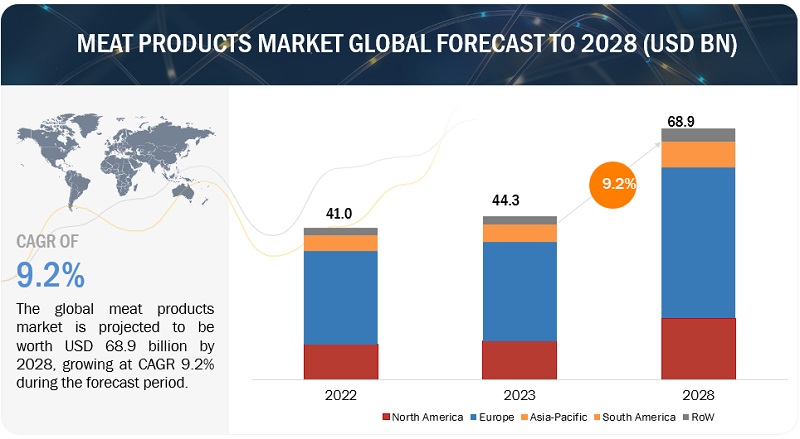

The meat products market size is valued at USD 44.3 billion in 2023 and is expected to grow to USD 68.9 billion by 2028, with a compound annual growth rate (CAGR) of 9.2% during the forecast period from 2023 to 2028. The global market for meat products is an ever-changing and varied segment within the food industry, comprising items such as beef, poultry, pork, lamb, and processed meats. In recent years, there has been a consistent rise in the demand for meat products, propelled by various factors, and this trend shows no signs of slowing down.

A key factor fuelling this increased demand is the continual growth of the world’s population, especially in emerging markets. As populations expand and disposable incomes increase, there is a corresponding rise in the consumption of meat as a primary source of protein. Urbanization is another significant driver, reshaping dietary preferences as more individuals move to cities, leading to a preference for processed and convenient meat products that cater to busy lifestyles.

Meat Products Market Drivers: Rising Demand for Meat-based Convenience Foods

The shift towards urbanization, characterized by the growing migration of people from rural to urban areas, has had a significant influence on the meat products market. One of the key factors driving this market growth is the convenience of processed and pre-packaged meat items. Urban lifestyles, often fast-paced and with limited time for traditional cooking, make these products particularly appealing due to their pre-cut, marinated, and easy-to-cook nature. Additionally, the compact living spaces and busy, on-the-go routines common in urban environments enhance the appeal of these products, which require minimal kitchen equipment and cater to the need for quick and portable meals. The rich culinary diversity in cities, reflecting various cultures and cuisines, further boosts the demand for processed meats that suit a wide range of tastes. Furthermore, the assurance of food safety and quality is crucial for urban consumers, who may have limited access to fresh, locally sourced meats. In conclusion, the convenience provided by processed and pre-packaged meat products is a major driver of market growth in urban areas, effectively meeting the varied needs and preferences of city dwellers.

Meat Products Market Opportunities: Technological Advancement in Meat Processing Industry

Technological advancements are revolutionizing the meat industry, driving its growth and transformation. These innovations are enhancing product quality, extending shelf life, and reducing waste. Modern meat processing equipment enables precise, controlled methods, ensuring consistent cuts that meet high standards for taste and quality. This demonstrates the industry’s commitment to safety and regulatory compliance while also boosting consumer satisfaction.

In packaging, technologies like Modified Atmosphere Packaging and vacuum sealing create controlled environments that extend the shelf life of meat products, addressing food waste concerns and promoting sustainability. Advanced processing equipment also supports waste reduction by maximizing meat utilization and minimizing trimmings and byproducts that would otherwise be discarded. Additionally, innovations in packaging materials contribute to eco-friendly practices by reducing excessive packaging.

