On April 30th, the day after entering GW, the Nippon Keizai Shimbun published an article saying that Toyota and Daihatsu would not only suspend car production during and after the Golden week due to a chronic shortage of semiconductors.

Toyota will close all 14 factories in Japan from April 30 to May 8, the article said. Among them, the Takaoka plant in Toyota City, Aichi Prefecture will stop production of some production lines until May 9, and the Fujisong plant with Toyota car body in Kariya City, Aichi Prefecture will stop production until May 16.

In addition to the second Shiga plant, which had previously announced an extension of the shutdown, Dafa will also increase the number of plants at the Dafen first factory and the head office from April 30 to May 8, extending the number of days of shutdown. In addition, the Kyoto plant is scheduled to stop production from May 18 to 19.

“from the perspective of automakers, semiconductors will not be enough until 2024,” read next to the big news in the April 30 edition of the Nikkei News. In this article, Intel CEO Pat Gelsinger said at its financial results conference on April 28 that “due to capacity and production equipment constraints, semiconductor shortages will last until at least 2024.”

How long will this shortage of semiconductors last?

I began to think that, as Intel’s chief executive said, “at least until 2024”, the semiconductor shortage will not disappear, and the semiconductor shortage will last for a long time.

In this article, I would like to discuss the basic principles. If we come to a conclusion first, we speculate that there will be a long-term shortage of traditional analog and power semiconductors in the future due to the following reasons:

With the increasing degree of automation of cars and electric vehicles, the number of semiconductors required will increase sharply. Most semiconductors are traditional analog and power semiconductors. These traditional analog and power semiconductors are produced by 8-inch factories. Because it is difficult to ensure 8-inch manufacturing equipment, it is difficult to add new 8-inch semiconductor factories.

In short, self-driving cars certainly require state-of-the-art semiconductors to run advanced artificial intelligence (AI), but the need for large quantities of traditional analog and power semiconductors has become the Achilles’ heel of automotive production, and solving this problem will not be easy. Although the automotive industry has ushered in the once-in-a-century CASE (Connected, Autonomous/Automated, Shared, Electric) period of great change, it is also an era suffering from semiconductor shortages. Purchasing semiconductor components has become extremely difficult, and many distributors are facing a lack of inventory. Now a better way to purchase is to purchase through a collection platform of electronic component distributors

The following is the full text of the compilation: “behind Toyota Dafa’s suspension of production, the era in which global auto companies are suffering.”

01. Automobile production is depressed due to the spread of the epidemic and the shortage of semiconductors

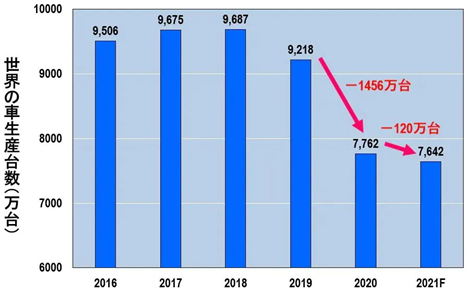

Due to the spread of the global COVID-19 epidemic in 2020, automobile production is in the doldrums (figure 1). The number of cars produced worldwide, which was 92.18 million in 2019 before the COVID-19 epidemic, fell by 14.56 million to 77.62 million in 2020 and appears to have fallen by 1.2 million to 76.42 million in 2021.

The decline in car production in 0A2020 was caused by the COVID-19 epidemic, which led to a sharp drop in demand. However, the downturn in car production in 2021 is mainly due to a shortage of semiconductors. In fact, by 2021, the shortage of semiconductors has made it impossible to build cars, and the governments of Japan, the United States and Germany, with automobile as the core industry, have made requests to TSMC to increase the production of on-board semiconductors through the government of Taiwan.

The semiconductors in short supply at that time were 28nm logic semiconductors and MCU (Micro Controller Units, commonly known as “microcontrollers”).

02. Why is there a shortage of 28nm semiconductors?

From April 2020 to June 2020, the demand for cars dropped sharply due to the spread of the COVID-19 epidemic. Automakers purchase parts according to Toyota’s “Just In Time” mode of operation, so, for example, Toyota canceled orders for in-car semiconductors for Denso, its main subcontractor, which canceled orders for in-car semiconductors such as Renesas, which then cancelled subsequent orders for 28nm, which was commissioned by TSMC.

Due to the special needs of COVID-19 at home under the epidemic, the production of 28nm semiconductors such as TSMC game consoles and household appliances swarmed in, and the blank production line after the cancellation of car semiconductors was instantly filled with these semiconductors.

Then, as demand for cars picks up in the fall of 2020, Toyota Denso Renesa plans to order 28nm semiconductors from TSMC again, but there is no room to produce in-car semiconductors because TSMC lines are occupied by other semiconductors. Although the inventory in the autumn and winter of 2020 exceeded the limit, by 2021, inventory had bottomed out, coupled with the shortage of 28nm semiconductors, cars could not be made.

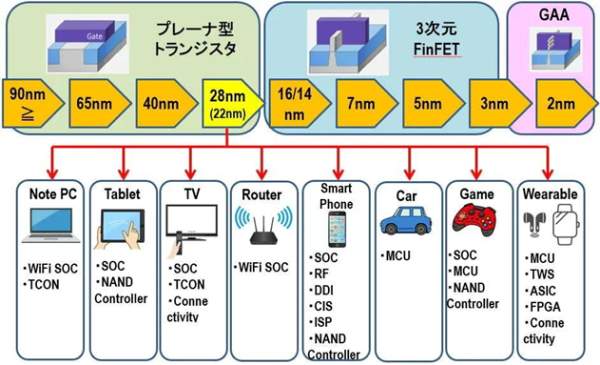

03. Unique 28nm semiconductor

(1) 28nm is the last generation of planar transistors (FinFET from 16 / 14nm to 3D) (2) do not use self-aligned double pattern (SADP) (will use SADP from FinFET) (3) Renesas vertical integration (integrated equipment manufacturer IDM), for example, outsource production to FinFET from this generation

In short, 28nm semiconductors produced by TSMC and other contract factories have a good performance-to-price ratio, so many electronic devices, including automobiles, use this semiconductor. At the invitation of the Japanese government, the TSMC Kumamoto plant, which will begin operation in 2024, will also mainly produce such 28nm semiconductors.

