– Discovering technology companies related to carbon credits and revealing investment plans.

– Plan to establish an Asian hub for carbon credits trading with local governments.

South Korea’s TGS Group is entering the ‘Voluntary Carbon Credits’ business as part of its Environmental, Social, Governance (ESG) management. Chairman Lee Jae-sun of TGS, who is included in the top 100 Korean assets, expressed his strong will to promote the project by saying that he plans to raise the necessary funds for this project in the form of matching funds with global funding companies and local governments in South Korea.

The carbon trading system to respond to climate change is largely divided into a regulated carbon market (CCM, Compliance Carbon Market) and a Voluntary Carbon Market (VCM).

In the regulated carbon market, regulators grant carbon credits free or paid to regulated companies. These companies efficiently manage carbon emissions and sell any remaining carbon credits at CCM. Conversely, they make carbon reduction practice by purchasing from CCM when carbon credits are insufficient in excess of the regulated emissions.

However, if the company is not a regulated company, there is no factor to induce carbon reduction, and there is a limit in that regulated companies are also reluctant to invest in carbon reduction if the price of carbon credits is lower than the cost of carbon reduction.

On the other hand, the voluntary carbon market promotes carbon reduction by allowing individuals, companies, institutions, and non-profit organizations that are not obligated to reduce carbon emissions to voluntarily perform greenhouse gas reduction or offset activities and trade carbon credits for social responsibility and environmental protection.

The voluntary carbon market is attracting attention as a new investment destination as many companies are advocating ESG management such as ‘low carbon green growth’, and the Korean government is actively pursuing VCM creation and activation.

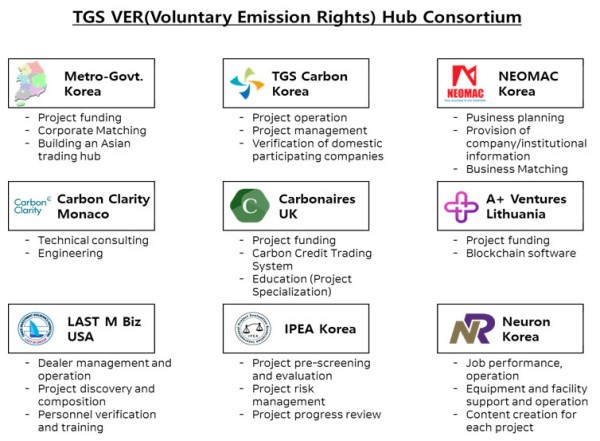

TGS signed a voluntary carbon credit business agreement with NeoMac Co., Ltd., an international business information provision and matching platform company, in August to promote the voluntary carbon credit business. In addition, through NeoMac, voluntary carbon credit investment and consulting business agreements with global companies are being carried out sequentially.

Representative participating companies include Carbon Clarity (Monaco) in charge of carbon reduction technology consulting and engineering, Carbonaires (UK) specializing in carbon credit funding, and A+ Ventures (Lithuania) with project funding and blockchain solutions. The Last M Biz Group (USA), which specializes in project discovery, supports the project.

In particular, TGS’s voluntary carbon credit business is expected to gain momentum as it is in discussions with one of Korea’s metropolitan governments to play a role in project funding, discovering carbon reduction technology companies, and supporting the establishment of an Asian VCM hub.

Media Contact

Company Name: TGS Holdings Co., Ltd.

Contact Person: Kim byoung min

Email: Send Email

Country: South Korea

Website: http://www.tgsholdings.net