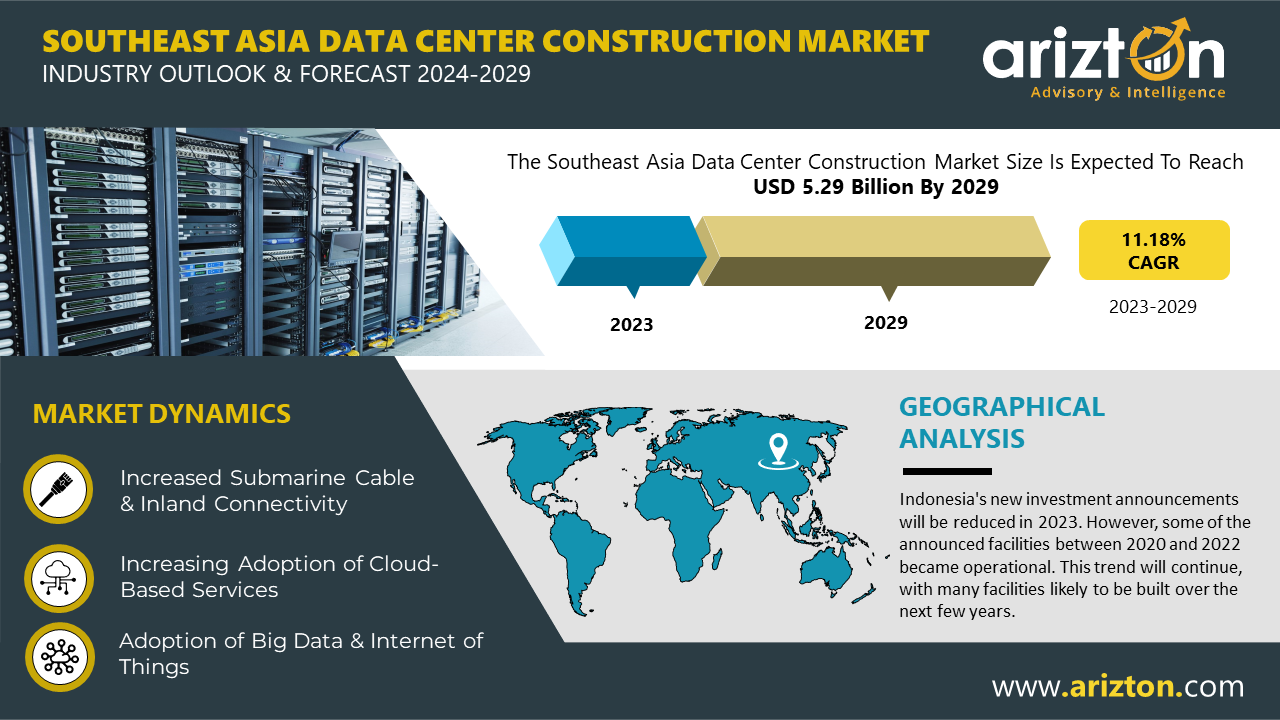

According to Arizton’s latest research report titled, the Southeast Asia data center construction market 2024-2029 by Arizton Advisory & Intelligence, the market will grow at a CAGR of 11.69% during 2023-2029.

To Know More, Click: https://www.arizton.com/market-reports/southeast-asia-data-center-construction-market

The Southeast Asia data center construction market is one of the fastest-developing markets globally, driven by the increase in cloud adoption, the advent of 5G services, and the adoption of AI, Big data, and IoT technology. Singapore, Malaysia, Indonesia, and Thailand have robust connectivity and are among the most connected countries in Southeast Asia. Singapore is the gateway and an integral interconnection point to several APAC countries, including Japan, South Korea, Vietnam, and Pakistan. The adoption of cloud-based services will likely be a significant driver of the data center market over the next few years.

Moreover, Singapore boasts the largest existing capacity in the region, and countries such as Malaysia, Indonesia, and the Philippines are outpacing it in terms of new investments, collectively capturing over 50% of the market share for new investments. This trend can be attributed to several factors, including lower energy costs, increased renewable energy sources, and inexpensive labor and land availability. These factors are influencing companies’ decisions to invest in these emerging markets.

Report Summary:

Market Size – Investment (2029): USD 5.29 Billion

Market Size – Investment (2023): USD 2.80 Billion

CAGR – Investment (2023-2029): 11.18%

Market Size – Area (2029): 3,079 Thousand Square Feet

Power Capacity (2029): 578 MW

Historic Year: 2020-2022

Base Year: 2023

Forecast Year: 2024-2029

Regional Analysis: Southeast Asia (Singapore, Indonesia, Malaysia, Thailand, Philippines, Vietnam, and Other Southeast Asia Countries)

Introducing Our Exclusive Subscription Model! Discover All the Benefits Today: https://www.arizton.com/subscription

Watch Out for How Advancing in Adoption of AI Boosting the Market Growth

-

In June 2023, Run ai, a company that manages computing resources for AI tasks, announced a strategic partnership with AI Singapore. AI Singapore, a national R&D initiative led by the National Research Foundation, Singapore, aims to establish strong AI capabilities in the country. This collaboration aims to provide scalable infrastructure solutions for various AI projects and assist AI Singapore in its mission to expedite AI adoption across industries.

