Recharge Resources Ltd. (RR: CSE) (RECHF: OTC) (SL5: Frankfurt) stock is in rally mode after announcing its commenced planning for a Phase 1 Exploration Program at its 100% owned Georgia Lake North and West Lithium properties. Since the release, Recharge Resources shares have surged by over 23%. And the better news is that RECHF has provided ample reason for why the rally may be the precursor to even higher prices.

The most valuable one is that Recharge’s properties border Rock Tech Lithium Inc.’s (RCK – CSE) properties. Why does that matter? Because on August 23rd, 2022, Rock Tech announced a planned strategic partnership with Mercedes-Benz AG whereby Rock Tech will produce and supply high-quality lithium hydroxide for the automaker and its battery suppliers. And it’s no small amount. Under the intended final agreement, Rock Tech expects to deliver up to 10,000 tonnes per year, roughly $670 million at today’s Lithium prices, starting in 2026. The better news is that the planned delivery of that product isn’t expected to account for all production. Hence, there’s a lot of anticipated lithium at that location. And that good news for Rock Creek could be excellent news for RECHF.

That’s likely, noting Recharge Resources being in the right place at the right time. Location is, in fact, everything when it comes to mining for metals and mineral riches. And RECHF is. Even better from an investor’s perspective is that RECHF is focused on maximizing its properties by accelerating development initiatives intending to meet surging demand for high-value battery metals from the green, renewable energy, and EV and fuel cell vehicle markets.

Location, Location, And Location

But while project location is critical, so is investor interest. RECHF could also check that box, following Rock Tech’s announcement of closing a $40 million private placement and intending to use a potentially significant part of those net proceeds to finance the company’s continued exploration and development of the company’s Georgia Lake Lithium Property.

That interest, supported by dollars, is an excellent forward-looking indicator for Recharge Resources. Company CEO and Director, David Greenway, thinks so, saying, “While we continue to advance our two fully-funded drill programs at Brussels creek and Pocitos 1 lithium Salar in Salta, Argentina, it is hard to ignore the developments by our neighbours Rock Tech Lithium and their new strategic partnership with premium automaker Mercedes-Benz. Recharge Resources will plan a surface reconnaissance exploration program on our Georgia Lake projects with a goal of identifying the potential for continuity of mineralization from Rock Tech’s active development at Georgia Lake.”

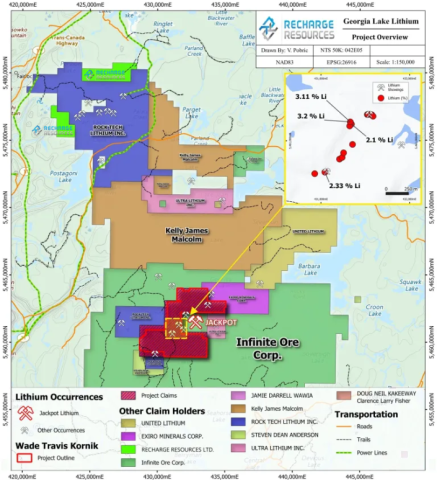

He’s referring to his company’s Georgia Lake North & West – Lithium Properties in Ontario, Canada. Specifically, the Georgia Lake North and West properties, located approximately 160 km northeast of Thunder Bay, Ontario, within the Thunder Bay Mining Division. More importantly to this discussion is that Recharge’s property borders the North and West boundaries of Rock Tech Lithium’s Georgia Lake Lithium Property, consisting of two claim blocks totaling 320 hectares (790 miles) and 432 hectares (1067 miles).

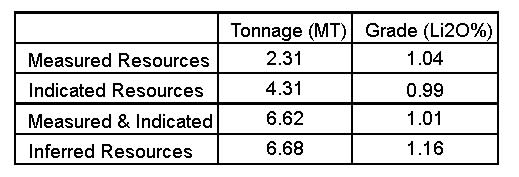

The heritage of those locations is inspiring. The Rock Tech Lithium, Georgia Lake project hosts several spodumene-bearing pegmatites, with Lithium mineralization discovered in 1955 and subsequently explored by several historic owners that exposed the properties as an NI 43-101 Mineral Resource, as reported in Rock Tech’s Preliminary Economic Assessment filed by Rock Tech in March of 2021. The Mineral Resource is summarized in the following table:

Of course, while past performance shouldn’t be the most relied-on indicator of future success, the mining and exploration sector may be an exception to that rule. And with mineral deposits not necessarily stingy where they settle, bordering a property indicated to have potentially massive reserves is indeed bullish to neighboring prospects. Thus, investors may be correct to bid RECHF shares higher.

Producing Properties Will Serve Massive Demand

And that trend deserves to continue. Besides ideally located, RECHF exploration, development, and production initiatives target an EV and battery metals industry expected to become a trillion-dollar market by 2034. But with an anticipated CAGR of 18.2% over the next eight years, breaching the trillion-dollar mark could happen years before the end of this decade.

Remember, too, that RECHF doesn’t necessarily need to mine the metals and minerals to deliver potentially exponential investment returns; just proving the reserves could be enough to increase share prices significantly. Therefore, if results from its Phase 1 exploration programs come as expected, RECHF could benefit from value-creating opportunities through partnerships, leases, or contract commitments similar to Rock Techs.

As it stands, few, if any, arguments suggest that RECHF isn’t in the right markets with the right properties at the right time. That’s because they are and are also well-positioned to capitalize on record-setting demand and prices from an EV metals market that, in the U.S. market alone, could account for a more than 16X increase in the need for EV batteries by 2035. Keep in mind, that’s just the U.S market, and factoring in global market demand, that number could be multiples higher.