The integration of technology into the meat industry significantly enhances operational efficiency. Automation and robotics are increasingly prevalent in meat processing facilities, streamlining operations, boosting productivity, and lowering labor costs. Automated systems for cutting, trimming, and portioning not only improve efficiency but also ensure product consistency and reduce the risk of human error. Moreover, technological advancements enable traceability and quality control through data, barcoding, and RFID systems, allowing real-time monitoring and tracking of products throughout the supply chain, thereby strengthening safety measures and regulatory compliance.

Sustainability is a key focus in the meat industry’s adoption of technological innovations. By emphasizing waste reduction, quality improvement, and the use of energy-efficient equipment, the industry is working to minimize its environmental footprint. Ultimately, the meat industry’s embrace of new technologies positions it to meet evolving consumer demands, reduce environmental impact, and maintain a competitive edge in the market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=53140407

Frozen Meat Products: The Driving Force Behind Market Momentum in 2022

The rising popularity of frozen meat in the meat products market highlights shifting consumer preferences and lifestyle needs. As busy schedules become more common, convenience and efficiency are top priorities for consumers. Frozen meat products, offering a range of processed options, provide a quick and easy meal solution with minimal preparation. The flash-freezing process not only enhances convenience but also extends product shelf life while maintaining nutritional value, aligning with the growing focus on food safety and quality. The global demand for diverse culinary experiences further fuels the need for a wider variety of meats, which frozen options readily satisfy. Innovations in freezing technologies, such as Individual Quick Freezing (IQF) and cryogenic freezing, have significantly improved the quality of frozen meat products. This growing preference is transforming the meat products market, driving expansion, increasing competition, and broadening global reach. Manufacturers and retailers are responding with creative strategies and targeted marketing, creating a dynamic and competitive industry landscape. As the frozen meat segment gains momentum, it presents promising opportunities for both consumers and industry stakeholders, shaping the future direction of the meat market.

Europe is the Fastest-Growing Market for Meat Products Among the Regions.

The European market presents substantial business opportunities for meat product manufacturers, largely driven by the region’s increasing focus on health awareness. This growing health consciousness has spurred a rise in demand for meat products, with a growing number of manufacturers entering the market and launching new products. Key factors influencing this trend include concerns about sustainability and a stronger emphasis on health practices.

The trend towards adopting new dietary preferences and health-conscious decisions is fueling the growth of the meat products market in Europe. The region is home to numerous major players in the meat industry, who are actively exploring ways to strengthen their market presence. These manufacturers are employing strategies such as product launches, expanding production capacities, and forming partnerships and acquisitions with other industry players to broaden their geographical reach and assert dominance in the European meat products market. For instance, in August 2022, the Netherlands-based Vion Group made significant investments to expand its operations in eastern Germany, particularly in Thuringia and Brandenburg. The company is committed to promoting regionalism in food retail by focusing on providing fresh beef and pork products that meet the growing demand for local and regional options, including organic choices. This approach aims to reduce carbon footprints and improve animal welfare by minimizing transport times.

The key players in this market include Cargill, Incorporated (US), JBS SA (Brazil), Tyson Foods, Inc. (Arkansans), Hormel Foods Corporation (US), Vion Group (Netherlands).

Tyson foods, Inc.

Tyson Foods, Inc. (NYSE: TSN) is a global food corporation renowned as a leading figure in the protein industry worldwide. Established in 1935, the company, now under its fourth generation of family leadership, has solidified its position as a major player in the food sector. Headquartered in Springdale, Arkansas, Tyson Foods boasts a workforce of approximately 142,000 employees. With a diverse array of products and brands catering to different markets, including Tyson, Jimmy Dean, Hillshire Farm, Ball Park, Wright, Aidella, IBP, and State Fair, the company is committed to innovation. This commitment is evident in their continuous efforts to enhance the sustainability of protein production, tailor products to meet global market demands, and set higher standards for the positive impact of quality food.

