India Trade Finance Market Overview

Base Year: 2023

Historical Years: 2018-2023

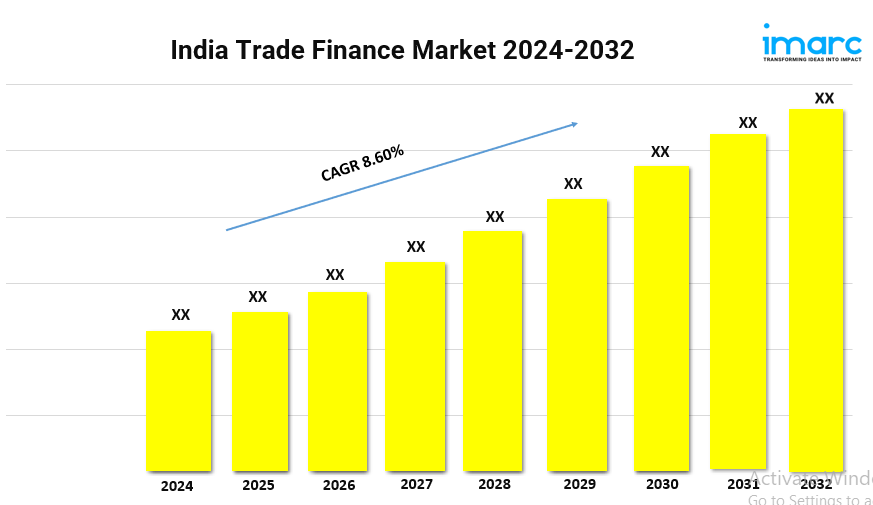

Forecast Years: 2024-2032

Market Growth Rate: 8.60% (2024-2032)

India Trade Finance Market is growing rapidly, driven by increasing international trade and government support for financial services. According to the latest report by IMARC Group, the market is projected to grow at a CAGR of 8.60% from 2024 to 2032.

Request for a PDF sample of this report: https://www.imarcgroup.com/india-trade-finance-market/requestsample

India Trade Finance Market Trends and Drivers:

The expanding international trade as well as the increasing need for efficient financial solutions to support importers and exporters are the factors responsible for the growth of the India trade finance market. Additionally, the market is propelling owing to the high demand for trade finance products such as letters of credit, export financing, and supply chain financing.

The focus by government authorities on boosting exports through initiatives like the “Make in India” campaign and the promotion of free trade agreements has further stimulated the market. Moreover, small, and medium enterprises (SMEs) are playing a significant role in driving the trade finance sector, as they seek financial support to access global markets and enhance their competitiveness.

A key trend in the India trade finance market is the growing adoption of digital technologies, including blockchain, artificial intelligence, and electronic trade platforms, which are transforming the efficiency and transparency of trade transactions. These innovations are helping to streamline processes, reduce paperwork, and mitigate risks associated with international trade, making trade finance more accessible, particularly for SMEs.

Furthermore, the rise of fintech companies offering digital trade finance solutions is also contributing to this shift, as they collaborate with traditional banks to provide faster and more flexible services. Apart from this, initiatives by government authorities aimed at improving the regulatory framework and increasing financial inclusion are expected to propel the market. As digitalization and global trade continue to expand, the India trade finance market is expected to drive sustained growth in the coming, offering new opportunities for businesses across sectors.

Buy Now: https://www.imarcgroup.com/checkout?id=21598&method=478

India Trade Finance Industry Segmentation:

The report has segmented the market into the following categories:

Finance Type Insights:

- Structured Trade Finance

- Supply Chain Finance

- Traditional Trade Finance

Offering Insights:

- Letters of Credit

- Bill of Lading

- Export Factoring

- Insurance

- Others

Service Provider Insights:

- Banks

- Trade Finance Houses

End User Insights:

- Small and Medium Sized Enterprises (SMEs)

- Large Enterprises

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

Ask An Analyst: https://www.imarcgroup.com/request?type=report&id=21598&flag=C

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Media Contact

Company Name: IMARC Group

Contact Person: Elena Anderson

Email: Send Email

Phone: +1-631-791-1145

Address:134 N 4th St.

City: Brooklyn

State: NY

Country: United States

Website: https://www.imarcgroup.com