“History has shown luxury watches hold more value than just attractiveness and style. While some watches have outperformed some forms of real estate, gold and stocks, like every investment, one must conduct their due diligence if purchasing a watch for investment purposes,” says Christian Emile (IG: @genevasealed) – Partner of Haute Luxury Watches. When considered wisely, there is opportunity for financial gain as well as enjoyment. Unlike many other investments, a watch can be physically worn and provide daily use. Sentimentally, they hold the heritage, memories, experiences and history of the wearers. One of Patek Philippe‘s catchphrases is: “you never actually own a luxury watch. You merely look after it for the next generation.” In that context, luxury watches serve as symbols of their owners. Once the owner is gone, they continue to tell their stories.

But buying watches is more than just making a quick buck. Where Christian believes many “watch investors” go wrong is not buying a watch they actually like or buying with the intention to flip short term.

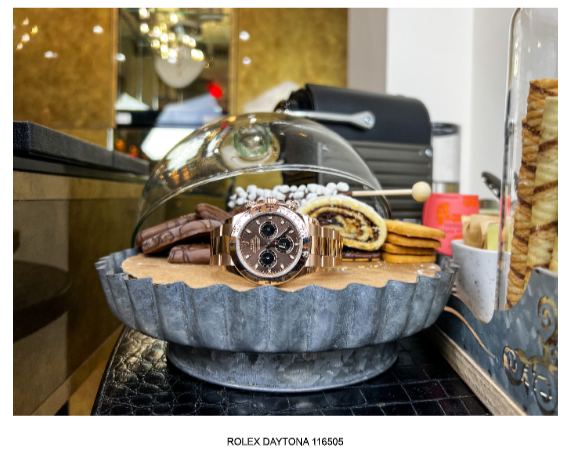

Making an intelligent decision either by consultation, research or even hype & likeliness involves several considerations like Brand, Model, and History. With Rolex being widely known, it is a good brand to consider, but all models don’t match investment wise. Same with other brand giants like Richard Mille, Patek Philippe and Audemars Piguet.

Condition is always a factor. Having original box and certificates aren’t necessary, but they will provide a competitive resell advantage.

“For the 7 years I’ve been in this business, a lot of models will never see the prices I’ve dealt from when I first started,” said Christian. “Fortunately for me, I started as an authorized Richard Mille dealer, and even as pricey of a timepiece they are, even on the retail side, we will never see those prices. I always see old newspapers ads with Patek retailing for $5,000 or Rolex’s for $1,000 and I wished I live in those times. These models, in decent conditions, will sell. I once attended an auction in New York in 2017, and a vintage Rolex from 1968 fetched $17 million. Of course it happened to be Paul Newman’s race car driver’s actual watch, but if you’re telling me that wasn’t an investment that what is? Even today, if that watch were to resell, it would break another watch record. It seems like every year there is a new watch record, so timepiece investing can reach all type of heights.”

A vintage Audemars Piguet Royal Oak watch fetched more than $1 million USD at an auction in May 2022. Additionally, Audemars Piguet, saw an increase in revenue of almost 30% to US$1.6 billion last year. The brand and Patek were on equal footing economically as a result of that rise.

While the world was shut down during the Pandemic, Christian’s WhatsApp was ringing off the hook. It seemed like many collectors and legitimate watch buyers didn’t miss a beat, and with factories worldwide being closed, there was an increased demand for these timepieces driving the market to all-time highs. Soon enough, after the crypto & NFT boom came inflation and those who didn’t invest wisely, was tight on cash or do their due diligence flooded the market with their assets, supply exceeded demand. At the current market, we are seeing steady prices as well as in the economy. Manufactures are raising their retail prices as they combat low supplies. Like in every financial market, there is a price correction. Even some watch brands are laying off workers and discontinuing more expensive models and debuting new ones given the current economic climate. New factors, like Rolex beginning its own secondhand watch sales, will also have influence in watch marketplace sales. Where they’re selling ceramic Panda Daytona at $62,000 USD, and grey market value is currently at $32,000**, this could be a strategy Rolex uses to drive the prices back up on the secondary market.

Some watches, such as limited edition or rare models, are quite popular with collectors, while others may be a total bust on the used market. Like any investment, it’s prudent to take time and make sound decisions & we are here to help: https://hauteluxurywatches.com/ and @HauteLuxuryWatches

Media Contact

Company Name: Haute Luxury Watches / The Vault Miami Beach

Contact Person: Christian Emile (@genevasealed)

Email: Send Email

Phone: 1(305)321-0398

City: Miami Beach

State: Florida

Country: United States

Website: https://hauteluxurywatches.com/