-

AI Singapore, as the country’s AI initiative, holds a pivotal position in aiding organizations in adopting AI solutions. It has made significant strides through its notable 100 Experiments Programme (100E) and the acclaimed AI Apprenticeship Programme (AIAP). Collaborating with over 60 companies, they’ve trained over 200 Singaporean AI engineers to create, assess, and implement numerous AI models that tackle real-world challenges.

-

While AI investments primarily focus on Singapore, nine out of the top 10 deals involved start-ups based in Singapore that cater to various businesses and use cases throughout the region. For instance, Biofourmis, a health analytics platform analyzing physiological data from clinical-grade wearables, operates in both Singapore and Indonesia. Similarly, Tookitaki, a sophisticated decision-support system for compliance programs in the financial services sector, extends its operations across the six major Southeast Asian countries.

The Southeast Asia Colocation Data Center Market by Investment to Reach $4 Billion by 2029

In Southeast Asia, colocation investments in Singapore declined significantly over the last few years owing to the lack of space for new builds. This has led to the spill over demand toward Indonesia and Malaysia. The upcoming capacity of under-construction announced and planned data center campuses across these two countries will overtake Singapore’s existing colocation capacity. In the same year, BDx Indonesia, Chindata Group, EdgeConneX, Equinix, Keppel Data Centres, GDS Services, Princeton Digital Group, and others invested in developing colocation data center facilities in the region.

Investment Surge in Southeast Asia’s Data Center Market Driven by Digitalization and Affordable Land

In Southeast Asia, the average cost of land varies significantly, ranging from $10 to $25 per square foot. Among these, Malaysia and Vietnam are particularly notable for their affordability, followed by countries like Indonesia, Thailand, and others. On the other hand, Singapore stands out as the most expensive location for land acquisition. Despite this cost disparity, countries such as Vietnam, Indonesia, and the Philippines are experiencing substantial digital growth. This growth is characterized by booming e-commerce, government-led digitalization initiatives, and the adoption of artificial intelligence (AI).

The region’s emphasis on digital infrastructure is evident in the presence of approximately 140 submarine cables and the ongoing development of over 41 new ones. These developments underscore the importance of AI, digitization, and the increasing volume of data stored in Southeast Asia. This trend is expected to significantly boost investments in the data center construction market across the region.

Major cities like Batam, Bekasi, Jakarta, Johor, West Java, Cyberjaya, Manila, Chon Buri, Ho Chi Minh City, and Bangkok collectively account for over 60% of the total data center capacity in Southeast Asia. However, other cities are gradually closing this gap. Factors such as favorable regulatory policies, the formation of data center clusters, and incentives like low-cost labor and affordable land prices are expected to attract increased investments in data centers across these emerging cities.

Overall, the dynamic interplay of affordable land, digital transformation, and strategic investments is propelling Southeast Asia’s data center market towards robust growth. As digital activities expand and infrastructure develops, the region is set to become a significant hub for data storage and processing in the foreseeable future.

Buy this Research @ https://www.arizton.com/market-reports/southeast-asia-data-center-construction-market

Post-Purchase Benefit

-

1hr of free analyst discussion

-

10% off on customization

The Report Includes the Investment in the Following Areas:

Facility Type

Colocation Data Centers

Hyperscale Data Centers

Enterprise Data Centers

Infrastructure

Electrical Infrastructure

Mechanical Infrastructure

General Construction

Electrical Infrastructure

UPS Systems

Generators

Transfer Switches & Switchgear

PDUs

Other Electrical Infrastructure

Mechanical Infrastructure

Cooling Systems

Racks

Other Mechanical Infrastructure

Cooling Systems

CRAC & CRAH Units

Chiller Units

Cooling Towers, Condensers & Dry Coolers

Other Cooling Units

Cooling Techniques

Air-based Cooling

Liquid-based Cooling

General Construction

Core & Shell Development

Installation & Commissioning Services

Engineering & Building Design

Fire Detection & Suppression

Physical Security

DCIM/BMS Solutions

Tier Standard

Tier I & II

Tier III

Tier IV

Geography

Southeast Asia

Singapore

Indonesia

Malaysia

Thailand

Philippines

Vietnam

Other Southeast Asia Countries

Vendors

Key Construction Contractors

-

Arup

-

Aurecon Group

-

CSF Group

-

DSCO Group

-

Gammon Construction

-

NTT Facilities

-

PM Group

-

Studio One Design

Other Prominent Construction Contractors

-

AtkinsRéalis

-

AWP Architects

-

Corgan

-

DPR Construction

-

First Balfour

-

Fortis Construction

-

ISG

-

Kienta Engineering Construction

-

Linesight

-

LSK Engineering

-

M+W Group

-

Nakano Corporation

-

Obayashi Corporation

-

Powerware Systems

-

Sato Kogyo

-

Red Engineering

Prominent Support Infrastructure Vendors

-

ABB

-

Caterpillar

-

Cisco Systems

-

Cummins

-

Dell Technologies

-

Eaton

-

Rittal

-

Schneider Electric

-

STULZ

-

Vertiv

Other Prominent Support Infrastructure Vendors

-

Airedale

-

Alfa Laval

-

Canovate

-

Cyber Power Systems

-

Delta Electronics

-

EAE

-

Fuji Electric

-

Fujitsu

-

Green Revolution Cooling

-

Hewlett Packard Enterprise

-

HITEC Power Protection

-

Huawei Technologies

-

KOHLER Power

-

Legrand

-

Lenovo

-

Mitsubishi Electric

-

Narada

-

Nortek Air Solutions

-

Piller Power Systems

-

Rolls-Royce

-

Shenzhen Envicool Technology

-

Siemens

-

Socomec

-

Trane

Prominent Data Center Investors

-

Amazon Web Services

-

Chindata Group (Bridge Data Centres)

-

DCI Indonesia

-

Digital Realty

-

ePLDT

-

Equinix

-

GDS Services

-

Keppel Data Centres

-

NTT DATA

-

ST Telemedia Global Data Centres

-

Telkom Indonesia

-

VADS (Telekom Malaysia)

-

Viettel IDC

Other Prominent Data Center Investors

-

AirTrunk

-

Beeinfotech

-

Big Data Exchange (BDx)

-

Converge ICT Solutions

-

Digital Edge DC

-

Meta (Facebook)

-

FPT Telecom

-

Google

-

MettaDC

-

Microsoft

-

OneAsia Network

-

Open DC

-

Princeton Digital Group

-

Singtel

-

Vantage Data Centers

New Entrants

-

CtrlS Datacenters

-

Digital Halo

-

EdgeConneX

-

Evolution Data Centres

-

Flow Digital Infrastructure

-

FutureData (Cyclect Group + TSG Group)

-

Gaw Capital

-

I-Berhad

-

Infinaxis Data Centre

-

Infracrowd Capital

-

K2 Data Centres

-

Minoro Energi Indonesia

-

Nautilus Data Technologies

-

Pure Data Centres Group

-

YCO Cloud

-

YTL Data Center

-

Yondr

Key Questions Answered in the Report:

How big is the Southeast Asia data center construction market?

What is the estimated market size in terms of area in the Southeast Asia data center construction market by 2029?

What is the growth rate of the Southeast Asia data center construction market?

What are the key trends in the Southeast Asia data center construction market?

How many MW of power capacity is expected to reach the Southeast Asia data center construction market by 2029?

Get Detailed TOC @ https://www.arizton.com/market-reports/southeast-asia-data-center-construction-market

Check Out Some of the Top Selling Research Reports:

U.S. Data Center Construction Market – Industry Outlook & Forecast 2024-2029

https://www.arizton.com/market-reports/united-states-data-center-construction-market-2024

Latin America Data Center Construction Market – Industry Outlook & Forecast 2024-2029

Why Arizton?

100% Customer Satisfaction

24×7 availability – we are always there when you need us

200+ Fortune 500 Companies trust Arizton’s report

80% of our reports are exclusive and first in the industry

100% more data and analysis

1500+ reports published till date

About Us:

Arizton Advisory and Intelligence is an innovative and quality-driven firm that offers cutting-edge research solutions to clients worldwide. We excel in providing comprehensive market intelligence reports and advisory and consulting services.

We offer comprehensive market research reports on consumer goods & retail technology, automotive and mobility, smart tech, healthcare, life sciences, industrial machinery, chemicals, materials, I.T. and media, logistics, and packaging. These reports contain detailed industry analysis, market size, share, growth drivers, and trend forecasts.

Arizton comprises a team of exuberant and well-experienced analysts who have mastered generating incisive reports. Our specialist analysts possess exemplary skills in market research. We train our team in advanced research practices, techniques, and ethics to outperform in fabricating impregnable research reports.

Media Contact

Company Name: Arizton Advisory & Intelligence

Contact Person: Jessica

Email: Send Email

Phone: +1 3122332770

Country: United States

Website: https://www.arizton.com/market-reports/southeast-asia-data-center-construction-market