At present, the blockchain network has changed the traditional production and accounting links, and the application of blockchain technology has been extended to digital finance, Internet of Things, intelligent manufacturing, supply chain management, digital asset trading and other fields.

Under the superimposed background of long-term low interest rates, low economic growth and high uncertainty in the macro environment, high-quality assets are crowded and scarce. The rise of new blockchain digital assets represented by Bitcoin and Ethereum has brought new ideas to the traditional asset portfolio allocation.

The symbiosis and integration of digital assets and blockchain networks are the blood of the entire blockchain ecosystem in many application scenarios, carrying important functions of value circulation and incentives. Some experts pointed out that scientifically increasing investment types other than stocks, fixed income or currencies traded in the traditional open market can cope with the impact of the low interest rate or high volatility environment we may face at present and for a long time to come, it is possible to earn higher returns than a traditional stock and bond portfolio.

A survey of 150 universities in Europe and the United States shows that 94% of the respondents have already allocated assets related to encrypted digital currency, and the university endowment fund has actively allocated encrypted digital currency as an alternative asset.

Now, as the traditional financial market is still volatile, funds from all over the world hope to find a safe-haven asset that can achieve the effect of the US dollar. Bitcoin and Ethereum have become the two most popular currencies in the two digital currency markets. The digital currency with platform attributes represented by Ethereum began to develop around 2014, mainly as a token for various application platforms.

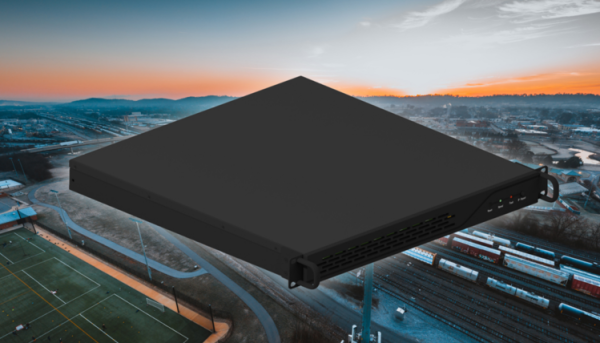

How to obtain ether and then participate in the asset allocation of digital currency has become a problem that investors need to think about in the next step. Before that, it is necessary to have a high-performance mining machine. For beginners or professional investors, JASMINER is a good choice. The professional ASIC Ethereum mining machine JASMINER X4 High-throughput 1U server adopts a self-developed high-throughput computing power chip with integrated storage and calculation. Compared with similar products, the chip has higher integration, lower power consumption and better heat dissipation. Its computing power is 520MH/s±10%, which can ensure the stability of the computing power while achieving the ultimate reduction in power consumption. The power consumption is only 240W±10%, and the electricity cost is only 3%. The advantages of low power consumption, small size, and high hashrate make it suitable for IDC computer rooms, homes and other scenarios. It is deeply loved by miners around the world and has become the new mainstream of digital asset allocation.

Whether it is traditional finance or digital assets, the core idea of asset allocation is to diversify risks and gain the greatest probability. As a money printing machine that will never power off, using JASMINER to obtain cryptocurrency is believed to be a more stable approach in allocating digital assets. In addition to choosing the best tool, asset allocators must maintain a good attitude and achieve long-term investment goals.

Media Contact

Company Name: JASMINER

Contact Person: Panda Hou

Email: Send Email

Phone: 400-022-3866

City: Beijing

Country: China

Website: www.jasminer.com