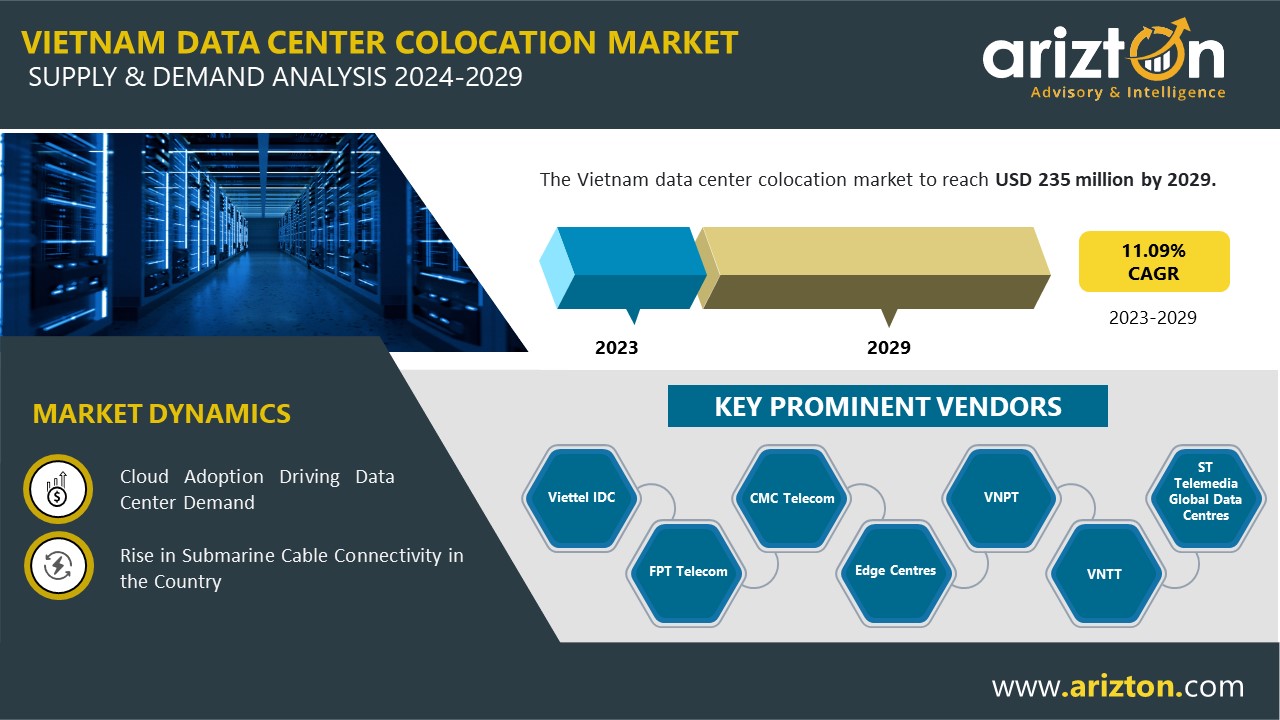

According to Arizton’s latest research report, the Vietnam data center colocation market is growing at a CAGR of 11.09% during 2023-2029.

Looking for More Information? Click: https://www.arizton.com/market-reports/vietnam-data-center-colocation-market

Report Scope:

Market Size – Colocation Revenue (2029): $235 Million

CAGR (2023-2029): 11.09%

Market Size – Utilized White Floor Area (2029): 1,398.5 Thousand Sq. ft

Market Size – Utilized Racks (2029): 37,100 Units

Market Size – Utilized IT Power Capacity (2029): 284 MW

Base Year: 2023

Forecast Year: 2024-2029

Looking for More Information? Visit: https://www.arizton.com/market-reports/vietnam-data-center-colocation-market

Colocation Data Center Market in Vietnam Overview

Vietnam is experiencing growth in its colocation data center sector, with approximately 26 operational facilities and increasing data center developments. As an emerging market for data center infrastructure in Southeast Asia, Vietnam is attracting considerable interest.

Key players in the market include major data center operators such as FPT Telecom, Viettel IDC, CMC Telecom, VNPT, VNTT, and ST Telemedia Global Data Centers. FPT Telecom, VNPT, and Viettel IDC account for about 70% of the IT load capacity in the data center market.

Data centers in Hanoi have a higher occupancy rate than those in other Vietnamese cities. Global companies like NTT DATA and Telehouse are already active in the market through partnerships with local colocation providers. New entrants should consider collaborating with established local telecom companies like FPT Telecom, Viettel IDC, VNPT, and CMC Telecom to enter the market effectively.

Although major cloud service providers like Microsoft, AWS, and Google do not yet have dedicated cloud regions in Vietnam, their potential entry is expected to enhance the country’s wholesale colocation capacity. Furthermore, local telecom operators are setting up subsidiaries to deliver cloud-based services nationwide, which will contribute to expanding the wholesale colocation market in Vietnam.