Tyson Foods operates across four primary segments: Beef, Pork, Chicken, and Prepared Foods. The International/Other category encompasses international operations and additional activities. In the Beef segment, the company processes live fed cattle into primal and sub-primal meat cuts, supplying a diverse range of products to both domestic and international markets. The Pork segment focuses on processing live market hogs, transforming pork carcasses into various products, while the Chicken segment involves the raising and processing of live chickens, offering fresh, frozen, and value-added chicken products. With a significant global footprint, Tyson Foods has a presence in approximately 140 countries and regions. The company conducts operations and holds interests in various countries, including China, the Netherlands, Australia, Mexico, Malaysia, and more.

Hormel Foods Corporation

Hormel Foods Corporation, a Delaware-based entity established in 1891, has grown into a prominent figure in the global food industry, with its headquarters in Austin, Minnesota. The company’s primary focus lies in the processing, manufacturing, and distribution of branded, value-added consumer food products, underpinned by a commitment to quality, innovation, and integrity.

As a leading player in the global food market, Hormel Foods has a significant presence in over 80 countries and boasts an impressive annual revenue surpassing USD 12 billion. Its journey of growth and diversification has been shaped by a blend of organic expansion and strategic acquisitions. Internationally, Hormel Foods Corporation utilizes its wholly owned subsidiary, Hormel Foods International Corporation (HFIC), to market products in major global markets such as Australia, Brazil, Canada, China, England, Japan, Mexico, Micronesia, the Philippines, Singapore, and South Korea.

1. In September 2023, Minerva Foods SA (Brazil) has completed its acquisition of Breeders and Packers Uruguay SA (BPU Meat), a subsidiary of NH Foods, with a total investment of USD 40 million. With this acquisition, Minerva Foods significantly enhanced its total slaughter capacity, which now reaches 3,700 heads per day, distributed across four refrigeration units, including the newly acquired BPU Meat.

2. In August 2023, Minerva Foods SA (Brazil) has acquired the majority of Marfrig’s cattle and sheep slaughtering and deboning operations in South America. The deal cost USD 1.45 billion. The transaction is expected to deepen Minerva’s geographical diversification

3. In July 2023, Vion Zucht- und Nutzvieh (Netherlands) and Danish Crown have entered a contract for cattle slaughtering services in Schleswig-Holstein. Commencing from August 1, 2023, Danish Crown will undertake the slaughter of up to 1,000 young bulls, cows, and heifers per week on behalf of Vion Food Group. This helps them to produce a large quantity of meat to meet the demand of consumers.

4. In May 2023, The Danish Crown (Denmark) acquired the SELO Verpakking and SELO Belgium, (Benlux). With the acquisition of the majority stake in the SELO companies gives them a perfect platform to grow their business in Benelux.

5. In March 2023, Hormel Foods (US), the maker of HORMEL BLACK LABEL Bacon, has introduced a unique product called “Hardcourt Smoked HORMEL BLACK LABEL Bacon.” This bacon is smoked using actual northern cherry maple wood that is used to make the basketball courts for the 2023 college basketball tournament.

Book a meeting with our experts to discuss your business needs @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=53140407

About MarketsandMarkets™

MarketsandMarketsTM has been recognized as one of America’s best management consulting firms by Forbes, as per their recent report.

MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients.

Earlier this year, we made a formal transformation into one of America’s best management consulting firms as per a survey conducted by Forbes.

The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines – TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing.

Built on the ‘GIVE Growth’ principle, we work with several Forbes Global 2000 B2B companies – helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry.

Media Contact

Company Name: MarketsandMarkets™ Research Private Ltd.

Contact Person: Mr. Rohan Salgarkar

Email: Send Email

Phone: 18886006441

Address:630 Dundee Road Suite 430

City: Northbrook

State: IL 60062

Country: United States

Website: https://www.marketsandmarkets.com/Market-Reports/meat-products-market-53140407.html