Beginning September 1, 2021, ‘Amazon’s Business Solutions Agreement’ will require sellers to carry and renew business liability insurance and name Amazon as an additional insured within 30 days of gross sales revenue exceeding $10,000 in any month on the Amazon Mall, or in other circumstances as required by Amazon.

During the past years, Poe Insurance Inc. has summarized the major points of the related questions. (Visit Poe Insurance at: www.insurancepoe.com)

1. What is commercial liability insurance?

Commercial liability insurance is a policy that covers damage caused by third party accidents and bodily injury. It covers bodily damage, property damage and even reputational damage caused by sellers’ businesses.

2. Under what circumstances do sellers need to be insured?

On Amazon.com, sellers will need to be insured if

● Prior to September 1, 2021, the seller achieves monthly gross sales revenue of more than $10,000 for three consecutive months on Amazon.com.

● After September 1, 2021, the seller achieves monthly gross sales revenue of more than $10,000 in any month in Amazon.com’s history.

● If Amazon requires sellers to provide proof of insurance, even if the seller does not meet the “sales revenue of more than $10,000 on Amazon.com” requirement, proof of insurance is still required.

3. What insurance providers and policy requirements are there?

● The policy limits must have a minimum of $1,000,000 per occurrence and aggregate limits of indemnity covering all liabilities (including merchandise liability, merchandise/completion liability and bodily injury) arising out of or in connection with the operation of sellers’ businesses.

● The type of insurance policy can be commercial general liability, umbrella liability or excess liability and should be a period occurrence policy.

● The insurance provider must have global claims handling capabilities and a financial rating of S&P A- and/or AM Best A-, or higher. If ‘S&P’ or ‘AM Best’ is not valid or used in the country sellers need to insure, sellers may use the local equivalent rating.

● The insurance provider must give Amazon at least 30 days’ notice of cancellation, amendment or non-renewal.

● The policy must name ‘Amazon.com Services LLC. and its affiliates and agents’ as an additional insured.

● The deductible amount of any policy may not exceed $10,000 and any deductible amount must be listed on the certificate of insurance.

● The policy must cover the sale of all items posted by sellers on the Amazon Store.

● Sellers insured names must match the “Legal Entity” name sellers provide to Amazon. To see the name of sellers’ legal entity, and refer to sellers’ account information.

● The insurance policy must be completed and signed.

● The policy must be valid for at least 60 days from the date of submission.

4. How do sellers add Amazon as an additional insured?

Please contact insurer to add ‘Amazon.com Services LLC and its affiliates and agents’ at ‘P. O. Box 81226, Seattle, WA 98108-1226.’ as an additional insured. (This one is essential, and Poe Insurance can fulfill this requirement perfectly for sellers’ businesses.)

5. Is Amazon US commercial liability insurance mandatory?

Yes. Commercial liability insurance can protect sellers in the event of an accident arising from the goods sellers sell, giving sellers the peace of mind to focus on growing sellers’ businesses. Under the Business Solutions Agreement, sellers must hold valid business liability insurance if sellers have reached the threshold for purchasing it. Sellers are also liable to indemnify Amazon for the costs incurred by Amazon in settling the claim unless Amazon agrees to waive its right to compensation. (Two-way cover)

6. What are the consequences of not taking out commercial liability insurance after the threshold has been reached?

If the threshold for purchasing business liability insurance has been met, and if Amazon finds that sellers have not purchased this insurance within the applicable claim period, or have not submitted proof of qualifying insurance in a timely manner, Amazon may take action, such as restricting sellers from selling items in specific categories, or even suspending sellers’ accounts, until sellers provide proof of insurance.

7. Do all sites require commercial liability insurance?

Under the Amazon Services Business Solutions Agreement, sellers must purchase business liability insurance for all sites sellers sell. Currently, Amazon only enforces this requirement for US sites.

