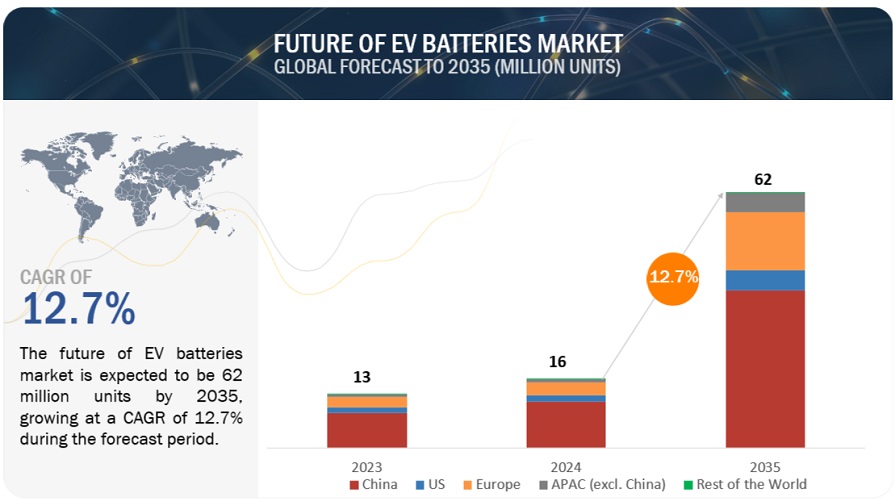

The global future of EV batteries market is projected to grow from 16 million units in 2024 to 62 million units by 2035, at a CAGR of 12.7%. Changes in lithium-ion (Li-ion) battery chemistry are leading to more efficient electric vehicles (EVs) as the industry switches from toxic metals such as nickel-manganese-cobalt (NMC) to lithium-iron-phosphate (LFP). Companies like Tesla, Rivian, and Ford have already changed their standard models from NMC to LFP, while manufacturers like Hyundai, Nissan, and Toyota are developing cheaper LFP variants to make EVs more affordable.

Market Dynamics:

Driver: Technological advancements in EV battery

The rapid progress made in EV battery technology has played a huge role in the emergence of this EV battery market. Electric vehicles are still in high demand due to increasing consumer interest in more sustainable and efficient transportation options. Manufacturers and researchers are constantly working to improve battery technology by solving problems related to energy density, charging time, cost, cleaner materials, and safety issues. The development of solid-state batteries is one such milestone that promises to revolutionize the automotive industry. Unlike traditional lithium-ion batteries that use a liquid or gel electrolyte, Solid-state batteries use a solid electrolyte, resulting in increased energy density, faster charging, and better safety. These improvements have the potential to significantly extend EV range and shorten charging times, addressing range anxiety concerns that have hindered widespread adoption. Solid Power Inc. (US) manufactures Solid-state batteries for electric vehicles using sulfide-based semiconductor cells.

Opportunity: EV battery recycling provides opportunities to maintain the supply of critical materials

As the demand for electric vehicles grows, so does the need for these scarce and often geopolitically sensitive resources. By extracting these valuable components from batteries nearing the end of their beneficial lives, recycling gives a sustainable alternative to relying on risky mining practices and unstable global supply chains. This helps to maintain material sources and promotes a circular economy by reusing materials continuously, improving resource efficiency, and lowering the carbon impact of producing new batteries.

In addition, recycling approaches emerge as more effective and permit increasing costs of crucial material recuperation as technology advances. This lowers manufacturing charges and promotes the improvement of recent battery technologies. The European Union (EU) has some laws governing EV battery recycling. From 2030, batteries must contain a minimum recycled content of 12% for cobalt, 4% for lithium, 4% for nickel and 85% for lead. By 2035, these thresholds will increase to 20% cobalt, 10% lithium, 12% nickel and 85% lead.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=243513539

“Solid state battery expected to be the next big shift during forecast period.”

Emerging solid-state battery technology has various potential benefits for electric vehicles. Unlike traditional lithium-ion batteries, which utilize liquid electrolytes, they use solid electrolytes. Because solid electrolytes are less likely to experience problems like leaking, overheating, and fire hazards, they are considered safer overall for electric vehicles. Faster charging times could be possible using solid-state batteries as opposed to lithium-ion batteries. Because of their enhanced conductivity and capacity to tolerate higher charging rates, EVs may require fewer charging cycles, saving users time and increasing convenience. For instance, In October 2023, Toyota secured a deal to mass-produce solid-state EV batteries with a 932-mile range. Using materials developed by Idemitsu Kosan will allow Toyota to commercialize these energy-dense batteries by 2028. Solid-state batteries can significantly extend a vehicle’s driving range as well. It is projected that a solid-state battery replacement may quadruple the driving range of the Tesla Roadster. Such benefits will help the solid state battery market grow over the projected period.

“North America to be the prominent growing market for EV batteries during the forecast period.”

The automotive sector in North America is one of the most developed worldwide. Major commercial automakers like Tesla, Proterra, MAN, and NFI Group are based in the region, which makes it well-known for its cutting-edge EV R&D, inventions, and technological advancements. These businesses are investing in constructing and expanding battery production plants in North America. To meet the growing demand for electric vehicles, these facilities produce sophisticated battery technology, including lithium-ion batteries. The US has historically led the way in technology in North America. Leading EV battery suppliers and startups have partnered with OEMs in the North American EV market. For example, GM and LG Chem have partnered.

Key Players

The major players in Future of EV Batteries market include CATL (China), BYD Company Ltd. (China), LG Energy Solution Ltd. (South Korea), Panasonic Holdings Corporation (Japan), and SK Innovation Co., Ltd. (South Korea). These companies adopted various strategies, such as new product developments and deals, to gain traction in the market.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=243513539

Media Contact

Company Name: MarketsandMarkets™ Research Private Ltd.

Contact Person: Mr. Aashish Mehra

Email: Send Email

Phone: 18886006441

Address:630 Dundee Road Suite 430

City: Northbrook

State: IL 60062

Country: United States

Website: https://www.marketsandmarkets.com/Market-Reports/future-of-batteries-market-243513539.html