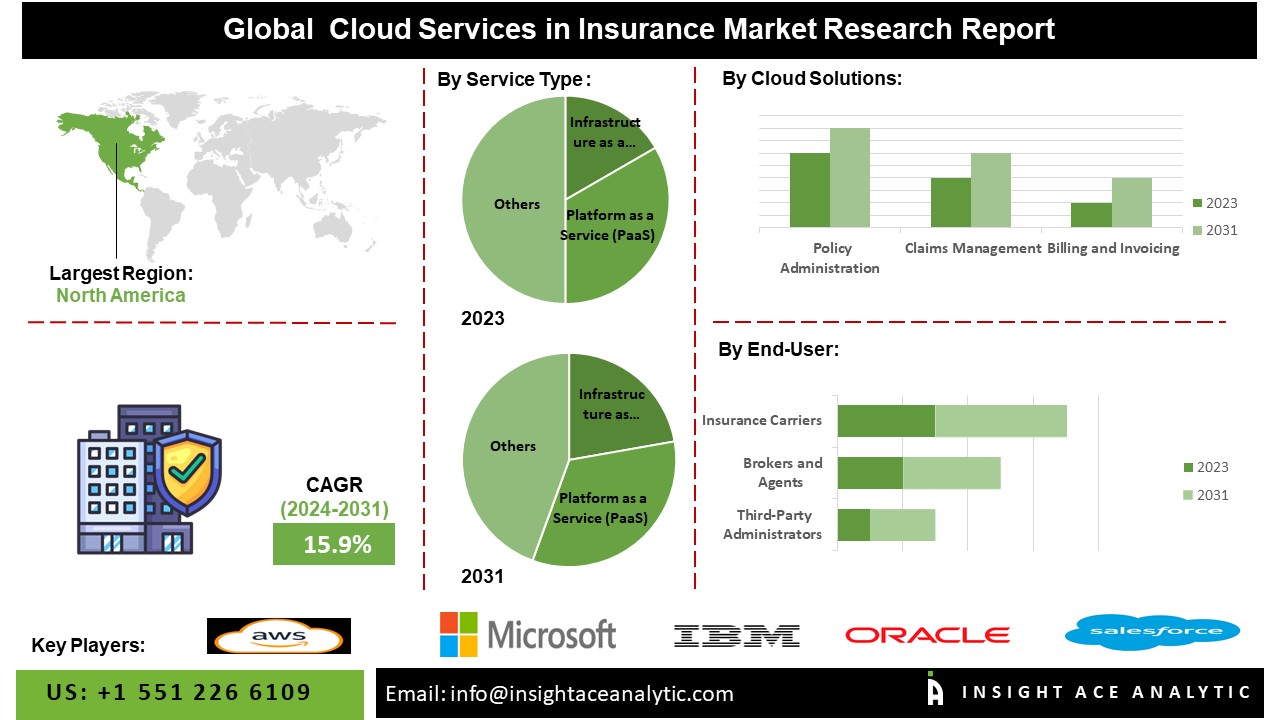

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the “Global Cloud Services in Insurance Market – (By Service Type (Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS)), By Cloud Solutions (Policy Administration, Claims Management, Billing and Invoicing, Customer Relationship Management (CRM), and Risk Management), By End User (Insurance Carriers, Brokers and Agents, and Third-Party Administrators)), Trends, Industry Competition Analysis, Revenue and Forecast To 2031.”

According to the latest research by InsightAce Analytic, the Global Cloud Services in Insurance Market is predictable to expand with a CAGR of 15.9% during the forecast period of 2024-2031.

Cloud services in insurance are the applications of cloud computing to the insurance industry. Cloud services usage in the insurance industry enables the implementation of more flexible, customer-centric, and data-oriented processes. As the development of cloud technology progresses, it will increasingly empower insurers to enhance their services, streamline their operations, also enhance their competitiveness in a swiftly evolving business.

This includes services like infrastructure, data analytics, storage, and cloud-based software programs that insurance companies obtain from outside vendors. The rising demand for cloud services because they offer disaster recovery and business continuity features that enable insurers to stay compliant with regulations while continuing to operate during disruptions and the rising desire for customized experiences are the main forces propelling the market forward. Using cloud computing in insurance eliminates the need for physical computer systems and the associated maintenance expenses. It can dramatically reduce operating costs for insurance firms by enabling them to pay for only the services and storage they utilize. However, the high expense of creating and deploying cloud solutions and the substantial computational resources will be required. Strict ethics and regulations may impose further limitations to restrict market growth. Furthermore, the industry is expected to be propelled by cutting-edge methods, and the accessibility of cloud-based solutions makes it easier for users to access data and apps remotely, encouraging teamwork and enhancing customer support.

