DeFi has been the most rapidly growing field in the entire blockchain world over the past two years.

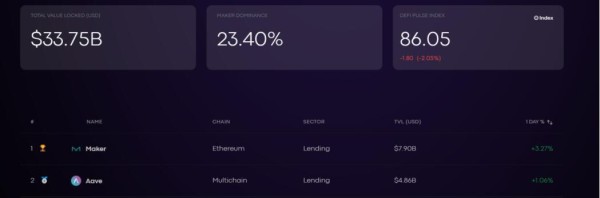

According to DeFi Purse, the total global DeFi lock has jumped 42-fold from $777 million two years ago to $33.77 billion now (note, September 21,2022). Typical DeFi protocol Uniswap locks-in volume increased 210 times from $27 million to $6.1 billion, and its monthly trading volume increased 204 times to $34.84 billion from $170 million a year ago.

The development of technology and finance will never stop.

If you don’t understand DEFI in 2022, you will miss the great opportunity in the next 100 years.

A brand new decentralized finance is emerging…

Traditional finance that is in decline

The following main problems generally exist in traditional finance:

Expensive:

For example, transnational transfers usually cost tens of dollars in fees, and investors usually pay at least 1-2% of their annual management fees;

The process is tedious:

The transaction process of traditional financial institutions is extremely complex, such as the bank account requires users to provide various identification certificates, I need to go to the bank to sign the contract, but also to conduct various KYC and AML related audit of users, inefficient; the above mentioned transnational transfer also takes 3-7 days;

Black case work:

Information asymmetry is one of the most criticized problems in traditional finance. The financial storm of 2008 was the storm under a large number of leveraged investment in complex derivatives, and many ordinary investors bear the losses;

DeFi open finance was born with the spirit of “free and open”, which is to provide effective solutions to the above series of problems.

Compared with traditional finance, DeFi’s advantages are in that:

Open and transparent:

Based on blockchain technology and cryptocurrency, all transactions are publicly audiable, traceable and searchable on the chain. Anyone can not arbitrarily tamper with them, so that the cost of centralized institutions increases and investors are more guaranteed.

No trust / authorization: DeFi financial management authority review in every user, in charge of their private key is proof of their wealth, in the lending scenario the borrower’s mortgage assets locked in the smart contract to protect depositors, open and transparent, visible mechanism gives individuals for the first time does not rely on centralized institutions for financial services.

Decentralization:

The process of centralized institutions is too complicated, the operation process of DeFi is simple and transparent, and the lending procedures can be completed within minutes. The advantage of disintermediation is to save expensive intermediate costs, which effectively reduce the financial transaction costs, so making the cost of financial services cheaper.

No threshold for participation:

There is no threshold limit on the investment amount;

high fluidity:

Background of the Auto Machine Machine Pool:

Auto Vaults is a DEFI machine gun pool jointly developed by 83 top blockchain engineers from all over the world. Most of them are from the University of Sydney, Australia, and the algorithm engineers are from Silicon Valley and Southeast Asia. All the core code is open source contracts, which has passed multiple security audits and is based on community DAO governance.

Through built-in automatic AI algorithm, combined with on-chain data analysis, AUTO Vaults can quickly select high-yield projects from the complex DeFi projects for automatic arbitrage, income second-level settlement, adopt a new FPPS + income distribution mode, real-time quantitative hedging, to ensure that users’ returns are greater than FPPS returns.

How to use the Auto machine gun pool?

[Using the platform machine gun pool, users can only maximize revenue with one click]

Users just put money into the Auto machine gun pool, the system through smart contract scheduling tokens to the optimal yield (high APY) liquidity mine pool to improve mining income, automated strategy contract will real-time capture and analysis of the data on the chain, and according to the comprehensive rate of return, risk coefficient, trading depth, TVL line, trading slip data evaluate the best trading strategy, when smart contract detection income reduced, will quickly clearing arbitrage, automatically switch to high yield contract, like a machine gun quality project, continuous arbitrage to provide user investment returns.

Officially set sail, began the private test

On September 21,2022, the Auto machine gun pool passed through the certik security audit officially began internal testing, regularly performing reinvestment operations for users to help users maximize revenue.

Technology leads change in investment. For more about Auto, watch official Twitter and media reports.

Media Contact

Company Name: Goknews

Contact Person: Bella

Email: Send Email

Country: United States

Website: www.goknews.com