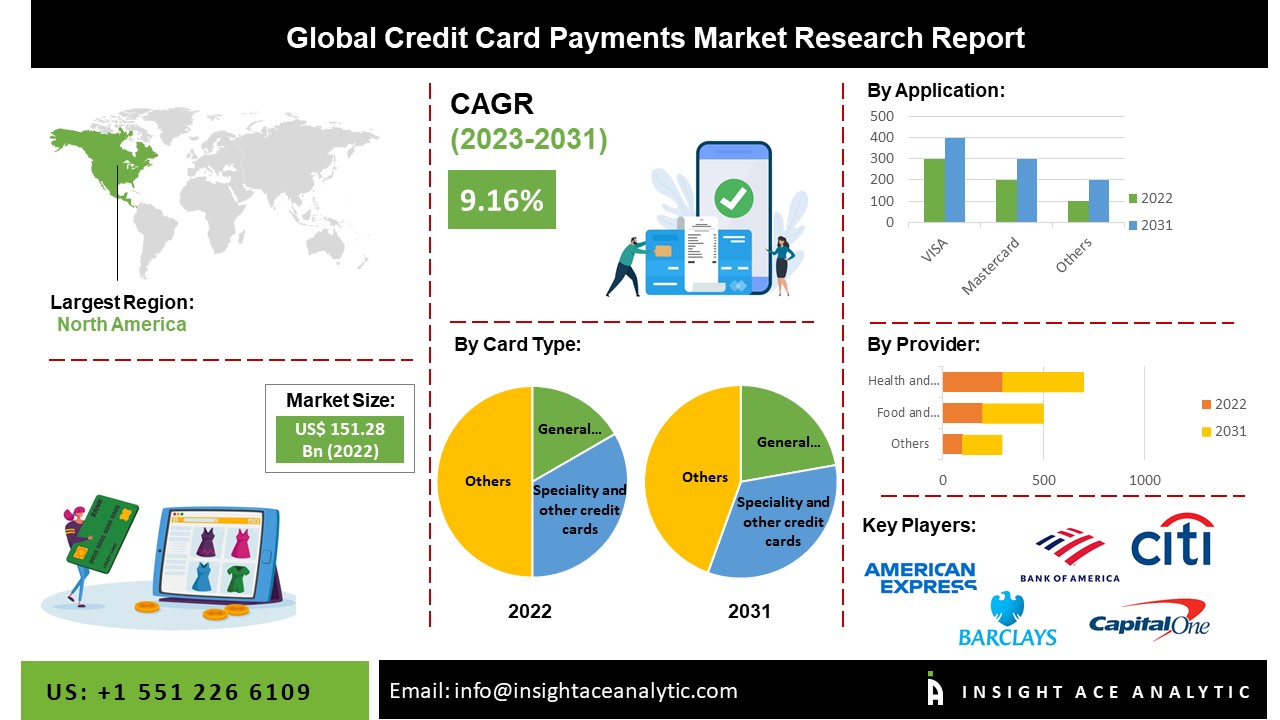

“Credit Card Payments Market” in terms of revenue was estimated to be worth $162.58 billion in 2023 and is poised to reach $327.68 billion by 2031, growing at a CAGR of 9.35% from 2023 to 2031 according to a new report by InsightAce Analytic.

Get Free Sample Report @ https://www.insightaceanalytic.com/request-sample/1600

Latest Drivers Restraint and Opportunities Market Snapshot:

Key factors influencing the global Credit Card Payments Market are:

- Changing consumer behavior and preferences are major drivers

- Advances in payment technologies, including contactless payments, tokenization, and biometric authentication, are driving the market

- Growing e-commerce activities and digitization will drive the market

The following are the primary obstacles to the Credit Card Payments Market’s expansion:

- Security concerns and fraud risk to restrict market growth.

- Lack of universal acceptance to limit market growth

Future expansion opportunities for the global Credit Card Payments Market include:

- Increasing popularity of contactless payments and mobile wallets presents an opportunity for credit card issuers and processors to enhance their offerings

- Enhanced security measures present a significant opportunity.

- Innovation in payment infrastructure to boost market growth

Market Analysis:

The credit card payments market is undergoing dynamic transformations driven by technological advancements, changing consumer preferences, and global economic shifts. With the rise of contactless payments, mobile wallets, and digital transactions, the market is experiencing increased innovation to enhance security, convenience, and efficiency.

