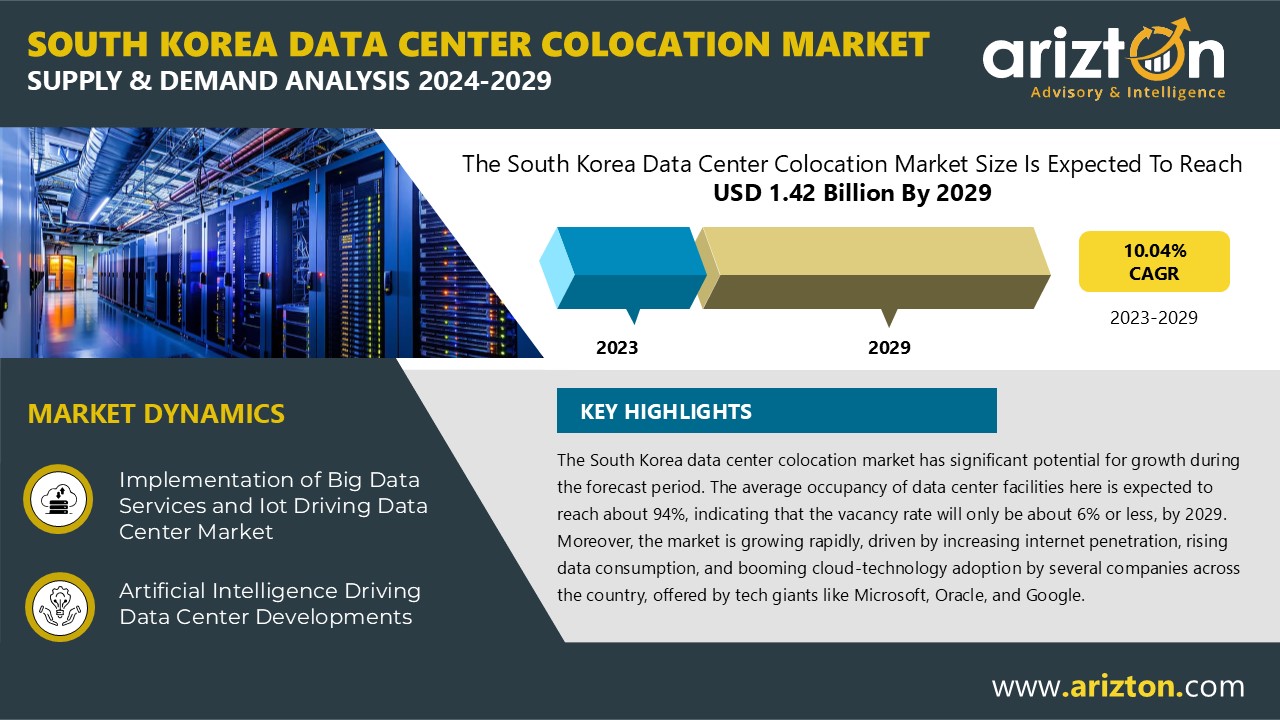

According to Arizton’s latest research report, the South Korea data center colocation market is growing at a CAGR of 10.04% during 2023-2029.

Looking for More Information? Click:

https://www.arizton.com/market-reports/south-korea-data-center-colocation-market

Report Scope:

Market Size – Colocation Revenue (2029): $1.42 Billion

CAGR – Colocation Revenue (2023-2029): 10.04%

Market Size – Utilized White Floor Area (2029): 6,095.2 Thousand Sq. Ft

Market Size – Utilized IT Power Capacity (2029): 1,400 MW

Market Size – Utilized Racks (2029): 144.47 Thousand Units

Base Year: 2023

Forecast Year: 2024-2029

The South Korea data center colocation market is experiencing significant growth, with a mix of regional and global operators such as Equinix, Digital Realty, Telehouse (KDDI), Digital Edge DC, and Epoch Digital (Actis), alongside new entrants like OneAsia Network, Empyrion Digital, STACK Infrastructure, and DCI Data Centers. Seoul, as the central hub, hosts the highest concentration of data center facilities in the country, with approximately 23 existing facilities totaling over 1.9 million square feet of core and shell area as of September 2024. The market is poised for continued expansion, driven by factors such as increasing internet penetration, rising data consumption, and the growing adoption of cloud technologies by major companies like Microsoft, Oracle, and Google. By 2029, the average occupancy rate is expected to reach 94%, with vacancy rates falling to 6% or less, underscoring the strong demand and growth potential in the sector.

Key Highlights

Seoul is a key hub for data centers in South Korea, hosting the highest concentration of facilities in the country. As of September 2024, the city had around 23 data center facilities, totaling more than 1,977.1 thousand square feet of core and shell space.

By December 2023, South Korea’s total data center space across the country had surpassed 2,898.2 thousand square feet, with approximately 1,960.0 thousand square feet utilized, reflecting a utilization rate of over 67.5%.

Major colocation providers, including LG CNS, LG Uplus, SK Broadband, KT Cloud, and Equinix, controlled more than 83% of the country’s total core and shell area as of December 2023.

By September 2024, the total core and shell area of data center facilities nationwide had grown to over 3,523.2 thousand square feet, with 625.0 thousand square feet added in the past nine months through new developments.