Request for Sample Pages: https://www.insightaceanalytic.com/request-sample/2394

List of Prominent Players in the Cloud Services in Insurance Market:

- Amazon Web Services (AWS)

- Microsoft Corporation

- IBM Corporation

- Oracle Corporation

- Salesforce

- SAP SE

- Cisco Systems, Inc.

- Dell Technologies Inc.

- Google Cloud

- Accenture plc

- DataRobot Inc.

- Zest AI

- Other Prominent Players

Market Dynamics:

Drivers-

The worldwide insurance industry fuels the growing demand for cloud services in the insurance market because insurance companies increasingly turn to more advanced cloud services for their solutions to meet regulatory requirements and improve claims processing, underwriting, and pricing. Also, insurance companies can easily handle changes in workload without overprovisioning because of the scalability of cloud services, which allows them to adapt resources to demand. The market, propelled by various factors such as innovation toward better, more efficient, and customer-focused services, will drive demand for cloud services in the insurance market.

Challenges:

The prime challenge is a high cost and requires specialized knowledge, which is predicted to slow the growth of cloud services in the insurance market. Cloud infrastructure requires a considerable upfront expenditure, particularly for large-scale implementations. Risks associated with implementing strong cybersecurity measures, moving data and systems to the cloud, and integrating different services must be covered by insurers. Smaller insurance organizations may find these charges particularly difficult due to their limited budgets. In addition, adopting cloud service in insurance also necessitates industry-specific expertise. Still, there is a need for more specialized knowledge experts in this industry, challenging market growth in the coming years.

Regional Trends:

The North American cloud services in the insurance market are anticipated to register a major market share in revenue. It is projected to grow at a high CAGR in the near future because the area is ideal for digital transformation. After all, it has a well-developed insurance industry, a robust presence of big insurance companies, and sophisticated customers. Businesses, especially insurance firms, are adopting sophisticated technologies like artificial intelligence and cloud computing at a significant rate due to the demand for increased customer service for insurance. In addition, insurers are among the many businesses that are quickly adopting new technology to improve customer service and operational efficiency. Besides, Europe had a substantial market share because of a rise in the middle class, which is driving up demand for insurance services. The speed at which technology is developing and becoming more digitalized is pushing insurance businesses to use cloud-based solutions to provide unique, practical, and individualized insurance services that can be accessed through digital platforms.

Curious About This Latest Version Of The Report? Enquiry Before Buying: https://www.insightaceanalytic.com/enquiry-before-buying/2394

Recent Developments:

- In Feb 2024, Oracle Exadata Database Service has been chosen by Max Life Insurance to facilitate its exponential expansion. In addition, Max Life implemented an OCI migration for its fundamental systems, encompassing marketing, customer service, claims management, and policy issuance. An increase of as much as 70 percent was observed in application performance as a consequence of this migration.

- In Oct 2023, Accenture completed the acquisition of ON Service GROUP, a well-established provider of insurance operations-focused business process services. The breadth of given delivered to clients in Germany for insurance business processes, including policy administration and sales, was expanded through the acquisition of ON Service GROUP, which bolstered Accenture’s capabilities in insurance operations. Accenture’s capability to oversee the complete process chain was fortified as a result of the acquisition, allowing clients to enhance operational efficiency, increase flexibility, and stimulate expansion via digital services.

Segmentation of Cloud Services in the Insurance Market-

By Service Type-

- Infrastructure as a Service (IaaS)

- Platform as a Service (PaaS)

- Software as a Service (SaaS)

By Cloud Solutions-

- Policy Administration

- Claims Management

- Billing and Invoicing

- Customer Relationship Management (CRM)

- Risk Management

By End-User-

- Insurance Carriers

- Brokers & Agents

- Third-Party Administrators

By Region-

North America-

- The US

- Canada

- Mexico

Europe-

- Germany

- The UK

- France

- Italy

- Spain

- Rest of Europe

Asia-Pacific-

- China

- Japan

- India

- South Korea

- South East Asia

- Rest of Asia Pacific

Latin America-

- Brazil

- Argentina

- Rest of Latin America

Middle East & Africa-

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

For More Customization @ https://www.insightaceanalytic.com/customisation/2394

Media Contact

Company Name: InsightAce Analytic Pvt. Ltd

Contact Person: Diana D’Souza

Email: Send Email

Country: United States

Website: https://www.insightaceanalytic.com/