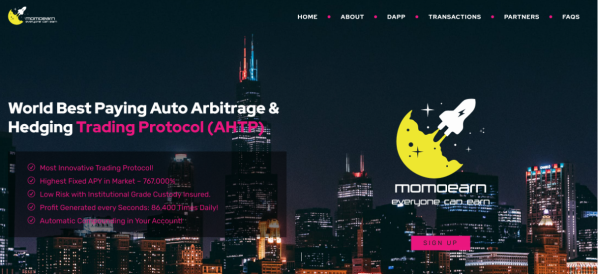

Momoearn is a Cryptocurrency arbitrage is buying cryptocurrencies on one exchange and selling them on another to profit. The main aim of the arbitrage strategy is to earn money by utilizing the differences in crypto coin value between two exchanges.

It is a simple approach to trading cryptocurrencies compared to other methods that need technical analysis. Moreover, it is one of the greatest trading strategies for cryptocurrency markets because of its volatility.

Many Crypto Arbitrage Exchanges Bots are available in the market, and choosing one is difficult. Following is a handpicked list of Top Crypto arbitrage bots with their popular features and website links.

What is Hedging?

Hedging is a financial strategy that should be understood and used by investors because of the advantages it offers. As an investment, it protects an individual’s finances from being exposed to a risky situation that may lead to loss of value. However, hedging doesn’t necessarily mean that the investments won’t lose value at all. Rather, in the event that happens, the losses will be mitigated by gains in another investment.

Hedging is recognizing the dangers that come with every investment and choosing to be protected from any untoward event that can impact one’s finances. One clear example of this is getting car insurance. In the event of a car accident, the insurance policy will shoulder at least part of the repair costs.

Hedging is the balance that supports any type of investment. A common form of hedging is a derivative or a contract whose value is measured by an underlying asset. Say, for instance, an investor buys stocks of a company hoping that the price for such stocks will rise. However, on the contrary, the price plummets and leaves the investor with a loss.

Such incidents can be mitigated if the investor uses an option to ensure that the impact of such a negative event will be balanced off. An option is an agreement that lets the investor buy or sell a stock at an agreed price within a specific period of time. In this case, a put option would enable the investor to make a profit from the stock’s decline in price. That profit would offset at least part of his loss from buying the stock. This is considered one of the most effective hedging strategies.

Visit Our Socials

Website: https://www.momoearn.finance

Telegram: https://t.me/momoearnofficial

Media Contact

Company Name: Momoearn

Contact Person: James

Email: Send Email

Country: United Kingdom

Website: https://momoearn.finance/