8. Can sellers choose their own insurance company?

If sellers do not currently have commercial liability insurance, sellers may choose any insurance provider that meets the above Amazon requirements or choose an insurance provider from a network of trusted insurance providers identified by Amazon.

9. What is the cost of insurance?

The cost of insurance varies depending on a number of factors, such as the type of goods sellers sell, the expected sales revenue and sellers’ choices of insurer. Poe Insurance is dedicated to provide sellers with affordable coverage.

10. Do sellers need a monthly or annual business liability policy?

Most of the insurance companies’ plans in the marketplace are currently annual, which can be decided by the seller and the insurance company.

11. Is Amazon’s insurance policy only for Chinese sellers?

No, it is not only for Chinese sellers, it is a requirement for global sellers, as long as the threshold is reached, they need to be insured.

12. Do both FBA and FBM sellers need to be insured?

No. Insurance is required once sales reach the threshold, regardless of the shipping method.

13. Do I need to take out insurance if I have reached the sales threshold but have not received an email notification?

Yes, if sellers have reached the threshold for commercial liability insurance, sellers must have valid commercial liability insurance.

14. Can sellers take out insurance for my personal seller account?

Both business seller accounts and individual seller accounts are required to have business liability insurance if the account has reached the threshold for purchasing business liability insurance. Currently individual sellers cannot purchase through the Amazon Insurance Accelerator program, there are some insurance companies that support individual sellers.

15. Is each shop insured individually? Or is it a brand-by-brand policy?

No. Sellers need to insure by shop, not by brand.

16. How long does it take to receive an approval notice after I have purchased the insurance and uploaded the proof of insurance in the back office?

Please refer to the actual situation. Normally, sellers can check the status of the audit on the Seller’s Platform within 7 days after uploading the proof of insurance.

「POE INSURANCE」

Poe Insurance is an insurance company specializing in Amazon product liability insurance located in Texas, USA. Each broker at Poe Insurance is professionally licensed and extensive experience to provide sellers with the most efficient and reliable service available. 24-hour customer service to meet sellers’ businesses needs. Practicing sustainability, reliability and integrity. Commitment to providing the best value for money insurance and the best quality of service. Poe Insurance charge reasonable fees and offer free valuations, free advice and other services. Poe Insurance have been in business for 7 years and have been trusted by over 10,000 small businesses. Choose Poe Insurance, the future is with sellers. (Visit Poe Insurance at: www.insurancepoe.com)

「 Specific operation steps 」

If sellers meet the insurance requirements, sellers only need 2 steps:

(1) Get insurance

(2) Upload COI

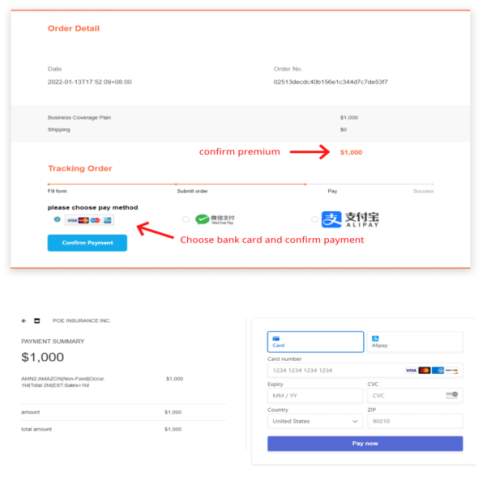

To purchase business liability insurance from Poe Insurance, just visit Poe Insurance at www.insurancepoe.com and make an order online.

Enter Poe Insurance official website (www.insurancepoe.com) – Click quotation & order

Fill in information – Choose appropriate insurance plan and period – Submit order and pay

After completing payment, a COI will be sent to your email address and it may take up to 24 hours from the time of purchase.

Contact Poe Insurance with any questions at Info@insurancepoe.com.

Media Contact

Company Name: Poe Insurance, Inc.

Contact Person: Dr. Poe

Phone: +1 (800)658-1079

State: Flower Mound

Country: United States

Website: www.insurancepoe.com