Reprinted from: Qianzhan Industry Research InstituteCore data of this article: Market segment structure of China’s manganese industry; China’s electrolytic manganese production; China’s manganese sulfate production; China’s electrolytic manganese dioxide production; China’s manganese alloy productionMarket segment structure of manganese industry: Manganese alloys account for over 90%China’s manganese industry market can be divided into the following market segments:1)Electrolytic manganese market: mainly used in the production of stainless steel, magnetic materials, special steel, manganese salts, etc.2)Electrolytic manganese dioxide market: mainly used in the production of primary batteries, secondary batteries (lithium manganate), soft magnetic materials, etc.

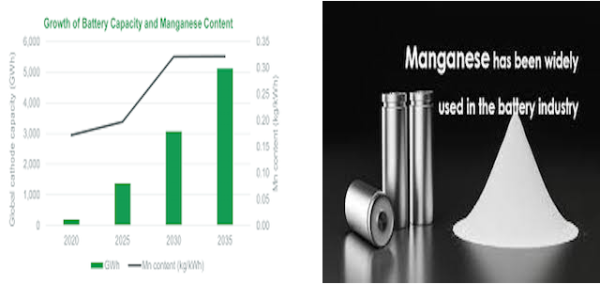

3)Manganese sulfate market: mainly used in the production of chemical fertilizers, ternary precursors, etc. 4) Manganese ferroalloy market: mainly used in the production of stainless steel, alloy steel, cast steel, cast iron, etc. From the perspective of output,In 2022, China’s manganese alloy production will account for the highest proportion of total production, exceeding 90%; followed by electrolytic manganese, accounting for 4%; high-purity manganese sulfate and electrolytic manganese dioxide both account for about 2%.

Manganese industry segment market output1. Electrolytic manganese production: sharp declineFrom 2017 to 2020, China’s electrolytic manganese output remained at around 1.5 million tons. In October 2020, the Electrolytic Manganese Metal Innovation Alliance of the National Manganese Industry Technical Committee was officially established, launching the supply-side reform of the electrolytic manganese industry. In April 2021, the Electrolytic Manganese Innovation Alliance released the “Electrolytic Manganese Metal Innovation Alliance Industrial Upgrading Plan (2021 Edition)”. In order to ensure the smooth completion of the industrial upgrade, the alliance proposed a plan for the entire industry to suspend production for 90 days for upgrading. Since the second half of 2021, the output of the southwestern provinces in the main electrolytic manganese production areas has declined due to power shortages. According to alliance statistics, the total output of electrolytic manganese enterprises nationwide in 2021 is 1.3038 million tons, a decrease of 197,500 tons compared with 2020, and a year-on-year decrease of 13.2%. According to SMM research data, China’s electrolytic manganese production will drop to 760,000 tons in 2022.2. Manganese sulfate production: rapid increaseChina’s high-purity manganese sulfate production will be 152,000 tons in 2021, and the production growth rate from 2017 to 2021 will be 20%. With the rapid growth in the output of ternary cathode materials, the market demand for high-purity manganese sulfate is growing rapidly. According to SMM research data, China’s high-purity manganese sulfate output in 2022 will be approximately 287,500 tons.

3. Electrolytic manganese dioxide production: substantial growthIn recent years, due to the continued increase in shipments of lithium manganate materials, the market demand for lithium manganate type electrolytic manganese dioxide has increased significantly, driving the output of electrolytic manganese dioxide upward. According to SMM survey data, China’s electrolytic manganese dioxide output in 2022 will be approximately is 268,600 tons.4. Manganese alloy production: the world’s largest producerChina is the world’s largest producer and consumer of manganese alloys. According to Mysteel statistics, China’s silicon-manganese alloy output in 2022 will be 9.64 million tons, ferromanganese output will be 1.89 million tons, manganese-rich slag output will be 2.32 million tons, and metallic manganese output will be 1.5 million tons.

Original Source: https://www.urbanmines.com/news/analysis-on-the-development-status-of-chinas-manganese-industry-segment-market-in-2023/

Media Contact

Company Name: UrbanMines Tech. Limited

Email: Send Email

Country: China

Website: https://www.urbanmines.com/