Acurx Pharmaceuticals, Inc. (NASDAQ: ACXP) stock may present an investment opportunity that is too good to ignore. That assessment is more than warranted; it’s justified, based on results from its Phase 2b clinical trial of its lead antibiotic candidate, ibezapolstat, for treating patients with Clostridioides difficile Infection (C. difficile, CDI). The data is more than compelling; it puts the target ACXP aims for, front-line treatment designation, in its crosshairs. And plenty supports hitting the bullseye.

Specifically, data showed that ACXP’s ibezapolstat outperformed the standard of care, vancomycin, with a 94% eradication rate of fecal C. difficile at Day 3, compared to 71% for vancomycin. That’s not all. Ibezapolstat preserved key gut bacterial species, believed to prevent CDI recurrence, a result vancomycin has been unable to duplicate in the Phase 2b trial as well as its known data since approval for CDI in 1986. And there could be more excellent news to come.

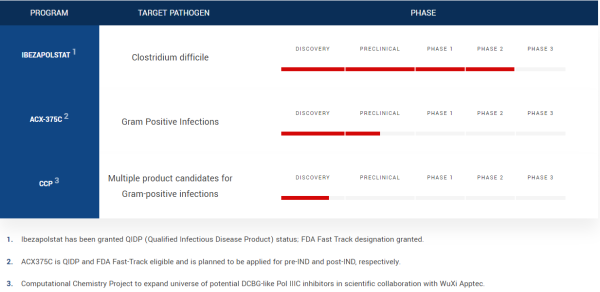

Further analyses of Phase 2b trial data were released on January 18, 2024, and the scientific poster is on the company website at www.acurxpharma.com. These data were presented at the Gulf Coast Consortia AMR Conference. In addition to that, the Company will announce extended clinical cure data 94 days out, which is a first in clinical history for patients treated for CDI with an antibiotic, as well as an upcoming announcement of the company’s FDA submission to finalize the Phase 3 clinical trial with the FDA.

Phase 2 Trial Data Supports Front-Line Designation

The Phase 2 clinical trial included an open-label segment (Phase 2a) and a double-blind, randomized, active-controlled segment (Phase 2b), with ibezapolstat demonstrating a 96% clinical cure rate across both phases, with well-tolerated adverse events. Notably, both trials were discontinued early due to success, and more importantly, the data earned increased ACXP’s confidence about demonstrating non-inferiority to vancomycin in Phase 3 trials. There’s more to appreciate.

The trial results support ongoing scientific investigations into ibezapolstat’s anti-CDI recurrence effects, emphasizing its unique mechanism of action that doesn’t target native gut bacteria. That differentiation is an advantage that appears to be unmatched by any known C. difficile treatment, supporting ACXP’s intent to advance ibezapolstat into Phase 3 trials, with expectations for the drug to prove its potential front-line worth as a comprehensive solution with clinical comparability, microbiome health, safety, and cost for CDI patients.

Designated as a Fast Track drug by the FDA, that could happen sooner rather than later. If so, that will be more than great news for patients; it can be for ACXP investors, too, noting the drug will target the $1 billion-plus US CDI market as well as potential revenues from European, UK, Canadian and Japanese markets, where the company is also seeking a pathway toward fast approvals.

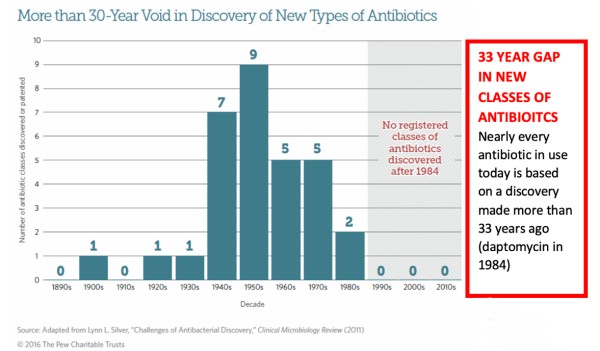

Keep in mind that ACXP is presenting compelling data at the right time. The Centers for Disease Control and Prevention (CDC) has labeled C. difficile as an urgent threat, underscoring the critical need for new antibiotics to address the challenges associated with the infection, which is a significant medical issue in various healthcare settings, including hospitals, long-term care facilities, and the broader community. Estimates included in a 2020 New England Journal of Medicine report indicate that C. difficile causes approximately 500,000 infections annually in the United States, leading to around 20,000 deaths yearly. Worse, the recurrence rate for CDI, with the currently employed antibiotics, is estimated to be between 20% and 40% among approximately 150,000 treated patients.

Outperforming Standard Of Care, Vancomycin

Acurx Pharmaceuticals aims to cure this pressing disease and is well on its way to doing so, noting that ibezapolstat is doing more than showing promising results in clinical trials; it’s outperforming the current standard of care in critical areas. That led to both arms of the Phase 2 clinical trial of ibezapolstat being discontinued due to successful outcomes, a decision made in consultation with independent medical, scientific advisors, and statisticians based on blinded data analysis and considering factors like trial site maintenance costs and COVID-19-related enrollment challenges.

