DePIN is currently the hottest sector. IoTeX, which has been preparing for this sector for years, has also announced the launch of its 2.0 plan to comprehensively build the DePIN ecosystem. Recently, IoTeX officially announced the ecosystem’s first decentralized derivative trading platform with DePIN features, Quenta, which will develop appropriate derivatives for DePIN, amplifying the trading value space of the sector.

IoTeX: The New Infrastructure for the Internet of Things (IoT) Under the DePIN Narrative

With the momentum of DePIN, leaders in DePIN infrastructure are beginning to showcase their own strengths, with IoTeX currently holding a leading position in the industry. IoTeX is a blockchain specializing in the Internet of Things (IoT), with its strengths lying in emphasizing privacy protection, scalability, and smart contract support, all of which actively drive the development of the ecosystem. Its focus on modular infrastructure for DePIN will accelerate the involvement of more developers in the DePIN project. In 2024, more DePIN projects are expected to launch and develop on IoTeX.

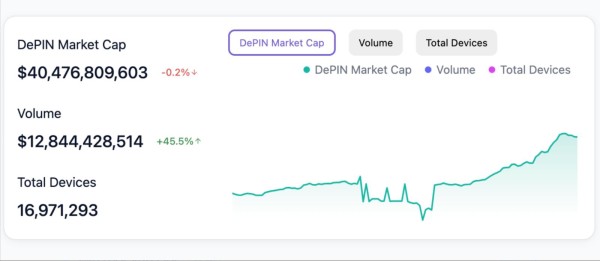

According to the data provided by DePINscan, launched by IoTeX, the DePIN sector is experiencing rapid growth, with the total market value currently exceeding $40 billion. A research report titled “The DePIN Sector Map” by Messari projects that by 2028, the market size of DePIN is expected to reach $35 trillion. It’s evident that the DePIN sector is still in its very early stages. These data demonstrate the immense potential and market attractiveness of the DePIN sector, solidifying IoTeX’s position as a leader in the blockchain technology field. With the continuous growth and development of the DePIN sector, the rise of the IoTeX ecosystem and the Quenta platform will further lead the direction of development in this field, bringing more innovation and prosperity to the crypto market.

Quenta: Unleashing the Hundred Billion Dollar Potential of DePIN

DePIN represents a new infrastructure for physical facilities, and its rapid development signifies the significant demand from users for diverse financial derivative services, including but not limited to other complex contract forms such as futures. These play important roles in risk management and investment strategy construction.The rapid development and expansion of the DePIN spot market are expected to result in exponential growth in its derivative market as well.

As a derivative DEX strategically positioned for DePIN, Quenta utilizes LP isolation mechanisms and flexible parameter settings, enabling more flexibility in providing leverage trading services for new assets. This allows users to hedge against volatility risk through hedging and enjoy stable returns.The upcoming pre-market futures products will enable users to trade hot assets ahead of others, assisting them in securing prices in advance. Specifically, Quenta has the following features:

1.Seamlessly Linking the Prosperity of the DePIN Derivatives Market

According to statistics from CoinGecko, as of Q2 2023, the ratio of spot and derivative trading volume on centralized exchanges (CEX) stands at 1:5, whereas in comparison, the ratio of spot and derivative trading volume on decentralized exchanges (DEX) is 3:1. This indicates that over time, there is a gradual trend of trading volume shifting from off-chain to on-chain, and the growth in on-chain trading volume will undoubtedly drive the development of decentralized finance. The explosion of the DePIN ecosystem will bring about more innovative products and services, catering to the investment needs of a wider user base and attracting more capital inflows.The operational environment of on-chain derivative trading is more tailored to the needs of DePIN users who are already on-chain, providing them with a more convenient trading environment. The on-chain derivative market is poised for robust and rapid development, and Quenta, as a key project launched within the IoTeX ecosystem, will undoubtedly leverage its first mover advantage on IoTeX and innovative models to become the best solution for meeting the surge in demand.