Vietnam’s Rapid Cloud Computing Expansion and Key Developments

Cloud computing is central to Vietnam’s rapid shift towards digital transformation, with organizations and businesses embracing it acceleratedly. As one of the fastest-growing markets for cloud computing and data center services in the ASEAN region, Vietnam hosts over 50 active providers, including domestic and international players. Cloud technology is a significant driver of digital transformation, offering a robust foundation for innovation and operational efficiency in Vietnam. It addresses the challenges faced by startups, small and medium-sized enterprises (SMEs), and giant corporations, who often struggle with the financial and resource constraints of traditional on-premises infrastructure.

In April 2023, Amazon Web Services (AWS) announced plans to launch an AWS Local Zone in Hanoi aimed at providing customers with access to AWS services with minimal latency. This move is expected to enhance the efficiency and performance of cloud services in the region. Additionally, in October 2022, Viettel launched the Viettel Cloud Ecosystem, reinforcing its position as a leading provider of cloud computing services in Vietnam. This initiative is designed to offer global enterprise clients customized solutions, accelerating their transition to comprehensive cloud adoption. The growing demand for cost-effective solutions is a significant factor driving the expansion of infrastructure as a service (IaaS) in the Vietnam cloud market.

What’s Included?

- A transparent research methodology and insights on the market’s colocation of demand and supply.

- Market size is available in terms of utilized white floor area, IT power capacity, and racks.

- Market size available in terms of Core & Shell Vs. Installed Vs. Utilized IT Power Capacity along with the occupancy %.

- An assessment and snapshot of the colocation investment regarding core & shell area, power, and rack in Vietnam and comparison between APAC countries.

- The study of the existing Vietnam data center market landscape and insightful predictions about industry size during the forecast period.

- An analysis of the current and future colocation demand in Vietnam by several industries.

- Study on sustainability status in the region

- Analysis of current and future cloud operations in the region.

- Snapshot of upcoming submarine cables and existing cloud-on-ramps services in the region.

- Snapshot of existing and upcoming third-party data center facilities in Vietnam

- Facilities Covered (Existing): 26

- Facilities Identified (Upcoming): 13

- Coverage: 4 locations

- Existing vs. Upcoming (White Floor Area)

- Existing vs. Upcoming (IT Load Capacity)

- Data Center Colocation Market in the Vietnam

- Colocation Market Revenue & Forecast (2023-2029)

- Retail Colocation Revenue (2023-2029)

- Wholesale Colocation Revenue (2023-2029)

- Retail Colocation Pricing along with Addons

- Wholesale Colocation Pricing along with the pricing trends.

- An analysis of the latest trends, potential opportunities, growth restraints, and prospects for the Vietnam data center colocation industry.

- Competitive landscape, including industry share analysis by the colocation operators based on IT power capacity and revenue.

- The vendor landscape of each existing and upcoming colocation operator is based on the existing/ upcoming count of data centers, white floor area, IT power capacity, and data center location.

Book the Free Sample Now:https://www.arizton.com/market-reports/vietnam-data-center-colocation-market

The Report Includes:

- Colocation Supply (MW, Area, Rack Capacity)

- Colocation Demand (MW, Area, Rack Capacity) and by End-User (Cloud/IT, BFSI, etc..)

- Colocation Revenue (Retail & Wholesale Colocation Services)

- Competitive Scenario (Market Share Analysis by Revenue & MW Capacity)

Vendor Landscape

Existing Operators

- Viettel IDC

- FPT Telecom

- CMC Telecom

- Edge Centres

- ST Telemedia Global Data Centres

- VNPT

- HTC Telecom International (EcoDC)

- VNTT

- Other Operators

New Operators

- Epsilon Telecommunications

- Gaw Capital (OneHub Saigon)

- Infracrowd Capital

- NTT DATA

Key Questions Answered in the Report:

How much MW of IT power capacity is likely to be utilized in Vietnam by 2029?

What is the count of existing and upcoming colocation data center facilities in Vietnam?

Who are the new entrants in the Vietnam data center industry?

What factors are driving the Vietnam data center colocation market?

Looking for Customization? Click: https://www.arizton.com/customize-report/4498

Why Arizton?

100% Customer Satisfaction

24×7 availability – we are always there when you need us

200+ Fortune 500 Companies trust Arizton’s report

80% of our reports are exclusive and first in the industry

100% more data and analysis

1500+ reports published till date

Post-Purchase Benefit

- 1hr of free analyst discussion

- 10% off on customization

About Us:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Media Contact

Company Name: Arizton Advisory & Intelligence

Contact Person: Jessica

Email: Send Email

Phone: +1-312-235-2040 / +1 302 469 0707

Country: United States

Website: https://www.arizton.com/market-reports/vietnam-data-center-colocation-market