towards durable and high-performing disposers.

Price Market: 0 to 100, 101 to 200, and Above 200

Revenue and CAGR for disposers priced above $200 encountered difficulties in the price segment in 2023. The supporting evidence originates from the inclinations of consumers towards cost-effective alternatives, specifically in markets where prices are critical. The importance of market participants addressing pricing strategies in order to increase market penetration and accommodate various consumer segments is underscored in the forecast.

Market by Channel of Distribution: Offline and Online

The revenue was dominated by online sales when distribution channels were analysed, demonstrating the growing inclination towards online purchasing channels. In contrast, the highest CAGR was observed in offline sales during 2023, underscoring the continued importance of conventional retail channels. The projection indicates that both online and offline channels will continue to expand, underscoring the importance of adopting a well-rounded strategy to accommodate the varied preferences of consumers.

Get Free Sample Copy From https://www.acutemarketreports.com/request-free-sample/140243

North America Continue to Be the Global Leaders

Revenue dominance in the geographic segment was attributed to well-established waste management practices and heightened consumer awareness in North America. Contrarily, the Asia-Pacific region exhibited the most substantial CAGR, which can be attributed to the expanding populace and rising prevalence of residential food waste disposers in the area. The evidence is attributable to the developing waste disposal infrastructure and environmental consciousness in the region. The forecast predicts that revenue will continue to be dominated by North America, while Asia-Pacific is expected to lead advancements in CAGR.

Competition To Intensify During the Forecast Period

Prominent organisations operating in the residential food waste disposer sector are devoting significant resources to rigorous research and development initiatives, aiming to introduce innovative products. The marketing strategy for residential food waste disposers continues to develop in tandem with the methodical integration of technology and the dynamic government policies that regulate the wastewater treatment industry. Prominent organisations implement critical strategies such as expanding their product portfolios and engaging in mergers and acquisitions. A number of notable corporations, including BLANCO Group, Emerson Electric Co., Franke Group, Bahn International Limited, Moen Incorporated, Waste King, Whirlpool Corporation, and Joneca Corporation, hold substantial market shares in the food waste disposers industry. The market is distinguished by its emphasis on technological progress, environmentally sustainable solutions, and catering to consumer demands for disposers that are both efficient and environmentally favourable.

Related Reports https://www.acutemarketreports.com/category/household-market

Media Contact

Company Name: Acute Market Reports, Inc.

Contact Person: Chris Paul

Email: Send Email

Phone: US/Canada: +1-855-455-8662, India: +91 7755981103

Address:90 Church St, FL 1 #3514, New York, NY 10008, USA

City: New York

State: New York

Country: United States

Website: www.acutemarketreports.com