The US 503A Compounding Pharmacy Market to Reach $5.04 Billion By 2029

503A compounding pharmacies are essential in providing personalized medications tailored to individual patient needs, based on prescriptions. These pharmacies specialize in creating non-standard dosages, allergen-free options, or custom dosage forms. While regulated by state boards of pharmacy, 503A pharmacies are exempt from some FDA regulations like CGMPs, though they must still meet safety and quality standards. Key challenges include navigating complex regulatory compliance, ensuring strict quality control, managing operational costs, and maintaining public trust following safety concerns. Despite these hurdles, 503A pharmacies play a vital role in offering customized treatments for patients with unique medical needs.

South Korea Public Cloud Market Poised for Rapid Growth

South Korea’s Public Cloud market is set to generate significant revenue, projected to surpass $9.95 billion by 2024. The market is expected to experience an 18% CAGR from 2024 to 2029, with the SaaS segment leading, estimated to reach over $3.75 billion in 2024.

In October 2023, South Korea’s Digital Platform Government committee emphasized adopting cloud-native practices in the public sector to ensure smooth and efficient service delivery.

Amazon Web Services (AWS) also announced plans to invest $5.88 billion by 2027 to enhance cloud computing infrastructure in South Korea.

Further reinforcing this trend, Kyndryl, a global IT infrastructure services provider, successfully completed a major 20-month project in March 2023 for Korean Re, transitioning the company’s core and information systems to the public cloud, marking a significant development in the Korean financial sector.

What’s Included?

- Transparent research methodology and insights on the market’s colocation of demand and supply.

- Market size is available in terms of utilized white floor area, IT power capacity, and racks.

- Market size available in terms of Core & Shell Vs Installed Vs Utilized IT Power Capacity along with the occupancy %.

- An assessment and snapshot of the colocation investment regarding core & shell area, power, and rack in South Korea and a comparison between other APAC countries.

- The study of the existing South Korea data center industry landscape and insightful predictions about industry size during the forecast period.

- An analysis of the current and future colocation demand in South Korea by several industries.

- Study on sustainability status in the region

- Analysis of current and future cloud operations in the region.

- Snapshot of upcoming submarine cables and existing cloud-on-ramps services in the region.

- Snapshot of existing and upcoming third-party data center facilities in South Korea

- Facilities Covered (Existing): 43

- Facilities Identified (Upcoming): 16

- Coverage: 13+ locations

- Existing vs. Upcoming (White Floor Area)

- Existing vs. Upcoming (IT Load Capacity)

- Data Center Colocation Market in the South Korea

- Colocation Market Revenue & Forecast (2023-2029)

- Retail Colocation Revenue (2023-2029)

- Wholesale Colocation Revenue (2023-2029)

- Retail Colocation Pricing along with Addons

- Wholesale Colocation Pricing along with the pricing trends.

- An analysis of the latest trends, potential opportunities, growth restraints, and prospects for the South Korea data center colocation market.

- Competitive landscape, including industry share analysis by the colocation operators based on IT power capacity and revenue.

- The vendor landscape of each existing and upcoming colocation operator is based on the existing/ upcoming count of data centers, white floor area, IT power capacity, and data center location.

Looking for More Information? Click:

https://www.arizton.com/market-reports/south-korea-data-center-colocation-market

Vendor Landscape

Existing Operators

- Digital Realty

- Equinix

- LG Uplus

- LG CNS

- Epoch Digital (Actis)

- kt cloud

- Dreammark1 Corporation

- Hostway

- Digital Edge DC

- SK Broadband

- Others*

New Operators

- ST Telemedia Global Data Centres

- Empyrion Digital

- DCI Data Centers

- OneAsia Network

- STACK Infrastructure

- Macquarie Asset Management

The Arizton Advisory & Intelligence market research report provides valuable market insights for industry stakeholders, investors, researchers, consultants, and business strategists aiming to gain a thorough understanding of the South Korea data center colocation market. Request for Free Sample to get a glance of the report now: https://www.arizton.com/market-reports/south-korea-data-center-colocation-market

What Key Findings Our Research Analysis Reveals?

How much MW of IT power capacity is likely to be utilized in South Korea by 2029?

What is the count of existing and upcoming colocation data center facilities in South Korea?

Who are the new entrants in the South Korean data center industry?

What factors are driving the South Korea data center colocation market?

Looking for Customization According to Your Business Requirement? https://www.arizton.com/customize-report/4620

Other Related Reports that Might be of Your Business Requirement

South Korea Data Center Market – Investment Analysis & Growth Opportunities 2024-2029

https://www.arizton.com/market-reports/south-korea-data-center-market-investment-analysis

Singapore Data Center Colocation Market – Supply & Demand Analysis 2024-2029

https://www.arizton.com/market-reports/singapore-data-center-colocation-market

Why Arizton?

100% Customer Satisfaction

24×7 availability – we are always there when you need us

200+ Fortune 500 Companies trust Arizton’s report

80% of our reports are exclusive and first in the industry

100% more data and analysis

1500+ reports published till date

Post-Purchase Benefit

- 1hr of free analyst discussion

- 10% off on customization

About Us:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Media Contact

Company Name: Arizton Advisory & Intelligence

Contact Person: Jessica

Email: Send Email

Phone: +1 3122332770

Country: United States

Website: https://www.arizton.com/market-reports/south-korea-data-center-colocation-market