Verifying provided information from applicants and clients is a vital part of many businesses. More than 10,000 businesses worldwide trust cCheck Compliance Solutions to confirm information with tailor-made individual and business onboarding.

At cCheck, businesses gain access to a variety of “know your customer” (KYC) and “know your business” (KYB) services, such as facial recognition, anti-money laundering (AML) screening, and identity document verification. From tailored onboarding questionnaires to industry-leading fraudulent document detection to behavioral risk score assessment, cCheck Compliance Solutions has the tools to help.

“Let us tailor your compliance requirements,” company founders said. “Book an introductory session to see how cCheck can help you establish state-of-the-art compliance solutions.”

cCheck Customer Dashboard

Customers get an extensive overview of applicants through the cCheck Dashboard. The dashboard allows users to review any applicant process, perusing the provided data and documents. Applicant information is checked against watchlists, sanctions, regulatory and law enforcement lists, government and non-government organizations, and many other places to ensure it is accurate and within compliance guidelines. Organizations and groups cCheck use for verification include the UN, HMT, DFAT, EU OFAC, and others.

“Screening is performed to check for politically exposed persons, relatives, and closely associated persons and entities of interest,” cCheck founders said. “The adverse media check is performed against million of extracted articles across more than 300 countries.”

Summaries provide the level the applicant processed through, offering PDF reports outlining the AML screening conducted on the application.

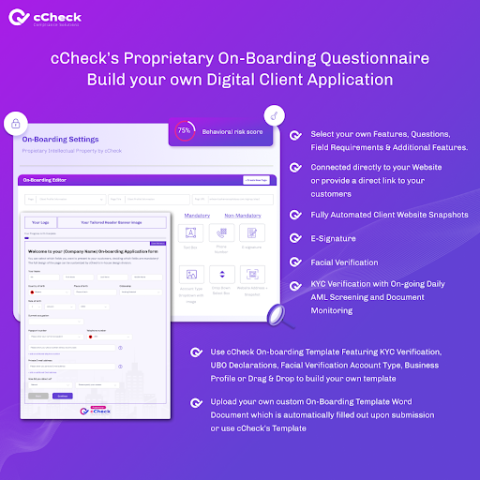

Connect onboarding questionnaires to websites in minutes

Connecting a website with a tailored individual and business client onboarding questionnaire has never been easier. With cCheck, it can be done in minutes. The company provides mobile and website software development kits (SDK), application programming interface integrations, ongoing daily AML screenings, and continuing daily document monitoring. Clients can also expect identity document verification, known face-checking abilities, SMS verification, management and ownership structure, and many more compliance solutions with cCheck.

“Select your pages, fields, mandatory uploads, file save locations, branding, and more!” representatives said.

Information verification

According to cCheck, millions of customers worldwide provide incorrect or false e-mail addresses and phone numbers. The company helps verify SMS, phone, and e-mail data. Fraudsters and cybercriminals are stopped in their tracks when cCheck clients detect fake documentation. Using pattern detection and protection built into the software, the company analyses patterns to assess whether documents have been edited.

Conclusion

To learn more about cCheck Compliance Solutions and how the company can offer unique compliance systems for every industry, visit the website to schedule a consultation or connect on social media at Instagram and Twitter.

Media Contact

Company Name: CCheck Compliance Solutions

Contact Person: Alexander

Email: Send Email

Country: United Arab Emirates

Website: https://ccheck.com