The outlook for China’s economic prospects has soured.

In its April World Economic Outlook (WEO), the IMF sharply reduced its medium-term forecast for China’s economy. The IMF’s projections for GDP growth in 2025 and 2026 were slashed by one percentage point from those made just a year earlier (Figure 1).

The IMF’s more downbeat assessment led the Financial Times to opine that “… China has now found itself in a classic middle-income trap”.

Figure 1

The term “middle-income trap” was first coined in 2007 by World Bank economists Indermit Gill and Homi Kharas. In their book “East Asian Renaissance: Ideas for Economic Growth“, Gill and Kharas reflected on the transformations East Asian countries needed to make to maintain rapid development. They noted that as the marginal productivity of capital declines, strategies based on factor accumulation were bound to result in slower growth. Countries in Latin America and the Middle East that were unable to affect this transformation, they said, had become caught in the middle-income trap.

Whether or not China could avoid the middle-income trap was front and center in China 2030, a detailed analytic assessment published in 2013 by the World Bank and China’s Development Research Center of the State Council. China 2030 provided empirical evidence for the middle-income trap. It found that of the 101 middle-income countries in 1960, only 13 had become high-income countries by 2008.

Like Gill and Kharas, China 2030 attributed the middle-income trap to countries’ inability to transition from extensive to intensive modes of production. As countries reach middle-income levels, their under-employed rural labour force shrinks and economy-wide wages rise. This makes their labour-intensive industries less competitive. At the same time, the gains from technological catch-up become more difficult to realize. Thus, if middle-income countries are unable to raise productivity through domestic innovation, they find themselves trapped.

Graduating to high-income status is generally understood to mean achieving a level of per capita gross national income (GNI) superior to that of the World Bank’s high-income threshold. GNI measures the aggregate income earned by domestic residents, including income earned abroad. In contrast, the more familiar gross domestic product (GDP) counts income generated from goods and services produced in the country, even if the income accrues to foreigners.

In some cases, the gap between per capita GDP and per capita GNI can be large. In Ireland, for example, per capita GDP is 37 percent larger than per capita GNI. In Luxembourg, the gap is 35 percent. These gaps arise because of the importance of foreign firms in these two economies. Since the World Bank is looking to assess the wealth of domestic residents, it relies on per capita GNI as its income measure.

In China, per capita GDP has been somewhat larger than per capita GNI (Figure 2). On average, between 2010 and 2022, the former has exceeded the latter by 3 percent. This reflects China’s stock of inward foreign direct investment being larger than its stock of direct investment abroad for most of the period.

Figure 2

China’s per capita GNI has been steadily converging to the World Bank’s high-income threshold (Figure 3). In 2010, per capita incomes in China were only one-third as high as the threshold. By 2020, Chinese per capita incomes rose to more than four-fifths of the threshold. Last year, they were only 7 percent smaller.

Figure 3

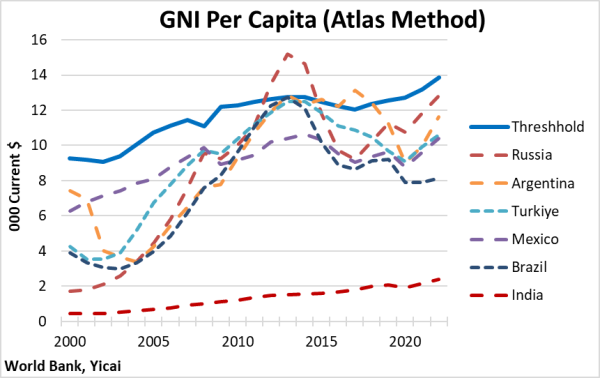

Looking across the other major emerging market countries, we see that Russia and Argentina had, for a time, breached the high-income threshold only to fall back into middle-income status. Brazil and Turkiye appeared to bounce off the threshold without actually crossing it. Among these large emerging market countries, the gaps between their per capita GNIs and the high-income threshold last year varied from Russia at -7 percent, to Mexico at -25 percent and India at -65 percent (Figure 4).

Figure 4

We can project when China’s per capita GNI will exceed the World Bank’s high-income threshold. Let’s assume that China’s real per capita GNI will grow at the same rate as the IMF’s forecasts for its GDP. In its July WEO Update, the IMF forecast real GDP growth of 5.2 percent this year and 4.5 percent next year. For 2025 and 2026, we will use the projection from its April WEO: 4.1 percent and 4.0 percent, respectively.

We also need to forecast China’s GDP deflator (we assume that the GDP and GNI deflators are the same). In the first half of this year, the GDP deflator fell by 0.6 percent. We assume deflation of 0.5 percent for 2023 as a whole. For 2024 through 2026, we assume that China’s GDP deflator grows by 2 percent per year. In comparison, in the three years before the pandemic, China’s GDP deflator increased by 3 percent annually.

Based on these assumptions, China’s per capita GNI would grow from $12,850 last year to $16,102 in 2026. This represents an increase of just over 25 percent or 5.8 percent per year.

The World Bank’s high-income threshold is a moving target. Each year it is updated for inflation. The World Bank uses the “SDR deflator” which is based on the GDP deflators of China, Japan, the UK, the US and the Euro Area – the economies represented in the IMF’s Special Drawing Rights.

The level and the rate of change of the World Bank’s high-income threshold are shown in Figure 5. The Global Financial Crisis and the European Debt Crisis led to low inflation and then deflation for the SDR deflator. As a result, the high-income threshold was essentially unchanged between 2010 and 2018. In 2021 and 2022, the SDR deflator increased sharply and the high-income threshold has risen by 9 percent in the last two years.

Figure 5

Looking at inflation in the SDR countries so far this year, we estimate that the threshold will increase by 5.5 percent in 2023. Thereafter, we assume it rises by 3 percent in 2024 and by 2 percent in both 2025 and 2026.

Based on the foregoing assumptions, we project that China’s per capita GNI will diverge slightly from the high-income threshold this year, falling from a 7 percent to an 8 percent gap. Subsequently, it will make steady progress and it will exceed the threshold by 3 percent in 2026.

Figure 6

The China 2030 study concluded that China would become a high-income country before 2030 and successfully avoid the middle-income trap. Ten years later, based on the most recent, albeit more pessimistic, economic projections, I think that conclusion still stands.

In some sense, the World Bank’s high-income threshold is an arbitrary measure of success. China already has been able to develop the sort of innovation – be it in high-speed rail, robotics, aeronautics, electric vehicles and chips – that characterize high-income countries. Still, emerging from the middle-income trap and remaining a high-income country would confer valuable credibility on China’s economic model.

About Yicai Global

Launched in August 2016, Yicai Global is the English-language news service of Yicai Media Group, the financial news arm of Shanghai Media Group, which is one of China’s largest state-owned media conglomerates. Focused primarily on China’s business world, Yicai Global is dedicated to provide reliable and insightful information and analysis of the economy, finance, tech, startups, and entrepreneurs.

Media Contact

Company Name: Yicai Media Group

Contact Person: Zhu Liming

Email: Send Email

Country: China

Website: https://www.yicaiglobal.com/