InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the “Global Crypto Credit Card Market – (By Type (Regular Crypto Credit Cards, Rewards Crypto Credit Cards, Others), By Application (BFSI, Personal Consumption, Business, Others)), Trends, Industry Competition Analysis, Revenue and Forecast To 2031.”

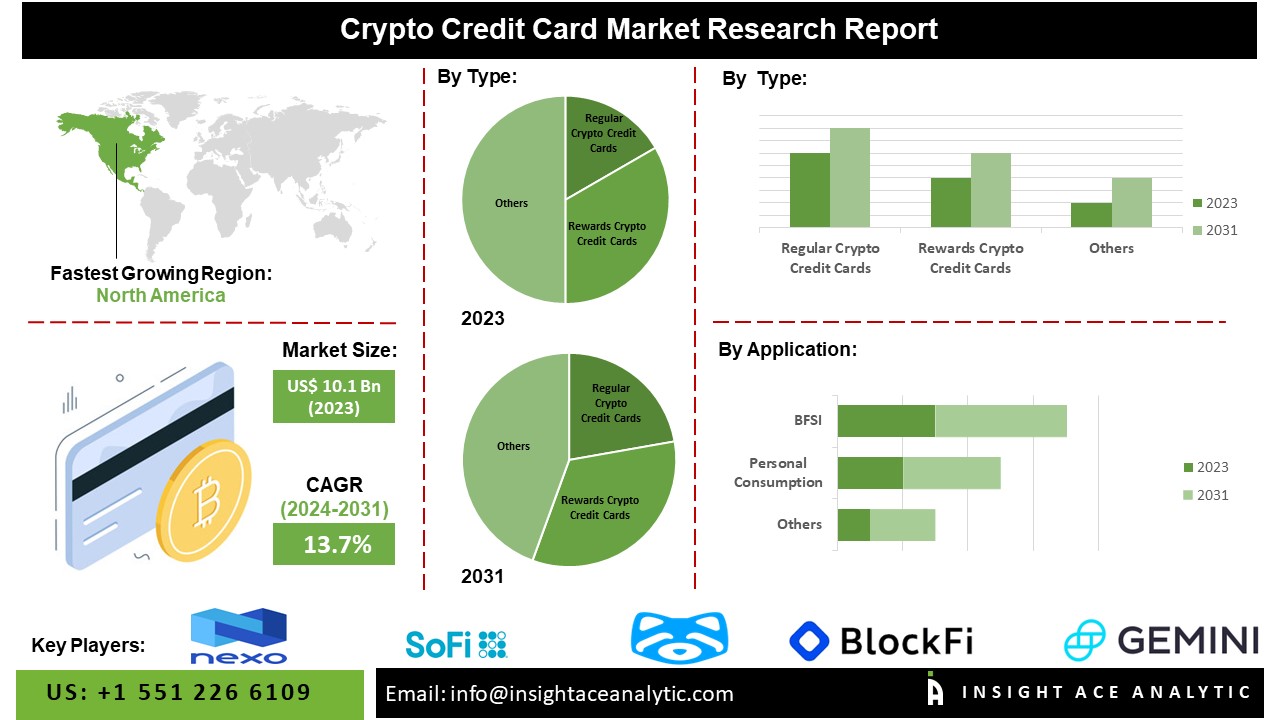

According to the latest research by InsightAce Analytic, the Global Crypto Credit Card Market is valued at US$ 10.1 billion in 2023, and it is expected to reach US$ 27.7 billion by 2031, with a CAGR of 13.7% during the forecast period of 2024-2031.

Get Free Access to Demo Report, Excel Pivot and ToC : https://www.insightaceanalytic.com/request-sample/2652

The crypto credit card market is emerging as a significant intersection between traditional finance and digital assets, catering to the growing demand for integrating cryptocurrencies into everyday transactions. These cards enable customers to spend their digital currencies at merchants worldwide, converting crypto holdings into fiat currencies in real time during transactions. Key players in this market are pioneering solutions that offer seamless integration with major cryptocurrencies like Bitcoin, Ethereum, and others, providing users with flexibility and convenience in spending their crypto holdings. Regulatory developments and partnerships with financial institutions are shaping the market’s growth trajectory, addressing concerns around security, compliance, and usability. Furthermore, consumer interest in cryptocurrencies continues to rise, driven by both investment opportunities and practical use cases; the Crypto Credit Card market is poised for expansion, aiming to bridge the gap between traditional banking systems & the decentralized world of digital assets.