However, thanks to the efforts of contract manufacturers such as TSMC, UMC and SMIC, the shortage of 28nm semiconductors was basically eliminated in the first half of 2021.

04. Changes in the shortage situation of semiconductors

Figure 3 is one of the slides presented by VLSI Research (Tech Insights) Andrea Lati in the Semiconductor Market Overview at the Semiconductor Industry Association (SIA) webinar on February 28, 2022.

According to figure 3, “shortage” or “shortage” of Foundry is until the second quarter of 2021, followed by “balance”, “saturation” and “surplus”. In other words, it can be said that the shortage of contract factories such as TSMC has disappeared since the third quarter of 2021.

However, the “shortage” of IDM such as Renesas lasted from the second quarter of 2020 to February 18, 2022. And, like IDM, the traditional analog and power semiconductors that Renesas and other companies produce internally without outsourcing to TSMC are “tight” from the second quarter of 2020 to February 18, 2022.

As a result, the automotive semiconductor “Auto” became “tight” in the fourth quarter of 2020 and almost a “shortage” after 2021.

According to figure 3, there has been a shortage of automotive semiconductors since the first quarter of 2021, while there was a shortage of 28nm produced by contract manufacturers such as TSMC in the first half of 2021, but in the second half of 2021, the shortage will disappear and be replaced by a shortage of traditional analog and power semiconductors produced by IDM such as Renesas.

05. Semiconductors for cars

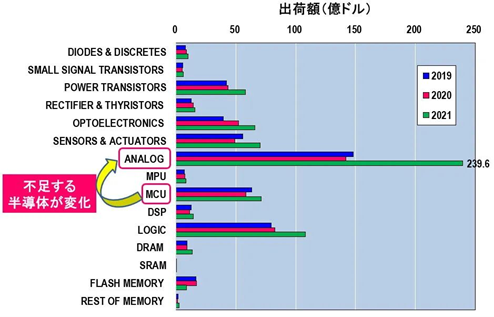

Figure 4 shows the types and transport values of semiconductors used in cars as published by the World Semiconductor Trade Statistics (WSTS).

Fig. 4 Automotive semiconductors (2019-2021), source: made by the author based on WSTS data

According to WSTS, there are at least 15 semiconductors used in cars. Analog semiconductors are particularly prominent, with less than $15 billion in 2019 and 2020, but soaring to about $24 billion in 2021 (power semiconductors are also included in these analog semiconductors, according to WSTS). This phenomenon also indicates a shortage of analog semiconductors (including power supplies).

So why did the analog semiconductor market for automobiles (including electricity) expand rapidly in 2021? As shown in figure 1, the number of cars produced is declining. However, the analog semiconductor market has expanded rapidly.

It can be inferred that the reason is that the shift from traditional fuel vehicles to electric vehicles and self-driving cars has begun to spread rapidly.

According to KPMG’s publication In-Vehicle Semiconductors: A New Era of ICE (April 23, 2020), semiconductors installed in a car cost less than $500 for an internal combustion engine car. EV cars, on the other hand, more than doubled to about $1000. As for autopilot, level 4 or level 5 fully autopilot will be equipped with $3000 semiconductors, eight to 10 times higher than level 0 (manual driving).

Electric vehicles need a large number of power semiconductors. In addition, self-driving cars need a large number of analog semiconductors to process analog information from various sensors. In other words, although the number of cars produced has declined from 2020 to 2021, the rapid expansion of analog semiconductors (including power supplies) installed in cars is due to the rapid expansion of EV and self-driving.

In some cases, however, the supply of analog and power semiconductors cannot be expanded significantly.

06. Most analog and power semiconductors are produced in 8-inch factories

Figure 5 shows the global semiconductor production capacity of 12-inch wafers by technology node (10000 wafers per month). Most of the remaining production capacity of 100nm is in 8-inch semiconductor factories. On the other hand, the production capacity after 90nm is 12-inch semiconductor factories.

Figure 5 12-inch conversion technology / node capacity (ten thousand chips / month) Source: based on World Semiconductor Factory Yearbook and SEMI Wafer World Forecast data of World wide Web Co., Ltd.

Therefore, near 100 nm, there is a boundary between 8 inches and 12 inches. The reason is that around 2000, when the semiconductor was miniaturized to 130nm or later, the diameter of the wafer increased from 8 inches to 12 inches. After that, with the advance of miniaturization, 12-inch manufacturing equipment has also improved with the development of refinement.

As a result, the fineness of 8 inches is about the 100nm, but at 12 inches, TSMC began mass production of cutting-edge 5nm semiconductors in 2020.

Today, many traditional analog and power semiconductors that lack semiconductors are produced in 8-inch semiconductor factories.

However, there are two main reasons why it is difficult to improve the production capacity of such traditional analog and power semiconductors.

07. Why not increase the production capacity of traditional semiconductors?

Relative News

How Will the Intelligent Car Machine Develop in the Future?

Media Contact

Company Name: EASYBOM, INC.

Contact Person: Media Relations

Email: Send Email

Phone: 718 – 737 – 2822

Country: United States

Website: http://www.easybom.com/