On Tuesday, June 11th, Peraso Inc. (NASDAQ: PRSO) Director Ian McWalter acquired 100,000 shares of the company’s stock at an average price of $1.27 per share, totalling $127,000. This strategic investment increases McWalter’s holdings to 101,246 shares.

On June 12, 2024, Ladenburg Thalmann, a renowned Wall Street firm since 1876, initiated coverage of Peraso Inc. (NASDAQ: PRSO). Research by Grandview Research in January 2024 highlighted the global mmWave market’s growth to $3.75 billion in 2023. The study suggests that mmWave technology applications in consumer sectors could drive significant market expansion, potentially causing a paradigm shift and achieving a compound annual growth rate (CAGR) of around 40% through 2030. The mmWave technology market is expected to surpass $55 billion by the end of the decade, driven by the increasing use of bandwidth-intensive applications and the rising demand for high-speed IoT solutions. Founded in 2009, Peraso Inc. (NASDAQ: PRSO) has focused on mmWave solutions, establishing itself as the leading producer of mmWave devices and innovating high-volume mmWave production testing methodologies.

Ladenburg Thalmann states, “Considering the current size and anticipated rapid growth of the mmWave market, we believe Peraso’s market-leading silicon and module solutions position the company for significant and sustained top- and bottom-line growth. We project a 22% revenue growth for 2024 and anticipate mmWave product revenue to increase by 160% year-over-year in 2025. With this expected growth, we value Peraso based on a multiple of 3x its estimated 2025 revenues, discounted back to the present at 20%. Therefore, we initiate coverage of Peraso Inc. (NASDAQ: PRSO) with a Buy rating and a 12-month price target of $3.75.”

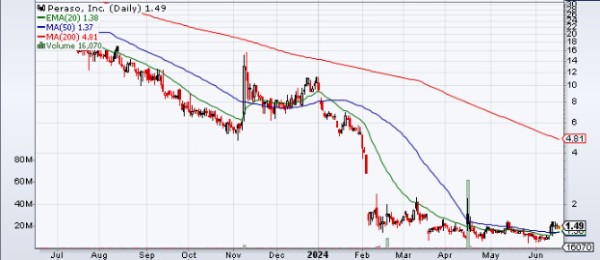

Peraso Inc. (NASDAQ: PRSO) shares opened at $1.50 on Friday. The stock has a twelve-month low of $1.17 and a 2024 high of $9.60, with a market cap of $4.01 million. It maintains a 50-day moving average of $1.37 and a 200-day moving average of $3.54. Recently, Peraso has shown multiple bullish indicators, reflected in a significant increase in trading volume over the past week, making it a stock to watch closely.

Pesaro Inc. NASDAQ: PRSO was recently featured with other MEME stocks trending tickers: GameStop (NYSE: GME). AMC Entertainment (NYSE: AMC), Novavax Inc. (NASDAQ: NVAX) Dyadic International Inc. (NASDAQ: DYAI), among others, Read more.

Disclaimers: The Private Securities Litigation Reform Act of 1995 provides investors with a safe harbor with regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, assumptions, objectives, goals, and assumptions about future events or performance are not statements of historical fact and may be forward looking statements. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties that could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements, indicating certain actions & quotes; may, could or might occur Understand there is no guarantee past performance is indicative of future results. Investing in micro-cap or growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investor’s investment may be lost or due to the speculative nature of the companies profiled. TheStreetReports (TSR) is responsible for the production and distribution of this content.”TSR” is not operated by a licensed broker, a dealer, or a registered investment advisor. It should be expressly understood that under no circumstances does any information published herein represent a recommendation to buy or sell a security. “TSR” authors, contributors, or its agents, may be compensated for preparing research, video graphics, podcasts and editorial content. “TSR” has not been compensated to produce content related to “Any Companies” appearing herein. As part of that content, readers, subscribers, and everyone viewing this content are expected to read the full disclaimer in our website.

Media Contact

Company Name: The Street Reports

Contact Person: Editor

Email: Send Email

Country: United States

Website: http://www.thestreetreports.com