List of Prominent Players in the Crypto Credit Card Market:

- Nexo Mastercard

- BlockFi Visa Card

- Crypto.com Visa Card

- Gemini Mastercard

- Shakepay Visa

- SoFi Credit Card

- Coinbase Visa

- Bitpay Mastercard

- Wirex Visa

- Club Swan Mastercard

Expert Knowledge, Just a Click Away: https://calendly.com/insightaceanalytic/30min?month=2024-02

Market Dynamics:

Drivers-

The crypto credit card market is driven by a number of key factors that are propelling its growth and adoption globally. Increasing mainstream acceptance of cryptocurrencies as viable assets for investment and spending has fueled demand for solutions that facilitate easy conversion and use of digital currencies in everyday transactions. These cards provide a bridge between traditional financial systems & the decentralized world of cryptocurrencies, offering users the flexibility to spend their crypto holdings directly at merchants worldwide. Moreover, technological advancements and innovations in payment processing have enhanced the functionality and security of Crypto Credit Cards, making them more attractive and accessible to a broader audience. Integration with major cryptocurrencies like Bitcoin and Ethereum, coupled with real-time conversion capabilities, ensures seamless transactions while mitigating the volatility risks associated with digital assets.

Challenges:

One of the challenges is regulatory uncertainty and evolving compliance requirements across different jurisdictions. The regulatory landscape surrounding cryptocurrencies and their integration into traditional financial systems remains complex and varied, posing compliance challenges for Crypto Credit Card issuers and users alike. Concerns about anti-money laundering (AML) and know-your-customer (KYC) regulations add further complexity, potentially limiting market growth and increasing operational costs. Another restraint is the volatility of cryptocurrency prices. Cryptocurrencies have a tendency to experience substantial fluctuations in value over brief timeframes, which can pose financial concerns for both users and financial institutions. This volatility can deter merchants from accepting crypto payments and users from holding large balances in their Crypto Credit Cards, affecting overall adoption and utility. Security concerns also pose a significant restraint. While advancements in blockchain technology offer robust security features, the Crypto Credit Card ecosystem remains vulnerable to cyber threats, including hacking, phishing attacks, and theft. Ensuring robust security measures and building trust among users and stakeholders are critical for sustained market growth.

Regional Trends:

The North American crypto Credit Card market is predicted to record a major market share in North America, which has a large and increasing number of cryptocurrency users and investors, creating a demand for financial products that integrate cryptocurrencies into everyday spending. Regulatory clarity in the U.S. regarding cryptocurrencies has provided a conducive environment for fintech companies to innovate and offer crypto-related financial products, including crypto credit cards. Besides, Europe had a notable share of the market. Countries like Japan and South Korea have a high level of awareness and adoption of cryptocurrencies among the general population, creating a fertile ground for crypto credit card products. Regulatory frameworks vary across APAC countries, with some, like Japan, having clear regulations supporting crypto activities, while others are evolving their stance. This affects the availability and features of crypto credit cards.

Unlock Your GTM Strategy: https://www.insightaceanalytic.com/customisation/2652

Recent Developments

- In July 2021, Visa launched a crypto rewards card in partnership with BlockFi. Card recipients were able to earn 1.5% back in Bitcoin on every purchase they made. Furthermore, cardholders received a 3.5% Bitcoin rewards rate for the first 90 days.

Segmentation of Crypto Credit Card Market-

By Type-

- Regular Crypto Credit Cards

- Rewards Crypto Credit Cards

- Others

By Application-

- BFSI

- Personal Consumption

- Business

- Others

By Region-

North America-

- The US

- Canada

- Mexico

Europe-

- Germany

- The UK

- France

- Italy

- Spain

- Rest of Europe

Asia-Pacific-

- China

- Japan

- India

- South Korea

- South East Asia

- Rest of Asia Pacific

Latin America-

- Brazil

- Argentina

- Rest of Latin America

Middle East & Africa-

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Empower Your Decision-Making with 180 Pages Full Report @ https://www.insightaceanalytic.com/buy-report/2652

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions. Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses. We help clients gain competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets and repositioning products. Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.

Media Contact

Company Name: InsightAce Analytic Pvt. Ltd

Contact Person: Diana D’Souza

Email: Send Email

Country: United States

Website: https://www.insightaceanalytic.com/