The Independent Data Monitoring Committee (IDMC) review, originally planned for the Phase 2b trial, was not required due to the trial’s actual performance, but there was unanimous consensus at the IDMC that early discontinuation of the Phase 2b trial was most appropriate. Thus, the early termination can expedite ibezapolstat’s progression to Phase 3 clinical trials, which, as noted, could be fueled by being a Qualified Infectious Disease Product (QIDP), Fast Tracked by the FDA, and presenting clinical cure rates for the primary efficacy endpoint of ibezapolstat’s clinical activity in treating CDI.

The latter is a powerful contribution. In the Phase 2 clinical trial, evaluations included pharmacokinetics (PK), microbiome changes, and testing for anti-recurrence microbiome properties. Phase 2a data revealed complete colonic C. difficile eradication by day three of ibezapolstat treatment, along with observed overgrowth of healthy gut microbiota, Actinobacteria, and Firmicute phyla species during and after therapy. Emerging data suggested increased secondary bile acids during and after ibezapolstat therapy, correlating with colonization resistance against C. difficile. The decrease in primary bile acids and a favorable increase in the secondary-to-primary bile acids ratio indicated potential for reducing CDI recurrence compared to vancomycin. That’s a benefit that’s taken nearly five decades to show.

And more may come. Remember, ibezapolstat is the first of a new class of DNA polymerase IIIC inhibitors under development by ACXP to treat bacterial infections. In other words, as a novel, orally administered antibiotic being developed as a Gram-Positive Selective Spectrum (GPSS™) antibacterial, pipeline indications could swell as more data posts.

A Compelling Value Proposition

If so, the value proposition presented at current prices could be an investment gift that keeps on giving.

And keep in mind that while ACXP has an ATM to raise capital to fund its planned Phase 3 trial, it may not need to. Partnership interest, and the competitive interest from it, could be intense, noting that pharma companies like Pfizer (NYSE: PFE), Sanofi (NYSE: SNY), and others may be interested in recouping clinical trial losses from their failed attempts at bringing an effective C. difficile drug to market.

That’s speculative. However, knowing that big pharma companies now prefer to acquire drugs once they are de-risked rather than develop them, ACXP’s chance to partner is certainly a value driver to keep in mind. If they do, ACXP’s roughly $50 million market cap could surge, a presumption based on past peer valuations that skyrocketed after entering Phase 3 trials. Considering that ACXP is positioned better than ever independently, could score near-term partnership interest, and, as importantly, may have the drug to earn front-line designation to treat a multi-billion dollar C. difficile patient market, it’s timely to suggest that history repeating to the benefit of ACXP may be more than likely in 2024- it’s probable.

Disclaimers: Hawk Point Media Group, Llc. (HPM) is responsible for the production and distribution of this content. Hawk Point Media Group, Llc. is not operated by a licensed broker, a dealer, or a registered investment adviser. It should be expressly understood that under no circumstances does any information published herein represent a recommendation to buy or sell a security. Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The information made available by Hawk Point Media Group, Llc. is not intended to be, nor does it constitute, investment advice or recommendations. HPM, or a company principal, owns Acurx Pharmaceuticals stock. No HPM employee or principal will buy or sell any shares of ACXP stock within 72 hours before or within 72 hours after this publication is made public. Still, despite refraining from any buying or selling activity, there is a major conflict of interest in our ability to be unbiased regarding our alerts, and this communication should be viewed as a commercial advertisement only. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. As part of all content, readers, subscribers, and website viewers, are expected to read the full disclaimers and financial disclosures statement that can be found on our website. Contributors reserve the right, but are not obligated to, submit articles for fact-checking prior to publication. Contributors are under no obligation to accept revisions when not factually supported. Furthermore, because contributors are sometimes compensated, readers and viewers of this content should always assume that content provided shows only the positive side of companies, and rarely, if ever, highlights the risks associated with investment. Thus, readers and viewers should accept the content as an advertorial that highlights only the best features of a company. Never take opinion, articles presented, or content provided as a sole reason to invest in any featured company. Investors must always perform their own due diligence prior to investing in any publicly traded company and understand the risks involved, including losing their entire investment. In no event shall Hawk Point Media Group, Llc. be liable to any member, guest or third party for any damages of any kind arising out of the use of any content or other material published or made available by Hawk Point Media Group, Llc., including, without limitation, any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages. Past performance is a poor indicator of future performance. The information in this video, article, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. Hawk Point Media Group, Llc. strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D. For some content, HPM, its authors, contributors, or its agents, may be compensated for preparing research, video graphics, and editorial content. Hawk Point Media Group, LLC. has not been compensated to produce and syndicate this content for Acurx Pharmaceuticals. However, HPM was previously compensated seven-thousand-five-hundred-dollars by Trending Equities, Inc to produce and syndicate digital content for Acurx Pharmaceuticals during the period starting August 12, 2021 and ending on June 1, 2023. HPM was further compensated one-thousand-five-hundred-dollars in October 2023 to produce and syndicate digital content for Acurx Pharmaceutical for a one month period ending on October 31, 2023. The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be forward looking statements. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quote; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investors investment may be lost or impaired due to the speculative nature of the companies profiled.

Media Contact

Company Name: Hawk Point Media

Contact Person: Editorial Dept.

Email: Send Email

Country: United States

Website: https://hawkpointmedia.com/