And that’s the number to watch since Recharge could be a critical metals and minerals supplier to a global market. Remember, since 2017, EV sales have been soaring, with more than 17 million vehicles sold, scoring over $140 billion in revenues for manufacturers and components suppliers. But, here’s the exciting part of that number; over that same period, EV sales accounted for only about a 3% share of the total vehicles sold. That signals that the industry, and the companies contributing to its growth, are still in the earliest stages of maximizing near and long-term opportunities. That’s excellent news for RECHF.

And so is an infrastructure package intending to provide billions to expedite strengthening an EV industry and a shift to green energy. Those grants, awards, and contracts aren’t only for a selected few. Junior exploration companies like RECHF can also benefit from investment programs. In fact, that’s probable, as the domestic demand for critical green fuel continues to grow at a record pace.

Moreover, in a green metals and minerals market with no borders, companies like Recharge Resources, which have promising properties and nano-cap valuations, could attract interest from deep-pocketed investors (companies) wanting to own the lion’s share of expected production.

EV Stalls Without Battery Metals

Companies are doing just that, with companies like Tesla (NASDAQ: TSLA) openly securing as much of these precious battery metals and minerals as possible. And they likely don’t care if the supplier is a billion-dollar market cap miner or a developing company like RECHF; those that can supply the goods get the contracts. Tesla CEO Elon Musk has been outspoken on the subject, saying that with nickel being their biggest concern for scaling lithium-ion cell production, “Tesla will give you a giant contract for a long period of time- if you mine nickel efficiently and in an environmentally sensitive way.”

But keep in mind that TSLA is just one player. As of 2022, over 20 manufacturers and component suppliers are now considered “major” players. And despite having different business agendas, they all share in common needing the same lithium, nickel, cobalt, and other metals to power their creations. With that comes their understanding that not securing a power source- their cars and products will face a difficult, if not impossible, challenge getting their goods to market.

Meeting Demand With Valuable Lithium, Nickel, And Cobalt

Recharge Resources intends to help cure that possibility. And to capitalize on and maximize opportunities, they’ve done well to position themselves as one of the early and vital resources and contributors for lithium and nickel in North American markets. But that’s not all RECHF is doing.

Adding diversification, RECHF is capitalizing on other market opportunities by adding a third asset to its business pipeline potential- cobalt. It’s also a critical metal needed for EV battery production. But more valuable to RECHF’s opportunity to attract client interest is that virtually no cobalt production is happening in North America. It is up for debate whether that’s due to its fractional use compared to other necessary battery metals. What isn’t, however, is that cobalt’s need is no less critical than other battery metals.

Thus, that focus adds another appreciable revenue-generating shot on goal to the business plan. Moreover, as one of only a handful of North American suppliers, it’s within reason to believe that RECHF could earn a sizable market share, whether alone or through partnerships, after reporting already being in the early stages of proving its cobalt resources. If those reserve estimates get verified, it’s feasible for RECHF to potentially become one of the first North American cobalt resources brought into commercial production. If so, expect RECHF’s market cap to get a substantial raise.

Positioned To Grow In 2022-23

Better still, that raise could be justified by a score in any of its projects, and they have the properties to make that happen. That’s further supported by expecting large-cap miners alone to haul the load isn’t realistic. The opposite is true. Junior miners and exploration companies like Recharge Resources are needed more than ever to meet the U.S. and global supply needs. And even if investors banked on small companies filling only “niche” opportunities, that’s not a bad option either. Those “niche” opportunities still keep multi-billion-dollar revenue-generating targets in the RECHF crosshairs.

That could be why speculation suggests that the recent 23% surge in share price is the first leg of a journey toward $1.00. With its Phase 1 development plans being expedited, that’s a realistic target, especially if survey results are published as expected. Remember, if Recharge Resources can prove it’s sitting on assets, potential client interest would likely surge, with opportunities to ink deals with global business giants potentially put into play. Rock Tech proves that potential and possibility.

Still, the biggest attraction to RECHF isn’t about Rock Tech. Instead, investors should recognize the value inherent to RECHF staying focused on monetizing its assets to markets showing no signs of slowing and “seller’s market” pricing power likely in play for the long term. Simply put, the combination of everything, land and business plan, makes current share prices an ideal price point to take advantage of Recharge Resources. In fact, with several updates expected, the valuation disconnect may be too wide to ignore.

Disclaimers: Shore Thing Media, LLC. (STM, LLC.) is responsible for the production and distribution of this content. STM, Llc. is not operated by a licensed broker, a dealer, or a registered investment adviser. It should be expressly understood that under no circumstances does any information published herein represent a recommendation to buy or sell a security. Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The information made available by STM, Llc. is not intended to be, nor does it constitute, investment advice or recommendations. The contributors may buy and sell securities before and after any particular article, report and publication. In no event shall STM, Llc. be liable to any member, guest or third party for any damages of any kind arising out of the use of any content or other material published or made available by STM, Llc., including, without limitation, any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages. Past performance is a poor indicator of future performance. The information in this video, article, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. STM, Llc. strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D. For some content, STM, Llc., its authors, contributors, or its agents, may be compensated for preparing research, video graphics, and editorial content. STM, LLC has been compensated up to ten-thousand dollars cash via wire transfer by a third party to produce and syndicate digital content for Recharge Resources, Inc. for a period of two weeks. As part of that content, readers, subscribers, and website viewers, are expected to read the full disclaimers and financial disclosures statement that can be found on our website by visiting primetimeprofiles.com/disclaimer.

Media Contact

Company Name: STM, LLC.

Contact Person: Michael Thomas

Email: Send Email

Phone: 973-820-3748

Country: United States

Website: https://primetimeprofiles.com/