2.Isolation LP Pool Leading the Long-Tail Asset Revolution

The Point-to-Pool mechanism and Isolation Liquidity Pool employed by Quenta provide revolutionary leveraged trading services for emerging assets. This not only enhances asset liquidity but also fosters the discovery of more asset value.This innovative product mechanism greatly enhances the efficiency of listing new coins, facilitating the attraction of more high-quality projects to enter the market. It provides users with more investment opportunities and significantly improves their investment efficiency. Quenta’s isolation pool design and flexible parameter configuration have effectively addressed the challenge encountered on traditional exchanges regarding the listing of new assets. This allows new assets to leverage trading from the outset, thereby ensuring the stability and growth of the entire DePIN ecosystem. Additionally, Quenta’s support for multiple stablecoins further enhances the platform’s flexibility, providing users with a diverse range of liquidity options. This, in turn, unleashes the liquidity of more long-tail investors’ assets.These advancements will further elevate Quenta’s position within the IoTeX ecosystem, injecting new momentum into the development of the DePIN market.

3.A New Milestone in Market Predictability

Quenta’s upcoming Pre-market futures contract products will enable market participants to lock in prices before the spot market opens. By locking in prices ahead of time, traders can better plan and manage their trading strategies. The Quenta team will leverage their keen market insights and deep industry expertise to proactively identify emerging trends and hotspots in the market, transforming them into innovative products and services.

The Quenta platform offers a more predictable trading environment, lower-cost high-yield trading strategies, and the ability to lock in prices ahead of time, all of which will attract more traders and investors to choose the Quenta platform for trading, further enhancing the brand’s appeal.

4.Order Book Boosts Trading Efficiency Enhancement

The order book feature currently under development by Quenta is poised to significantly enhance trading efficiency, increase liquidity, and improve transaction transparency. Once launched, this order book functionality will display all trading orders on the market, including buy and sell orders with their respective prices and quantities. This enables traders to gain clearer insights into market supply and demand dynamics, swiftly identify optimal trading pairs, and execute trades more effectively, thereby boosting overall trading efficiency.

Through the order book functionality, traders can submit buy and sell orders at any time, and these orders will be recorded on the order book. Consequently, even with disparate market participants, transactions can proceed freely without intermediaries, thereby enhancing market liquidity.By clearly displaying market order book status and facilitating faster matching of trading pairs, the buy and sell orders within the order book offer depth and breadth to the market. Increased liquidity consequently reduces users’ trading slippage and costs, enhancing user experience and thereby fostering the development of Quenta and greater user participation.

Prospects of On-Chain Derivatives for Quenta

Since 2023, we have witnessed the evolution of the crypto market from a downturn to prosperity, and within this transformation, the DePIN sector has shown its remarkable potential, emerging as a shining star. However, there are still many unexplored opportunities within the DePIN sector.

Against the backdrop of rapid growth in the DePIN spot market, investors’ demand for higher returns is also expected to increase. Quenta will meet this demand through leveraged trading services, attracting more investors to participate in trading, thereby achieving exponential growth in market size. As a blockchain-operated ecosystem, DePIN primarily operates on-chain, with its users and projects predominantly existing within this environment. In such circumstances, an on-chain derivatives trading platform is better suited to the operational requirements of these users and projects, eliminating the need for cross-environmental adjustments.

As DePIN evolves, investors’ demand for various types of derivatives becomes increasingly diversified. Quenta offers a range of tools and products to cater to investors’ diverse risk preferences, return expectations, as well as financial needs such as fund management and hedging. The emergence of the IoTeX ecosystem alongside the Quenta platform not only signifies a new impetus for change but also serves as a significant driving force propelling DePIN towards prosperity and innovation.It can be affirmed that the IoTeX ecosystem and the Quenta platform will lead this field towards greater prosperity and innovation.

Disclaimer: This press release may contain certain forward-looking statements. Forward-looking statements describe expectations, plans, outcomes, or strategies for the future (including product offerings, regulatory plans, and business plans) and are subject to change without prior notice. Please be advised that such statements are influenced by various uncertainties, which may result in future circumstances, events, or outcomes differing from those predicted in the forward-looking statements.

Media Contact

Company Name: Andrew Parker

Contact Person: Media Relations

Email: Send Email

Country: Singapore

Website: https://quenta.io