The dream of a “new world” is rooted in the ancient genes of human beings. Since the ancestors of human beings left the African continent and were scattered all over Eurasia, the first person who crossed the ocean and discovered the Australian continent bore no less significance in the discovery of a “new world” than the future colonization of Mars.

But there has never been a thoroughly new world with no traditional connection with the old one because people are from the ancient world, and human nature remains unchanged.

The innovation based on blockchain technology will create a “new world.” But again, instead of a complete subversion, this new world represents an evolution, reform, and integration of traditional finance, which is a gradual and dynamic process.

Blockchain technology gained genuine and wide recognition because of bitcoin. Hence it naturally has the property of finance. Despite the emergence of decentralized models, many business models are replicas of the traditional financial world.

Take exchanges as an example; DEX represents a development direction, but only part of the whole or mainstream. All decentralized models bring to individuals: more choices and freedom. Although blockchain technology is decentralized, people and organizations always tend to be centralized. Because of the possibility of evil in human nature, “Leviathan” is essential to this world, which will otherwise fall into Hobbes’s war of all against all.”

It is because of the lack of regulation that, in some areas, digital assets are repeating the barbaric tales of traditional finance in the era of wilderness. For example, Luna, which offered double-digit fixed returns, was inevitably a Ponzi scheme, which should be common sense to financial professionals.

The same goes for the collapse of FTX. FTX was also trading in the market, which led to insider trading and exposure to tremendous trading risks. But it still secured financing from a lot of top investment institutions. There were also many professional investors trading on FTX, which made them strategically disadvantaged as they were trading in a market where Alameda knew their trump cards were known as a counterparty.

After the FTX incident, many who have claimed that CEX is not trustworthy don’t truly understand CEX. Traditional exchanges have perfect solutions, especially at the level of risk management. People need to “embrace tradition” and learn from traditional exchanges’ risk management systems and models. After all, with so many historical experiences and lessons available, there is no need to pay for these lessons. For example, exchanges can prevent embezzlement of user funds if they are put in third-party escrow.

Therefore, the future development direction of digital asset exchanges should be a hybrid model that integrates the respective advantages and characteristics of centralization and de-centralization and makes combinatorial innovations in aspects such as pricing efficiency, liquidity creation, trading models, trading technology, risk control, and security, governance models, privacy and regulation.

Let’s take a closer look at the advantages and disadvantages of CEX and DEX. First, the two mainly serve retail and institutional users in terms of transaction speed, respectively. The transaction per second (TPS) of digital assets CEX trading system applied is about 20,000 at present, while the transaction speed of traditional exchanges has entered the nanosecond level. When conditions such as regulations are mature, digital CEX can introduce mature traditional trading technology and systems and usher in the era of quantitative and high-frequency trading dominated by institutions. In this regard, DEX needs to catch up. As a result, from the perspective of liquidity and trading volume, CEX will always be the industry’s mainstream.

Second, in terms of trading products, DEX is suitable for standardized products defined by exchanges with extensive participation. CEX is fit for niche, even customized, personalized products and a long-tail market.

Third, in terms of transaction costs, CEX boasts the advantages of economies of scale, and the transaction costs tend to be zero, while DEX trades on the chain and the gas fees are costly and volatile.

Fourth, in terms of risk control and security, the risks of CEX mainly come from humans and organizations. If digital CEX learns well from the risk management systems of traditional exchanges, they can comfortably resolve fundamental risk problems such as user funds and liquidation. DEX naturally has the advantages of blockchain technology, so its risks mainly lie in technology. Therefore, it is worth exploring the integration of the two, on the chain such as transaction centralization and liquidation centralization.

Fifth, in terms of regulation and privacy, all exchanges, especially mainstream ones, are bound to, actively or passively, be subject to regulation. Regulators have the ability and illness to supervise the operated organizations and people of CEXs. However, establishing and improving global regulatory systems require a long cycle, and DEX can continue to provide services for users who value privacy.

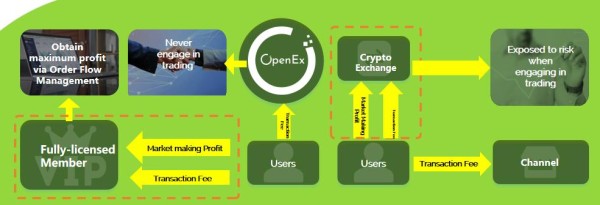

Based on the above judgment, OpenEx(OpenEx.xyz) launched a new generation of hybrid exchange model that has integrated centralization and decentralization, as shown in Figure 1.

OpenEx(OpenEx.xyz) has a centralized matching pool of CEX. Also, it introduces professional market makers to provide market-making quotes and liquidity, which can attract diversified participants, especially institutional investors, and maximize liquidity and pricing efficiency.

At the same time, each of the full licenses members can serve as a decentralized liquidity supply pool like Uniswap and finely provide liquidity to users: the innovative “order flow management” model creates an exclusive back-end system for members that allows them to achieve “member sovereignty.” For example, they can choose users, decide when to provide liquidity for users and make changes at any time. Members can also use their funds to trade in the matching pool, manage their orders, and control the overall position risks.

In this way, countless members represent countless decentralized liquidity supply pools. A Hybrid trading model of “1 matching pool + N OTC trading pools” is established by connecting order flow management and members’ proprietary transactions with a centralized matching pool.

For users, all orders go into the matching pool and are traded according to the “price first, time first” rule to ensure transaction fairness. Their liquidity can come from the matching pool and their members, allowing them to enjoy better liquidity supply and lower market impact costs.

Ultimately, the goal is to maximize the levels of the exchange ecosystem and participants so that each category and trader can form the most suitable position and a dynamic and balanced trading relationship under exchange neutrality and fairness principles.

Media Contact

Company Name: OpenEx Technology Pte Ltd

Contact Person: Bob JT Chien

Email: Send Email

Address:71 Ubi Road 1#06-34 Oxley Bizhub

City: Singapore 408732

Country: Singapore

Website: http://www.openex.xyz/