List of Prominent Players in the Credit Card Payments Market:

- American Express

- Bank of America Corporation

- Barclays PLC

- Capital One

- Citigroup Inc.

- JPMorgan Chase & Co

- MasterCard

- Synchrony

- The PNC Financial Services Group, Inc.

- United Services Automobile Association

- Visa Inc.

Credit Card Payments Market Report Scope:

|

Report Attribute |

Specifications |

|

Market size value in 2023 |

USD 162.58 billion |

|

Revenue forecast in 2031 |

USD 327.68 billion |

|

Growth rate CAGR |

CAGR of 9.35% from 2024 to 2031 |

|

Quantitative units |

Representation of revenue in US$ Million, and CAGR from 2024 to 2031 |

|

Historic Year |

2019 to 2023 |

|

Forecast Year |

2024-2031 |

|

Report coverage |

The forecast of revenue, the position of the company, the competitive market structure, growth prospects, and trends |

|

Segments covered |

By Card Type, Application and Provider |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

Recent Developments:

- In January 2024, Barclays relaunched its Cambridge Eagle Lab with a renewed focus on helping high-growth climate tech startups connect, grow, and scale.

- In March 2022, Fintech unicorn Razor Pay uncovered that it had paid an undisclosed whole to procure IZealiant Advances, a best startup that provides banks installment innovation arrangements. The securing of Azealia will help Razor Pay’s division of keeping money arrangements develop and empower it to create cutting-edge installment management and account innovation for related banks.

- In September 2021, Wizi was obtained by M2P, an Indian supplier of advanced framework, for a $5 million exchange charge. With this merger, the businesses will manage the credit card industry and have an advantage over their clients. An Indian company called Wizz offers credit cards.

Curious about this latest version of the report? @ https://www.insightaceanalytic.com/enquiry-before-buying/1600

Credit Card Payments Market Dynamics:

Market Drivers: Consumer Behavior and Preferences

Consumer behavior and preferences play a pivotal role in shaping the dynamics of the credit card payments market. The market is witnessing a notable shift driven by changing consumer habits, technological advancements, and evolving expectations. As consumers increasingly embrace digital channels for shopping and payments, the demand for convenient, secure, and seamless credit card transactions has grown substantially. The rise of contactless payments, mobile wallets, and online shopping reflects a preference for quick and frictionless payment experiences.

Challenges: Security Concerns and Fraud Risk

Security concerns and the associated risk of fraud pose significant challenges and constraints to the credit card payments market. As consumers increasingly rely on electronic transactions, the industry must address apprehensions related to data breaches, identity theft, and unauthorized access to financial information. The fear of potential security lapses may hinder consumer trust and adoption of credit card payments, especially in regions or industries with a history of high-profile security incidents. Financial institutions and payment service providers face the ongoing challenge of implementing robust cybersecurity measures, such as encryption, tokenization, and advanced authentication protocols, to mitigate these risks.

North America Is Expected To Grow With The Highest CAGR During The Forecast Period

The North America Credit Card Payments Market is likely to register a significant revenue share and develop at a rapid CAGR in the near future. The region’s robust growth is attributed to factors such as a well-established financial infrastructure, high consumer spending patterns, and a rapid adoption of advanced payment technologies. With a mature credit card market and a tech-savvy consumer base, North America is at the forefront of embracing innovations like contactless payments, mobile wallets, and digital transactions. Additionally, the continuous expansion of e-commerce and the increasing trend of online shopping contribute to the region’s dominance in credit card transaction volumes.

Segmentation of Credit Card Payments Market-

By Card Type-

- General Purpose Credit Cards

- Specialty and Other Credit Cards

By Application-

- Large Food & Groceries

- Health & Pharmacy

- Restaurants & Bars

- Consumer Electronics

- Media & Entertainment

- Travel & Tourism

By Provider-

- Visa

- MasterCard

- Others

By Region-

North America-

- The US

- Canada

- Mexico

Europe-

- Germany

- The UK

- France

- Italy

- Spain

- Rest of Europe

Asia-Pacific-

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

Latin America-

- Brazil

- Argentina

- Rest of Latin America

Middle East & Africa-

- GCC Countries

- South Africa

- Rest of Middle East and Africa

For More Customization @ https://www.insightaceanalytic.com/customisation/1600

Media Contact

Company Name: InsightAce Analytic Pvt. Ltd

Contact Person: Diana D’Souza

Email: Send Email

Country: United States

Website: https://www.insightaceanalytic.com/