July 18, 2024 – New York, NY – You’re digging for gold in a mine shaft… suddenly your canary starts warbling on its perch.

That’s exactly what’s happening on Wall Street right now, but instead of one canary, we’ve got five and they’re all singing the same tune.

Nobel laureate Robert Shiller and investment legend Warren Buffett, typically at odds, find their market indicators alarmingly in sync. Shiller noted in a recent conversation, “It does appear that the S&P 500 now is right around a record high.” “I’ve never seen anything like it,” panned Leonidas Tam of Amicus AI Advisors. “It’s like watching a perfect storm brew in slow motion.”

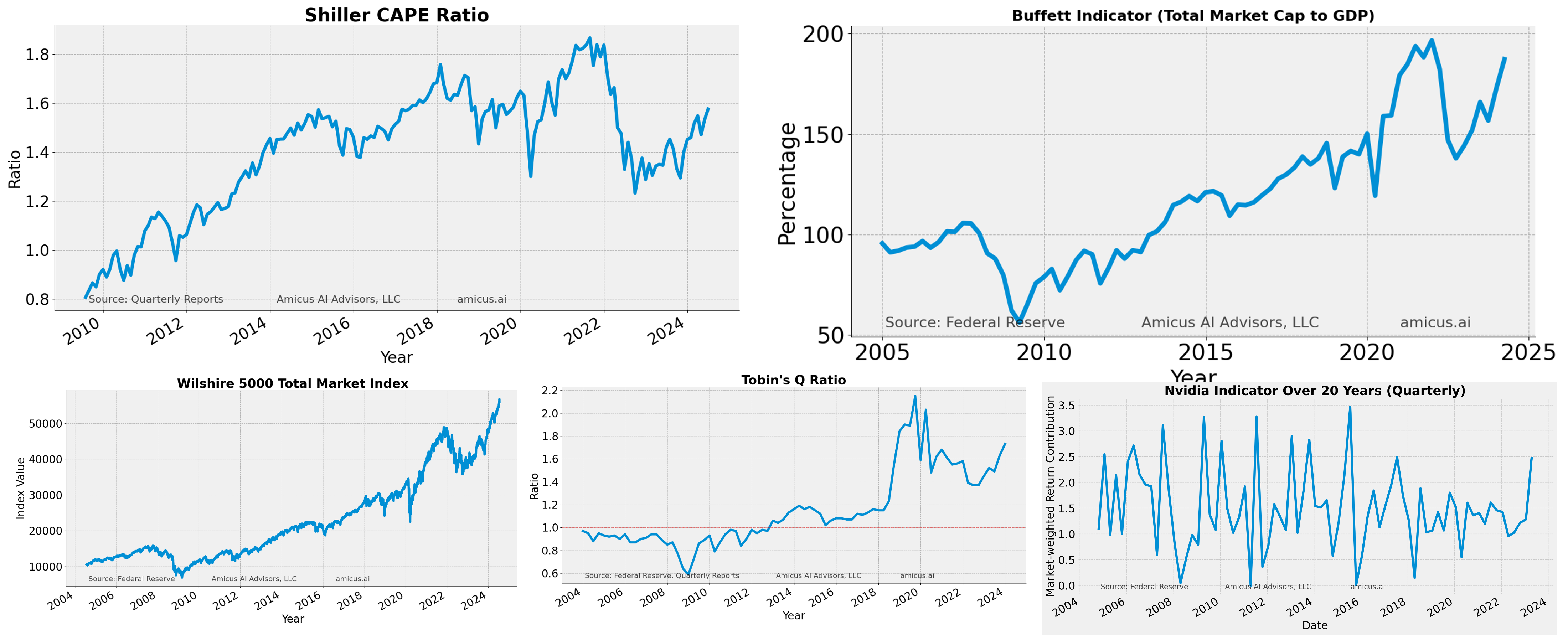

Shiller’s CAPE ratio, factoring earnings over the past decade, is reaching levels reminiscent of the dot-com bubble. Buffett’s preferred gauge, which compares the total value of the stock market to the country’s GDP, is indicating overvaluation. The market appears to be outpacing the economy it represents.

Additionally, Tobin’s Q ratio, which assesses the market value of company assets as if they were sold off, is flashing red. Stanley Druckenmiller of Duquesne Capital remarked, “They set financial conditions on fire again.” The Wilshire 5000, an effectively whole market index, reflects a widespread fever among stocks.

The Nvidia metric, summarizing market-weighted returns over the last quarter, signals an elevated pulse in the market.

For the first time in decades, these five indicators align, prompting Wall Street veterans to brace for impact.

In finance, numbers tell the true story. They convey a narrative that’s causing sleepless nights for even the most experienced investors.

Media Contact

Company Name: Amicus AI Advisors, LLC

Contact Person: Barrett Williams

Email: Send Email

Country: United States

Website: https://amicus.ai/